Question: ANSWER IN DETAIL!!! EXPLAIN YOUR DECISION FOR SELECTION!!! Develop a critical analysis comparing the following three alternatives. State the reasons for selecting the most financially

ANSWER IN DETAIL!!! EXPLAIN YOUR DECISION FOR SELECTION!!!

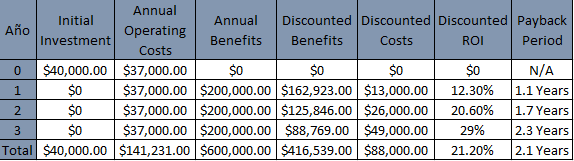

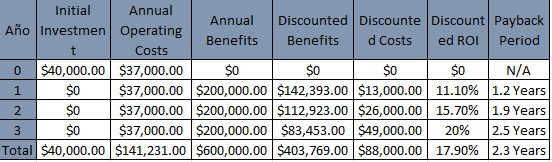

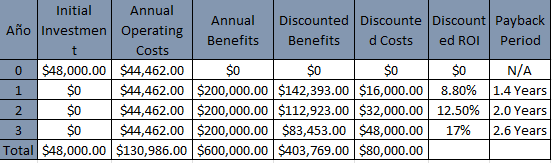

Develop a critical analysis comparing the following three alternatives. State the reasons for selecting the most financially favorable alternative. Use payback period and return on investment (ROI) metrics in the evaluation.

CHOOSE THE BEST ALTERNATIVE!

Alternative 1

\fInitial Annual Annual Ano | Investmen Discounted | Discounte | Discount | Payback Operating Benefits Benefits d Costs ed ROI Period t Costs 0 $40,000.00 $37,000.00 SO SO SO SO N/A 1 SO $37,000.00 $200,000.00 $142,393.00 $13,000.00 11.10% 1.2 Years 2 SO $37,000.00 $200,000.00 $112,923.00 $26,000.00 15.70% 1.9 Years 3 SO $37,000.00 $200,000.00 $83,453.00 $49,000.00 20% 2.5 Years Total $40,000.00 $141,231.00 $600,000.00 $403,769.00 $88,000.00 17.90% 2.3 YearsInitial Annual Annual Discounted | Discounte | Discount | Payback Ano | Investmen Operating Benefits Benefits d Costs ed ROI Period t Costs 0 $48,000.00 $44,462.00 SO SO SO SO N/A 1 So $44,462.00 $200,000.00 $142,393.00 $16,000.00 8.80% 1.4 Years 2 So $44,462.00 $200,000.00 $112,923.00 $32,000.00 12.50% 2.0 Years SO $44,462.00 $200,000.00 $83,453.00 $48,000.00 17% 2.6 Years Total $48,000.00 $130,986.00 $600,000.00 $403,769.00 $80,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts