Question: answer in words no math needed 2. Consider the CCAPM. Let r be the interest rate at which an investor borrows. Assume the investor chooses

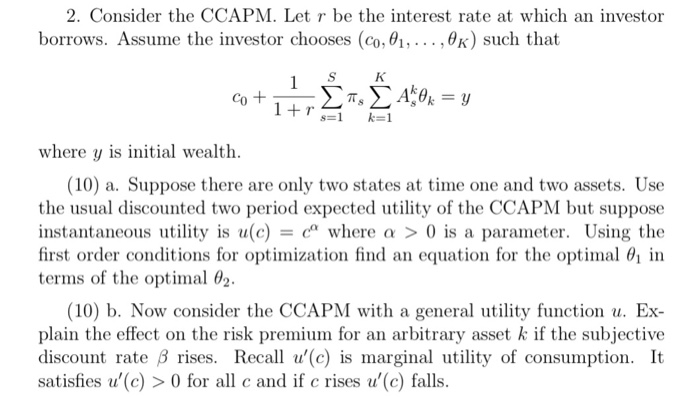

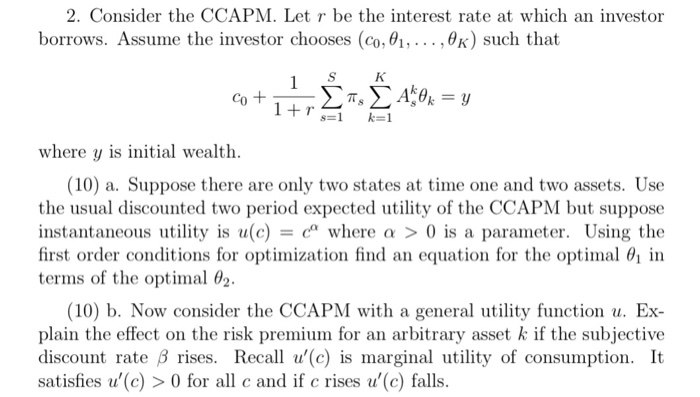

2. Consider the CCAPM. Let r be the interest rate at which an investor borrows. Assume the investor chooses (C0,01, ...,Ok) such that 1 cot - 4:0,= 1+r where y is initial wealth. (10) a. Suppose there are only two states at time one and two assets. Use the usual discounted two period expected utility of the CCAPM but suppose instantaneous utility is u(c) = (a where a > 0 is a parameter. Using the first order conditions for optimization find an equation for the optimal 0in terms of the optimal 02. (10) b. Now consider the CCAPM with a general utility function u. Ex- plain the effect on the risk premium for an arbitrary asset k if the subjective discount rate B rises. Recall u'C) is marginal utility of consumption. It satisfies u'(c) > 0 for all c and if c rises u'(c) falls. 2. Consider the CCAPM. Let r be the interest rate at which an investor borrows. Assume the investor chooses (C0,01, ...,Ok) such that 1 cot - 4:0,= 1+r where y is initial wealth. (10) a. Suppose there are only two states at time one and two assets. Use the usual discounted two period expected utility of the CCAPM but suppose instantaneous utility is u(c) = (a where a > 0 is a parameter. Using the first order conditions for optimization find an equation for the optimal 0in terms of the optimal 02. (10) b. Now consider the CCAPM with a general utility function u. Ex- plain the effect on the risk premium for an arbitrary asset k if the subjective discount rate B rises. Recall u'C) is marginal utility of consumption. It satisfies u'(c) > 0 for all c and if c rises u'(c) falls. 2. Consider the CCAPM. Let r be the interest rate at which an investor borrows. Assume the investor chooses (C0,01, ...,Ok) such that 1 cot - 4:0,= 1+r where y is initial wealth. (10) a. Suppose there are only two states at time one and two assets. Use the usual discounted two period expected utility of the CCAPM but suppose instantaneous utility is u(c) = (a where a > 0 is a parameter. Using the first order conditions for optimization find an equation for the optimal 0in terms of the optimal 02. (10) b. Now consider the CCAPM with a general utility function u. Ex- plain the effect on the risk premium for an arbitrary asset k if the subjective discount rate B rises. Recall u'C) is marginal utility of consumption. It satisfies u'(c) > 0 for all c and if c rises u'(c) falls. 2. Consider the CCAPM. Let r be the interest rate at which an investor borrows. Assume the investor chooses (C0,01, ...,Ok) such that 1 cot - 4:0,= 1+r where y is initial wealth. (10) a. Suppose there are only two states at time one and two assets. Use the usual discounted two period expected utility of the CCAPM but suppose instantaneous utility is u(c) = (a where a > 0 is a parameter. Using the first order conditions for optimization find an equation for the optimal 0in terms of the optimal 02. (10) b. Now consider the CCAPM with a general utility function u. Ex- plain the effect on the risk premium for an arbitrary asset k if the subjective discount rate B rises. Recall u'C) is marginal utility of consumption. It satisfies u'(c) > 0 for all c and if c rises u'(c) falls

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts