Question: answer it as per Ind AS FR FR T-1: Y Ltd. is a first time adopter of Ind AS. The date of transition is April

answer it as per Ind AS FR

FR

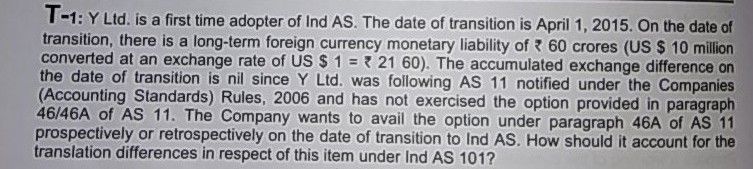

T-1: Y Ltd. is a first time adopter of Ind AS. The date of transition is April 1, 2015. On the date of transition, there is a long-term foreign currency monetary liability of 60 crores (US $ 10 million converted at an exchange rate of US $ 1 21 60). The accumulated exchange difference on the date of transition is nil since Y Ltd. was following AS 11 notified under the Companies (Accounting Standards) Rules, 2006 and has not exercised the option provided in paragraph 46/46A of AS 11. The Company wants to avail the option under paragraph 46A of AS 11 prospectively or retrospectively on the date of transition to Ind AS. How should it account for the translation differences in respect of this item under Ind AS 101? T-1: Y Ltd. is a first time adopter of Ind AS. The date of transition is April 1, 2015. On the date of transition, there is a long-term foreign currency monetary liability of 60 crores (US $ 10 million converted at an exchange rate of US $ 1 21 60). The accumulated exchange difference on the date of transition is nil since Y Ltd. was following AS 11 notified under the Companies (Accounting Standards) Rules, 2006 and has not exercised the option provided in paragraph 46/46A of AS 11. The Company wants to avail the option under paragraph 46A of AS 11 prospectively or retrospectively on the date of transition to Ind AS. How should it account for the translation differences in respect of this item under Ind AS 101

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts