Question: Answer format: With a comma, no decimal places, and no peso signs. Example: Your computed amount is 123456.78910. Encode it as 123,457. -For negative amounts:

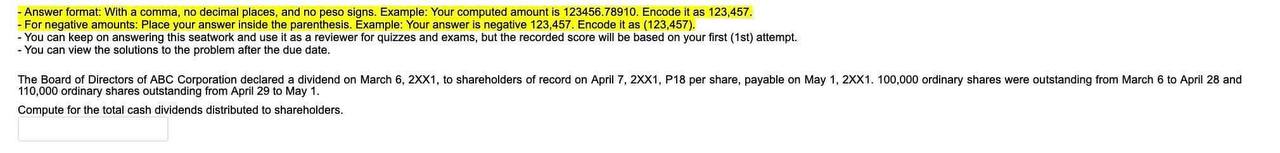

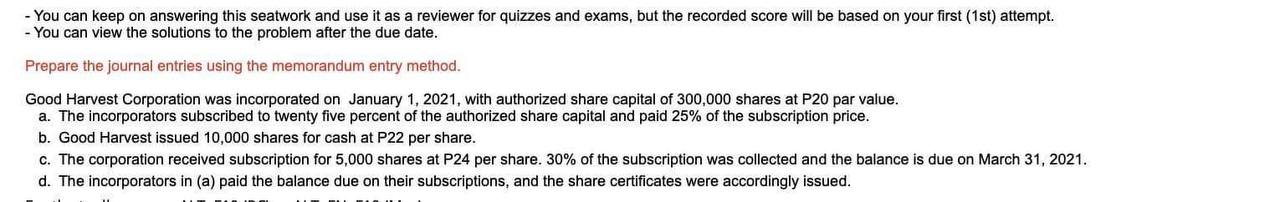

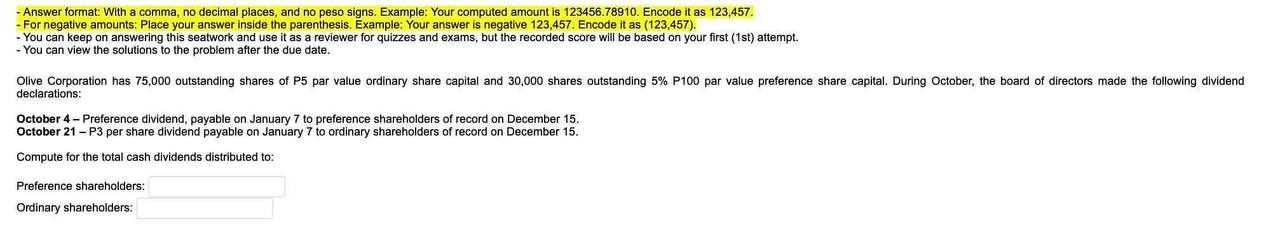

Answer format: With a comma, no decimal places, and no peso signs. Example: Your computed amount is 123456.78910. Encode it as 123,457. -For negative amounts: Place your answer inside the parenthesis. Example: Your answer is negative 123,457. Encode it as (123,457). - You can keep on answering this seatwork and use it as a reviewer for quizzes and exams, but the recorded score will be based on your first (1st) attempt. - You can view the solutions to the problem after the due date. The Board of Directors of ABC Corporation declared a dividend on March 6, 2XX1. to shareholders of record on April 7, 2XX1, P18 per share, payable on May 1, 2XX1. 100,000 ordinary shares were outstanding from March 6 to April 28 and 110,000 ordinary shares outstanding from April 29 to May 1. Compute for the total cash dividends distributed to shareholders.- You can keep on answering this seatwork and use it as a reviewer for quizzes and exams, but the recorded score will be based on your first (1st) attempt. - You can view the solutions to the problem after the due date. Prepare the journal entries using the memorandum entry method. Good Harvest Corporation was incorporated on January 1, 2021, with authorized share capital of 300,000 shares at P20 par value. a. The incorporators subscribed to twenty five percent of the authorized share capital and paid 25% of the subscription price. b. Good Harvest issued 10,000 shares for cash at P22 per share. c. The corporation received subscription for 5,000 shares at P24 per share. 30% of the subscription was collected and the balance is due on March 31, 2021. d. The incorporators in (a) paid the balance due on their subscriptions, and the share certificates were accordingly issued.- Answer format: With a comma, no decimal places, and no peso signs. Example: Your computed amount is 123456.78910. Encode it as 123,457. - For negative amounts: Place your answer inside the parenthesis. Example: Your answer is negative 123,457. Encode it as (123,457). You can keep on answering this seatwork and use it as a reviewer for quizzes and exams, but the recorded score will be based on your first (1st) attempt. - You can view the solutions to the problem after the due date. Olive Corporation has 75,000 outstanding shares of P5 par value ordinary share capital and 30,000 shares outstanding 5% P100 par value preference share capital. During October, the board of directors made the following dividend declarations October 4 - Preference dividend, payable on January 7 to preference shareholders of record on December 15. October 21 - P3 per share dividend payable on January 7 to ordinary shareholders of record on December 15. Compute for the total cash dividends distributed to: Preference shareholders: Ordinary shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts