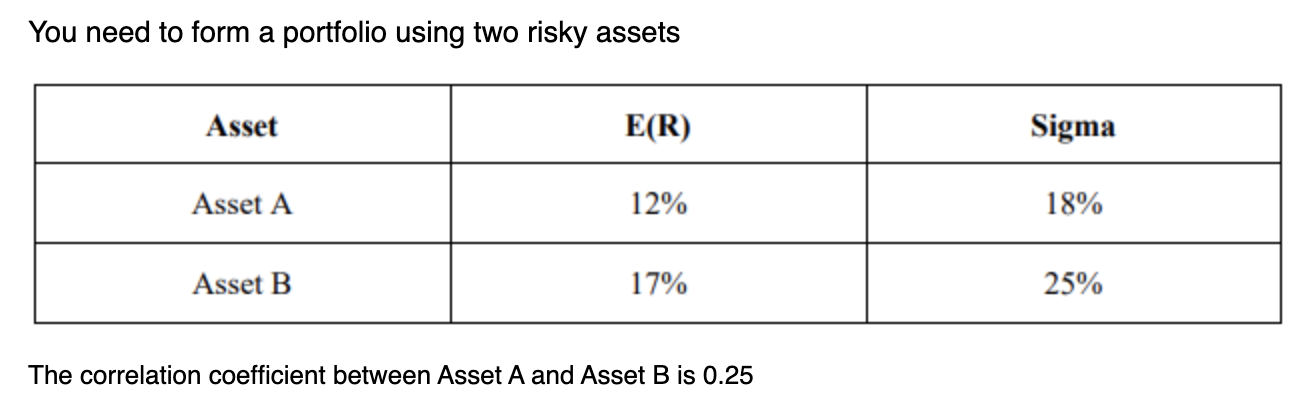

Question: answer is not decrease You need to form a portfolio using two risky assets Asset E(R) Sigma Asset A 12% 18% Asset B 17% 25%

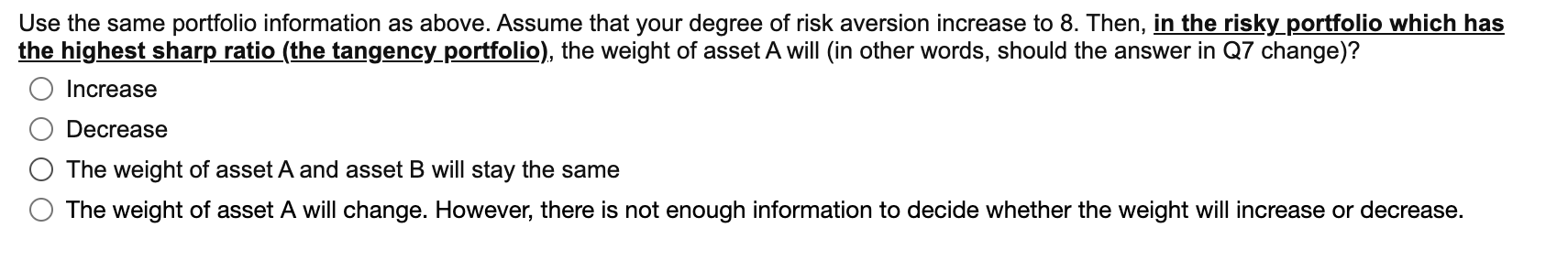

answer is not decrease

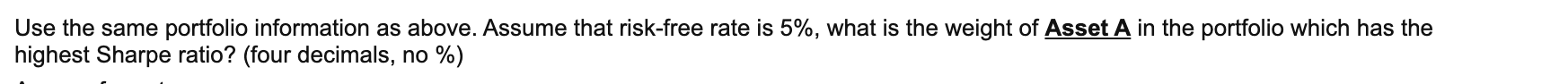

You need to form a portfolio using two risky assets Asset E(R) Sigma Asset A 12% 18% Asset B 17% 25% The correlation coefficient between Asset A and Asset B is 0.25 Use the same portfolio information as above. Assume that risk-free rate is 5%, what is the weight of Asset A in the portfolio which has the highest Sharpe ratio? (four decimals, no %) Use the same portfolio information as above. Assume that your degree of risk aversion increase to 8. Then, in the risky_portfolio which has the highest sharp ratio (the tangency_portfolio), the weight of asset A will (in other words, should the answer in Q7 change)? Increase Decrease The weight of asset A and asset B will stay the same O The weight of asset A will change. However, there is not enough information to decide whether the weight will increase or decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts