Question: answer for this Problem #7 Preparing the Worksheet, Adjusting and Closing Entries, and Financial Statements The ledger accounts of the Christine Sousa Bags for the

answer for this

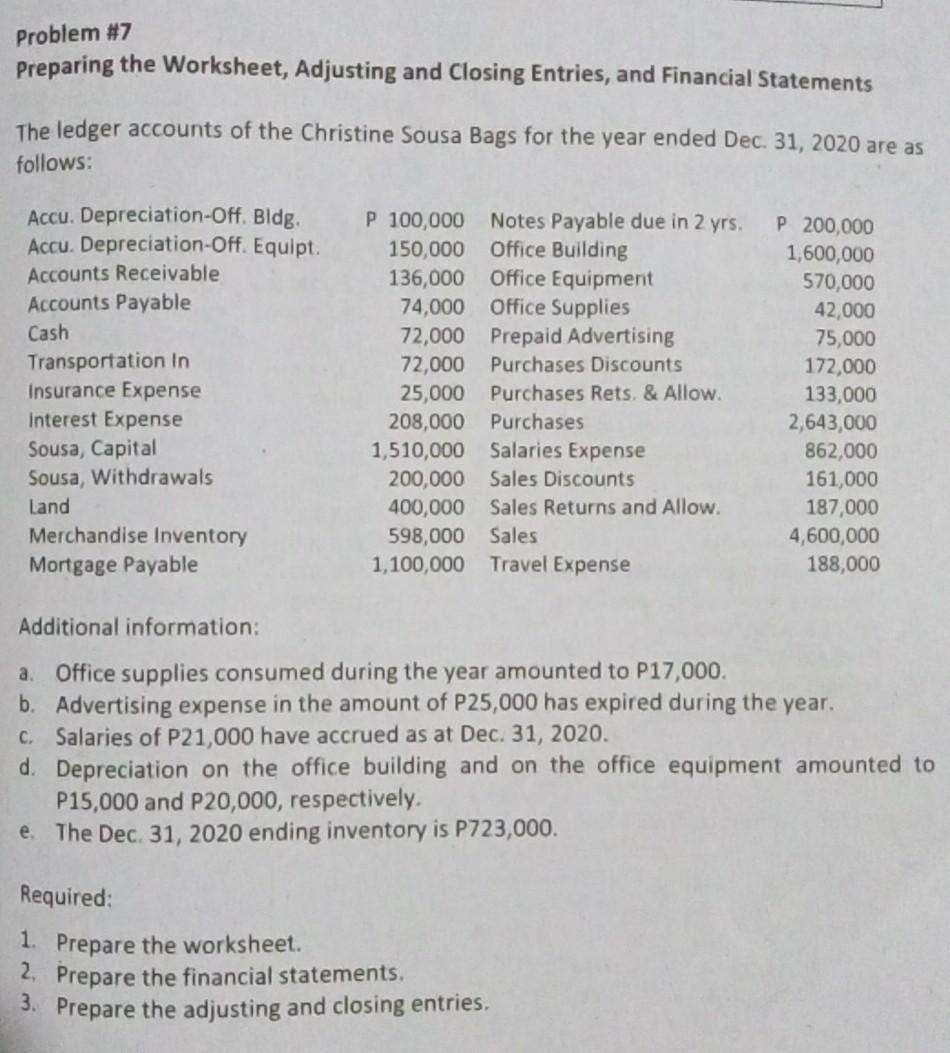

Problem #7 Preparing the Worksheet, Adjusting and Closing Entries, and Financial Statements The ledger accounts of the Christine Sousa Bags for the year ended Dec 31, 2020 are as follows: Accu. Depreciation-off. Bldg. Accu. Depreciation Off. Equipt. Accounts Receivable Accounts Payable Cash Transportation in Insurance Expense Interest Expense Sousa, Capital Sousa, Withdrawals Land Merchandise Inventory Mortgage Payable P 100,000 Notes Payable due in 2 yrs. 150,000 Office Building 136,000 Office Equipment 74,000 Office Supplies 72,000 Prepaid Advertising 72,000 Purchases Discounts 25,000 Purchases Rets. & Allow. 208,000 Purchases 1,510,000 Salaries Expense 200,000 Sales Discounts 400,000 Sales Returns and Allow. 598,000 Sales 1,100,000 Travel Expense P200,000 1,600,000 570,000 42,000 75,000 172,000 133,000 2,643,000 862,000 161,000 187,000 4,600,000 188,000 Additional information: a. Office supplies consumed during the year amounted to P17,000. b. Advertising expense in the amount of P25,000 has expired during the year. C. Salaries of P21,000 have accrued as at Dec. 31, 2020. d. Depreciation on the office building and on the office equipment amounted to P15,000 and P20,000, respectively. e The Dec 31, 2020 ending inventory is P723,000. Required: 1. Prepare the worksheet. 2. Prepare the financial statements. 3. Prepare the adjusting and closing entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts