Question: Answer is A for sure How to solve? Dont answer if you get different number thanks C) $991.33 D) $998.21 E) $1,000.00 3 23 In

Answer is A for sure

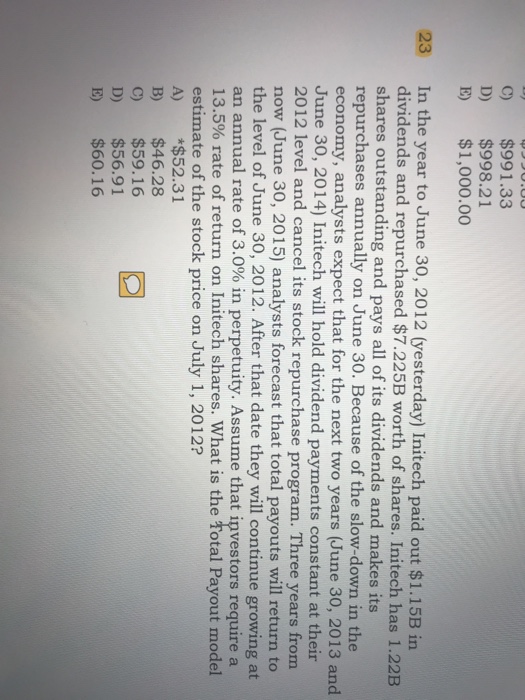

Answer is A for sure C) $991.33 D) $998.21 E) $1,000.00 3 23 In the year to June 30, 2012 (yesterday) Initech paid out $1.15B in dividends and repurchased $7.225B worth of shares. Initech has 1.22B shares outstanding and pays all of its dividends and makes its repurchases annually on June 30. Because of the slow-down in the economy, analysts expect that for the next two years (June 30, 2013 and June 30, 2014) Initech will hold dividend payments constant at their 2012 level and cancel its stock repurchase program. Three years from now (June 30, 2015) analysts forecast that total payouts will return to the level of June 30, 2012. After that date they will continue growing at an annual rate of 3.0% in perpetuity. Assume that investors require a 13.5% rate of return on Intech shares. What is the total Payout model estimate of the stock price on July 1, 2012? A) *$52.31 B) $46.28 C) $59.16 D) $56.91 E) $60.16 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts