Question: Answer in True or False Please answer all the questions from 26 to 35 in True or False: 26. Intercompany loans do not need to

Answer in True or False

Please answer all the questions from 26 to 35 in True or False:

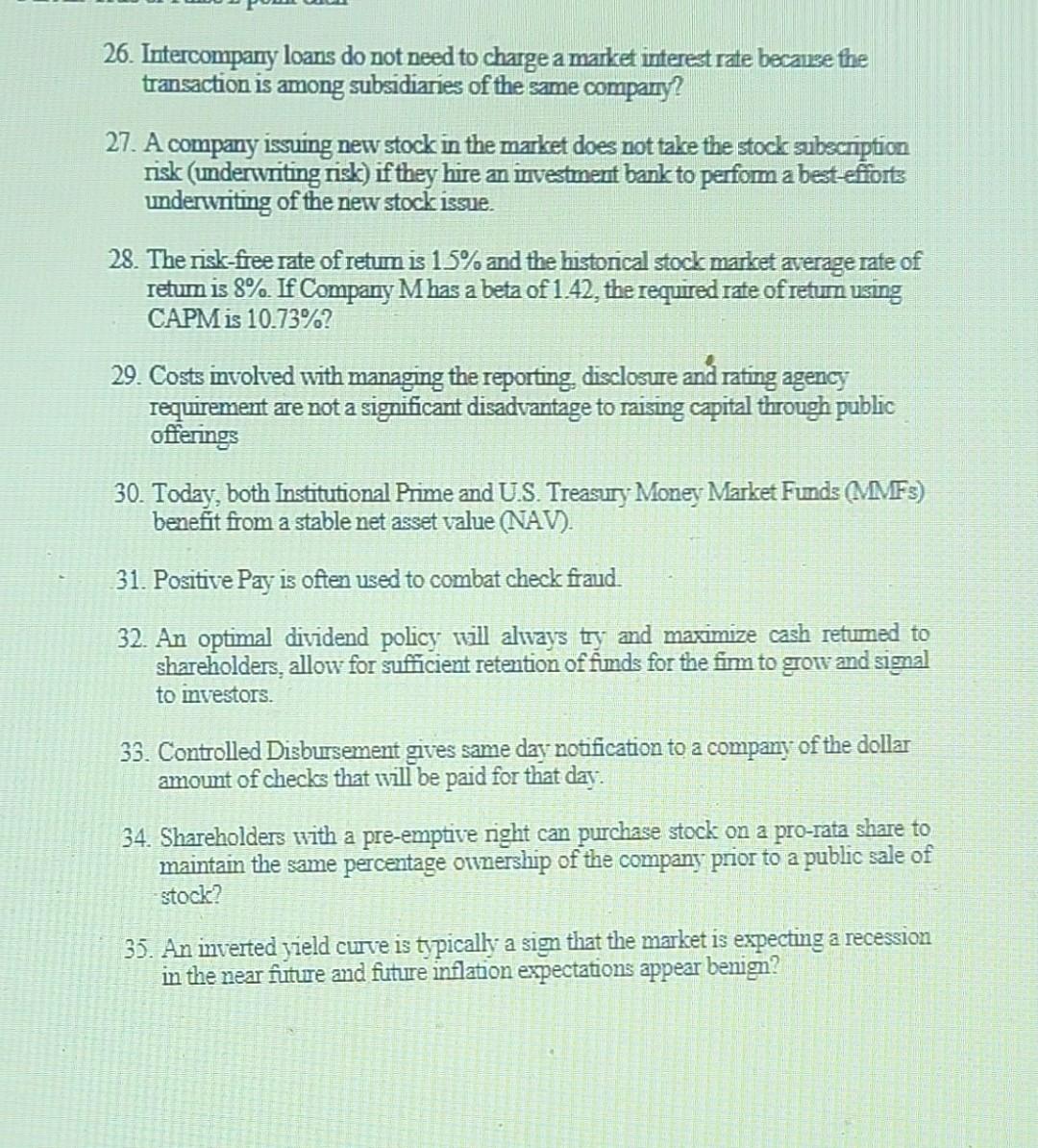

26. Intercompany loans do not need to charge a market interest rate because the transaction is among subsidiaries of the same company? 27. A company issuing new stock in the market does not take the stock subscription risk (underwriting risk) if they hire an investment bank to perform a best-efforts underwriting of the new stock issue. 28. The risk-free rate of retum is \15 and the historical stock market average rate of retum is \8. If Company \\( M \\) has a beta of 1.42 , the required rate of return using CAPM is \10.73 ? 29. Costs involved with managing the reporting, disclosure and rating agency requirement are not a significant disadvantage to raising capital through public offerings 30. Today, both Institutional Prime and U.S. Treasury Money Market Funds (MMFs) benefit from a stable net asset value (NAV). 31. Positive Pay is often used to combat check fraud. 32. An optimal dividend policy will always try and maximize cash retumed to shareholders, allow for sufficient retention of funds for the firm to grow and signal to investors. 33. Controlled Disbursement gives same day notification to a company of the dollar amount of checks that will be paid for that day: 34. Shareholders with a pre-emptive right can purchase stock on a pro-rata share to maintain the same percentage ownership of the company prior to a public sale of stock? 35. An inverted yield curve is typically a sign that the market is expecting a recession in the near future and future inflation expectations appear benign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts