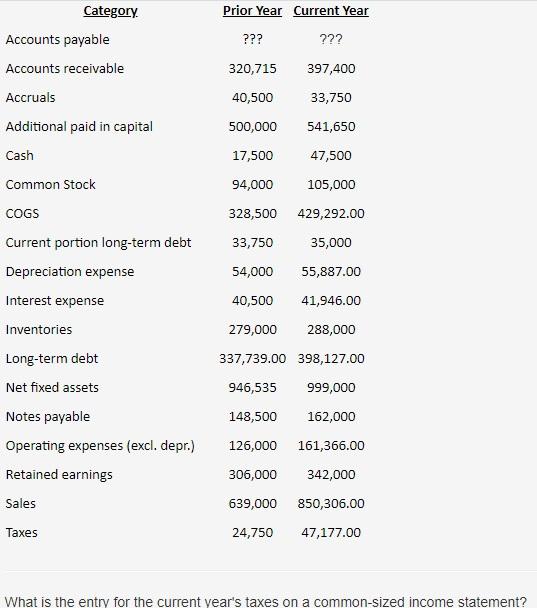

Question: Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Prior

Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

Prior Year Current Year Category Accounts payable Accounts receivable ??? ??? 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 94,000 105,000 Common Stock COGS Current portion long-term debt 328,500 429,292.00 33,750 35,000 54,000 55,887.00 40,500 41,946.00 Depreciation expense Interest expense Inventories Long-term debt Net fixed assets 279,000 288,000 337,739.00 398,127.00 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 161,366.00 Retained earnings 306,000 342,000 639,000 850,306.00 Sales Taxes 24,750 47,177.00 What is the entry for the current year's taxes on a common-sized income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts