Question: ***PLEASE CREATE 2 DIFFERENT EXCEL SHEETS (1 FOR EACH PROBLEM). PLEASE ALSO SHOW FORMULAS*** THANK YOU! In Excel, create a solution for each situation making

***PLEASE CREATE 2 DIFFERENT EXCEL SHEETS (1 FOR EACH PROBLEM). PLEASE ALSO SHOW FORMULAS***

THANK YOU!

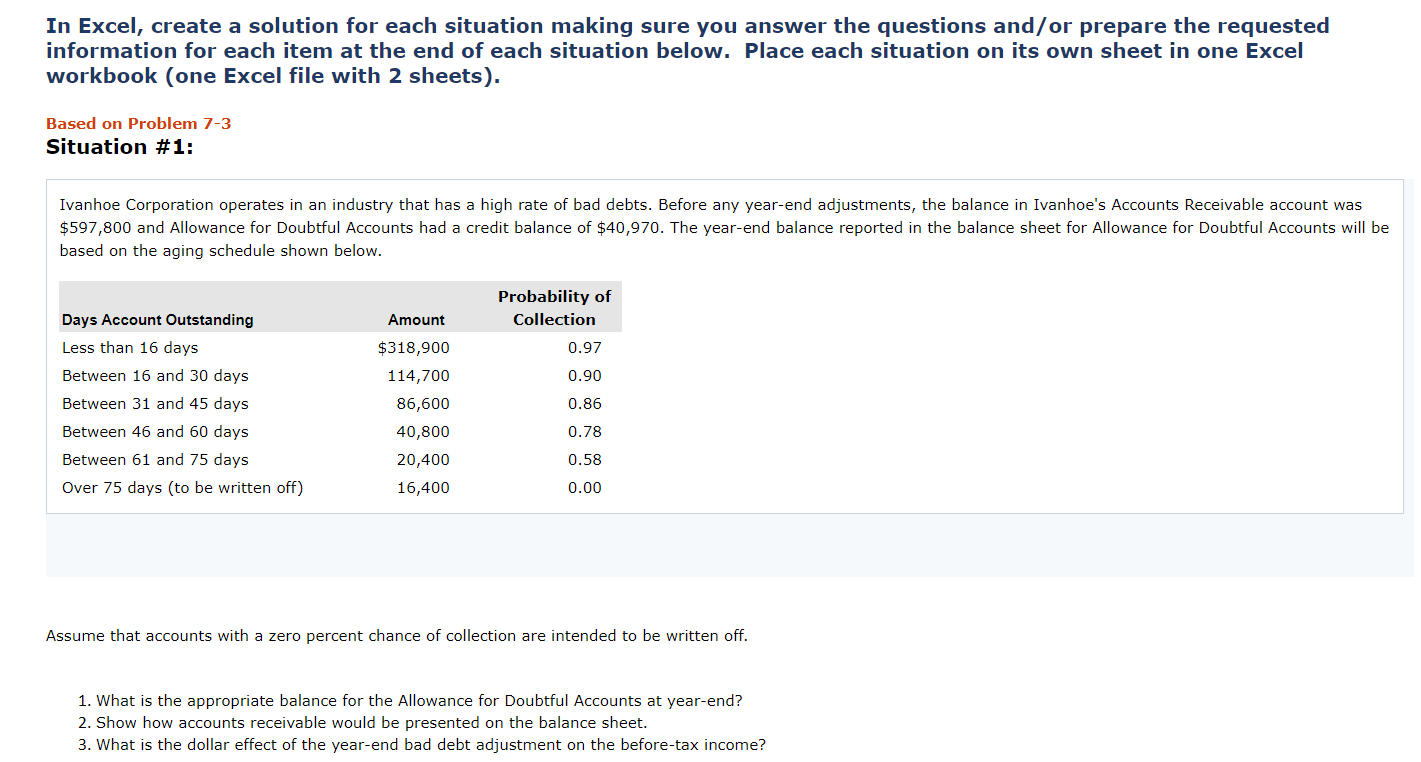

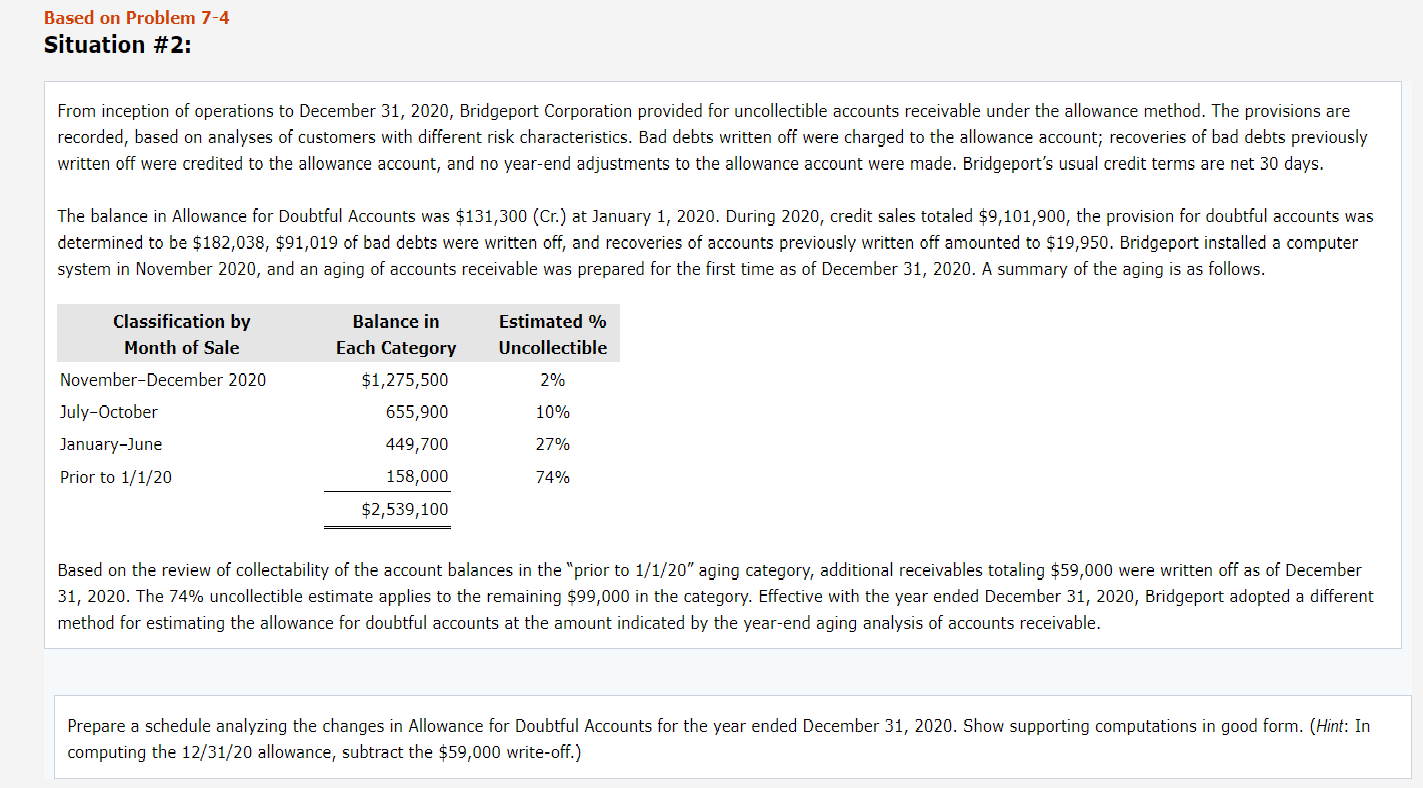

In Excel, create a solution for each situation making sure you answer the questions and/or prepare the requested information for each item at the end of each situation below. Place each situation on its own sheet in one Excel workbook (one Excel file with 2 sheets). Based on Problem 7-3 Situation #1: Ivanhoe Corporation operates in an industry that has a high rate of bad debts. Before any year-end adjustments, the balance in Ivanhoe's Accounts Receivable account was $597,800 and Allowance for Doubtful Accounts had a credit balance of $40,970. The year-end balance reported in the balance sheet for Allowance for Doubtful Accounts will be based on the aging schedule shown below. Amount Probability of Collection 0.97 0.90 Days Account Outstanding Less than 16 days Between 16 and 30 days Between 31 and 45 days Between 46 and 60 days Between 61 and 75 days Over 75 days (to be written off) 0.86 $318,900 114,700 86,600 40,800 20,400 16,400 0.78 0.58 0.00 Assume that accounts with a zero percent chance of collection are intended to be written off. 1. What is the appropriate balance for the Allowance for Doubtful Accounts at year-end? 2. Show how accounts receivable would be presented on the balance sheet. 3. What is the dollar effect of the year-end bad debt adjustment on the before-tax income? Based on Problem 7-4 Situation #2: From inception of operations to December 31, 2020, Bridgeport Corporation provided for uncollectible accounts receivable under the allowance method. The provisions are recorded, based on analyses of customers with different risk characteristics. Bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account, and no year-end adjustments to the allowance account were made. Bridgeport's usual credit terms are net 30 days. The balance in Allowance for Doubtful Accounts was $131,300 (Cr.) at January 1, 2020. During 2020, credit sales totaled $9,101,900, the provision for doubtful accounts was determined to be $182,038, $91,019 of bad debts were written off, and recoveries of accounts previously written off amounted to $19,950. Bridgeport installed a computer system in November 2020, and an aging of accounts receivable was prepared for the first time as of December 31, 2020. A summary of the aging is as follows. Classification by Month of Sale Estimated % Uncollectible Balance in Each Category $1,275,500 655,900 2% November-December 2020 July-October January-June 10% 27% Prior to 1/1/20 449,700 158,000 $2,539,100 74% Based on the review of collectability of the account balances in the "prior to 1/1/20" aging category, additional receivables totaling $59,000 were written off as of December 31, 2020. The 74% uncollectible estimate applies to the remaining $99,000 in the category. Effective with the year ended December 31, 2020, Bridgeport adopted a different method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable. Prepare a schedule analyzing the changes in Allowance for Doubtful Accounts for the year ended December 31, 2020. Show supporting computations in good form. (Hint: In computing the 12/31/20 allowance, subtract the $59,000 write-off.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts