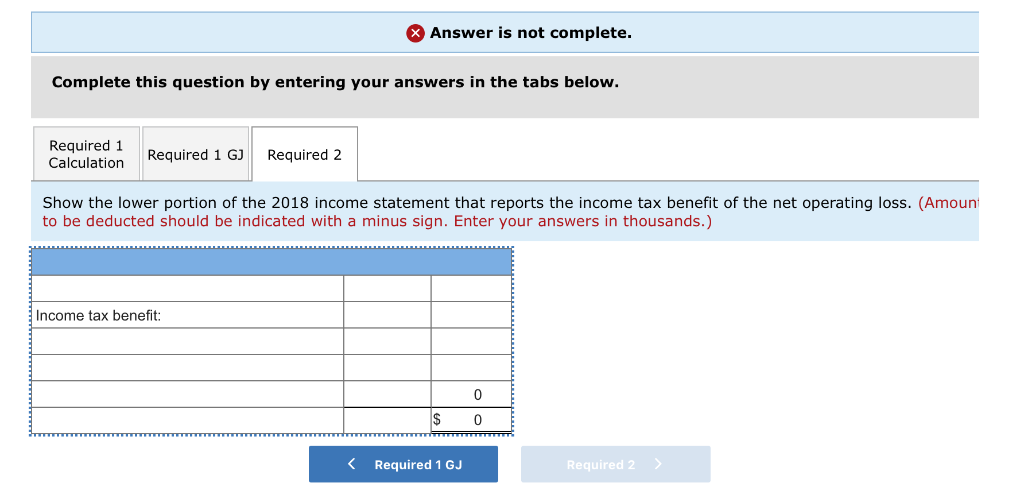

Question: Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1GJ Required 2 Show the lower

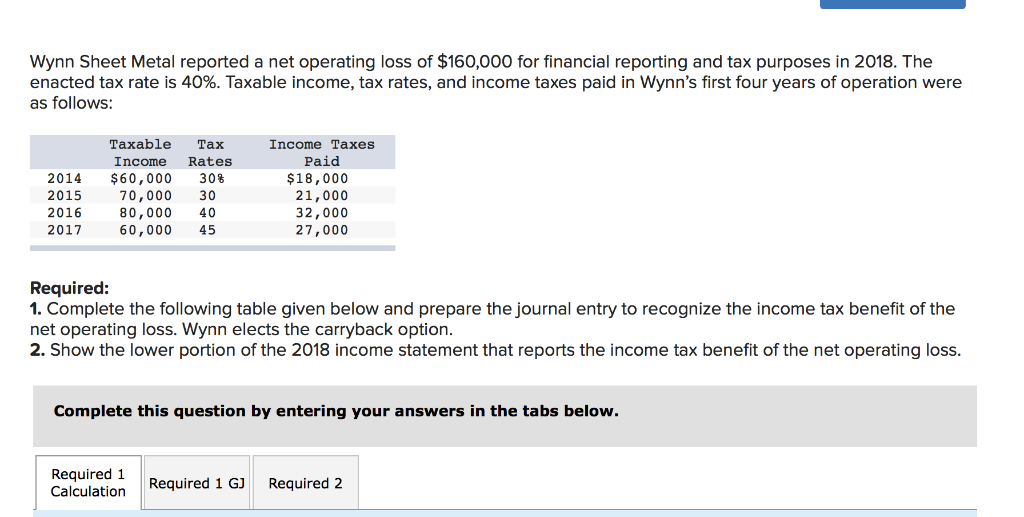

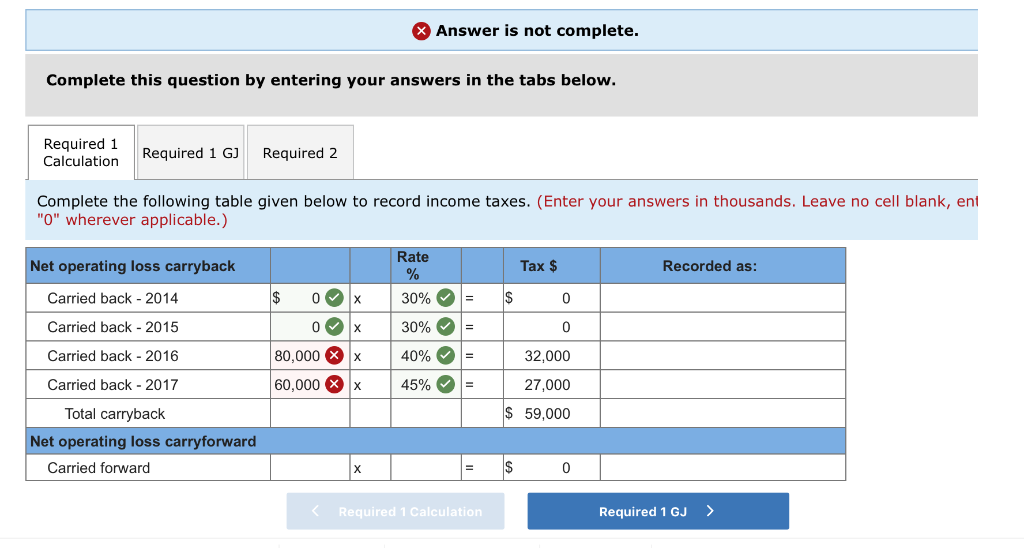

Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1GJ Required 2 Show the lower portion of the 2018 income statement that reports the income tax benefit of the net operating loss. (Amoun to be deducted should be indicated with a minus sign. Enter your answers in thousands Income tax benefit: Required 1 GJ Required 2 Wynn Sheet Metal reported a net operating loss of $160,000 for financial reporting and tax purposes in 2018. The enacted tax rate is 40%. Taxable income, tax rates, and income taxes paid in Wynn's first four years of operation were as follows: Taxable Tax Income Taxes Paid $18,000 21,000 32,000 27,000 Income Rates 2014 $60,000 30% 015 70,000 30 2016 80,000 40 2017 60,000 45 Required: 1. Complete the following table given below and prepare the journal entry to recognize the income tax benefit of the net operating loss. Wynn elects the carryback option. 2. Show the lower portion of the 2018 income statement that reports the income tax benefit of the net operating loss Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1 G1 Required 2 Answer is not complete Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1 GJ Required 2 Complete the following table given below to record income taxes. (Enter your answers in thousands. Leave no cell blank, ent "O" wherever applicable.) Rate Net operating loss carryback Tax $ Recorded as Carried back 2014 Carried back - 2015 Carried back - 2016 Carried back 2017 Total carryback 30% 40%- 45% 32,000 27,000 S 59,000 80,000 XX 60,000 X x Net operating loss carryforward Carried forward Required 1 Calculation Required 1GJ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts