Question: Comprehensive Module 1: Final Exam 1. The Smiths are married and have filed jointly in prior years. On July 29th of the current tax year,

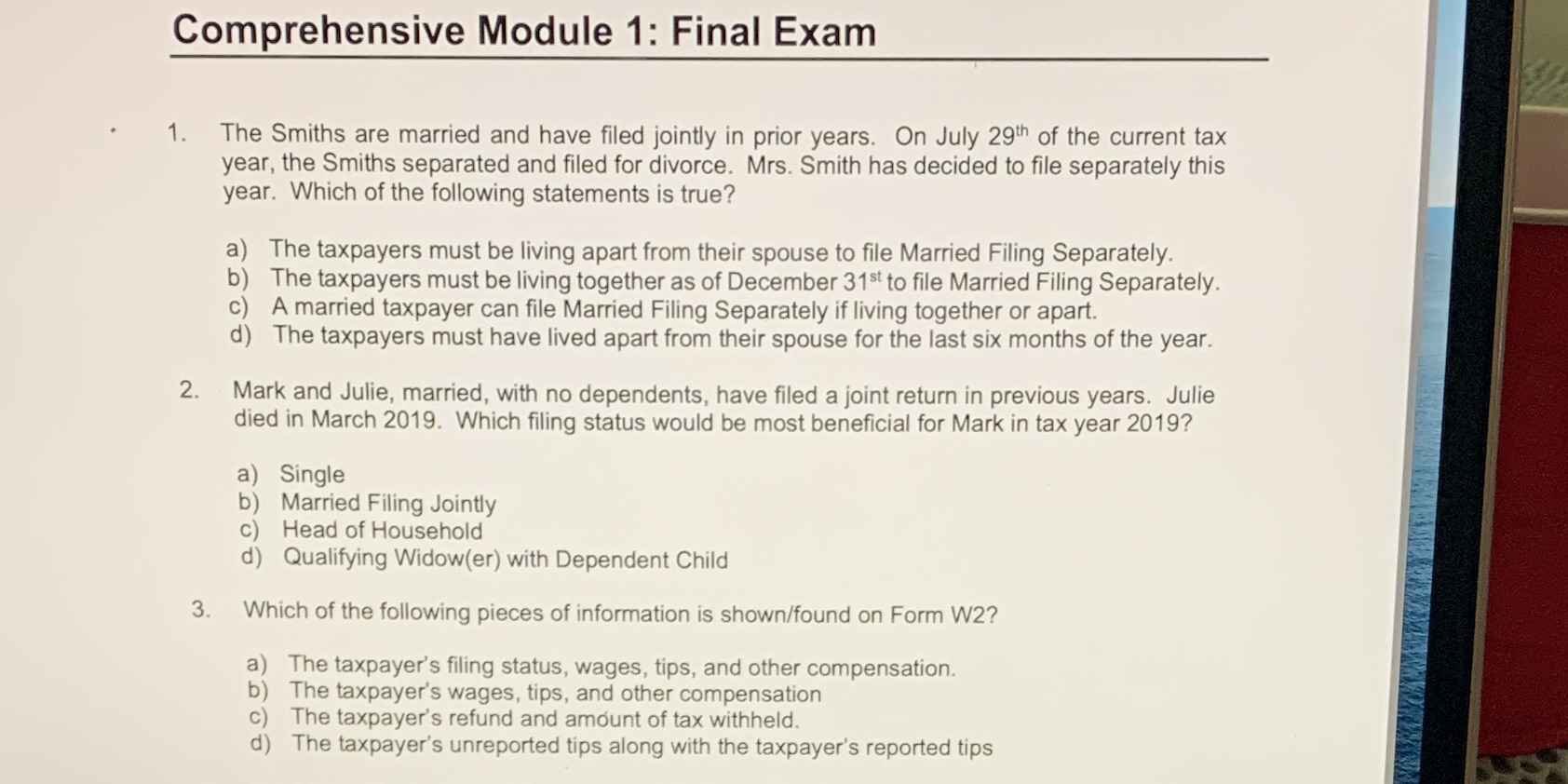

Comprehensive Module 1: Final Exam 1. The Smiths are married and have filed jointly in prior years. On July 29th of the current tax year, the Smiths separated and filed for divorce. Mrs. Smith has decided to file separately this year. Which of the following statements is true? a) The taxpayers must be living apart from their spouse to file Married Filing Separately. b) The taxpayers must be living together as of December 31st to file Married Filing Separately. C) A married taxpayer can file Married Filing Separately if living together or apart. d) The taxpayers must have lived apart from their spouse for the last six months of the year. 2. Mark and Julie, married, with no dependents, have filed a joint return in previous years. Julie died in March 2019. Which filing status would be most beneficial for Mark in tax year 2019? a) Single b) Married Filing Jointly Head of Household d) Qualifying Widow(er) with Dependent Child 3. Which of the following pieces of information is shown/found on Form W2? a) The taxpayer's filing status, wages, tips, and other compensation. b) The taxpayer's wages, tips, and other compensation C) The taxpayer's refund and amount of tax withheld. d) The taxpayer's unreported tips along with the taxpayer's reported tips

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts