Question: answer in type written please 3 Q. No. 6- Jane Lim owns all of the shares of J Ltd., a Canadian- controlled private corporation with

answer in type written please

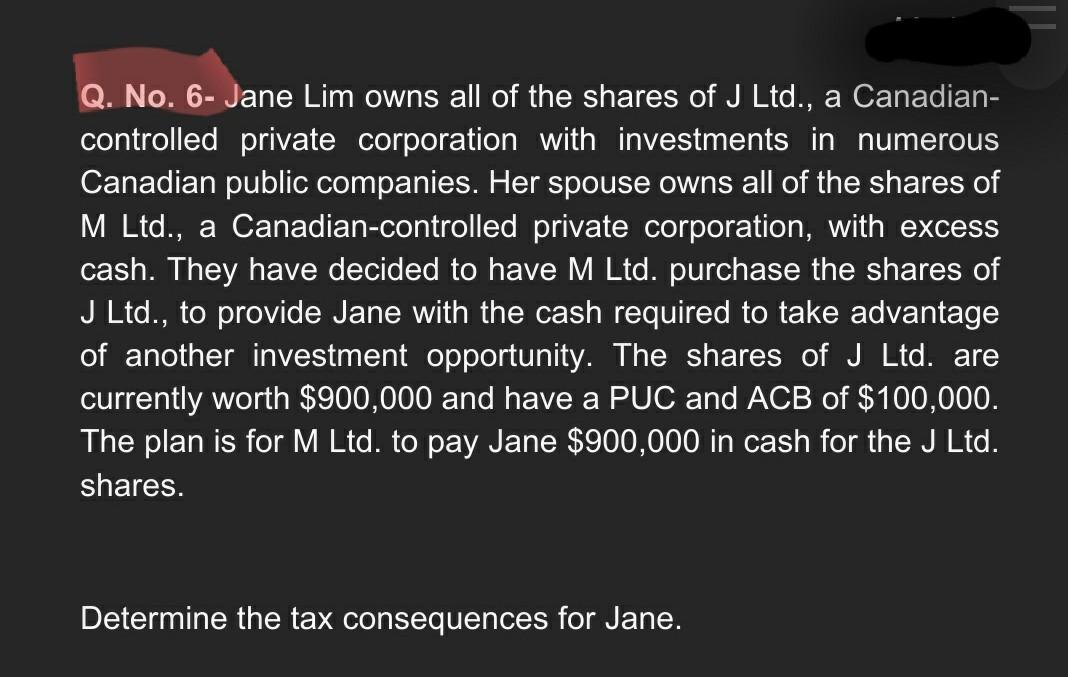

3 Q. No. 6- Jane Lim owns all of the shares of J Ltd., a Canadian- controlled private corporation with investments in numerous Canadian public companies. Her spouse owns all of the shares of M Ltd., a Canadian-controlled private corporation, with excess cash. They have decided to have M Ltd. purchase the shares of J Ltd., to provide Jane with the cash required to take advantage of another investment opportunity. The shares of J Ltd. are currently worth $900,000 and have a PUC and ACB of $100,000. The plan is for M Ltd. to pay Jane $900,000 in cash for the J Ltd. shares. Determine the tax consequences for Jane

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts