Question: Please list all steps to problems thoroughly and steps to each one as well. Thank you! 11 The market price of a stock is $24.03

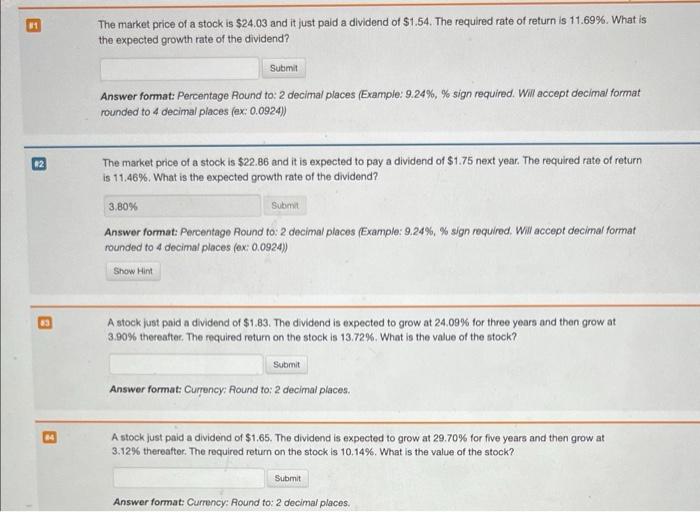

11 The market price of a stock is $24.03 and it just paid a dividend of $1.54. The required rate of return is 11.69%. What is the expected growth rate of the dividend? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Wil accept decimal format rounded to 4 decimal places (ex: 0.0924)) 12 The market price of a stock is $22.86 and it is expected to pay a dividend of $1.75 next year. The required rate of return is 11,46%. What is the expected growth rate of the dividend? 3.80% Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Show Hint 53 A stock just paid a dividend of $1.83. The dividend is expected to grow at 24.09% for three years and then grow at 3.90% thereafter. The required return on the stock is 13.72%. What is the value of the stock? Submit Answer format: Currency: Round to: 2 decimal places. A stock just paid a dividend of $1,65. The dividend is expected to grow at 29.70% for five years and then grow at 3.12% thereafter. The required return on the stock is 10.14%. What is the value of the stock? Submit Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts