Question: post DataXu: Selling Ad Tech On June 20, 2016, DataXu CEO Mike Baker surveyed the beachfront at the Cannes Lions International Festival of Creativity. Each

post

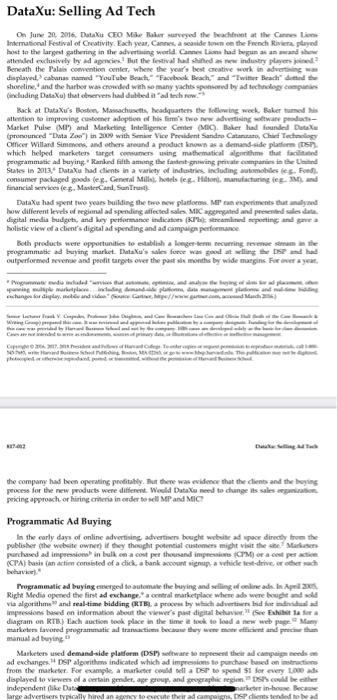

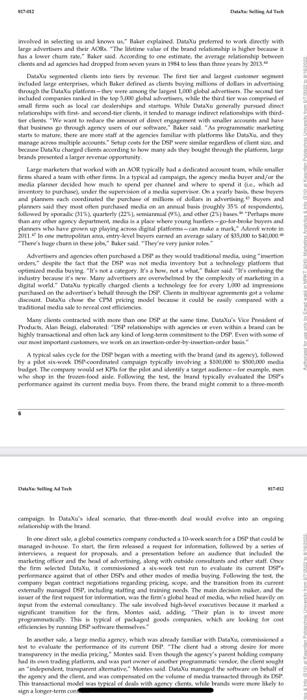

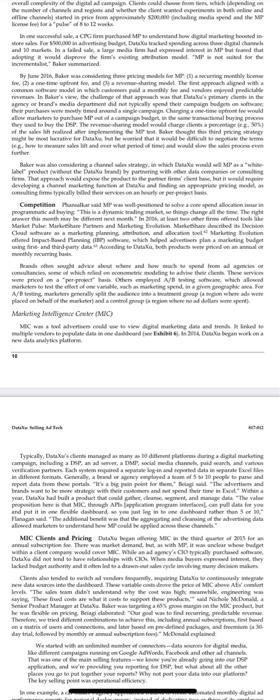

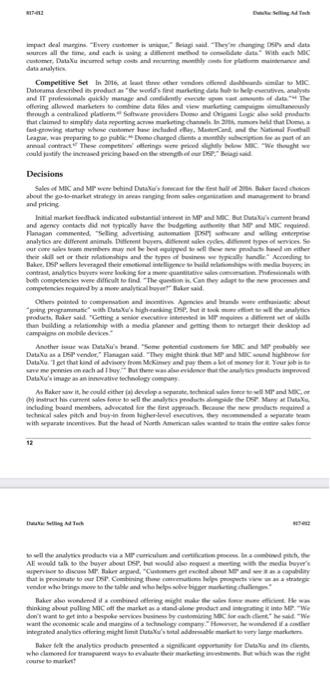

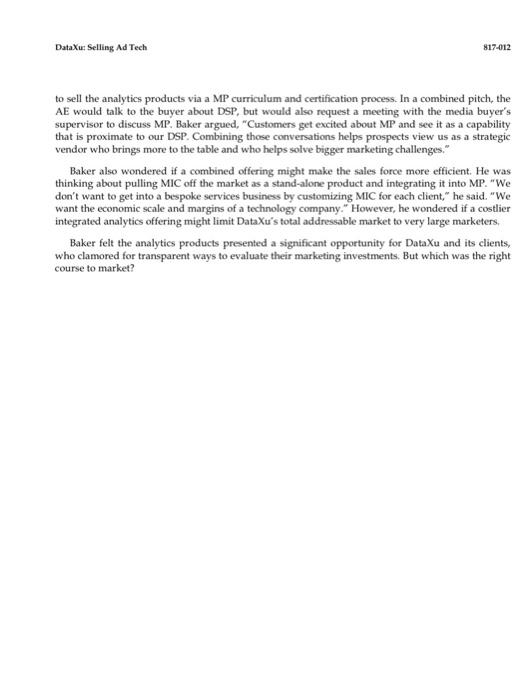

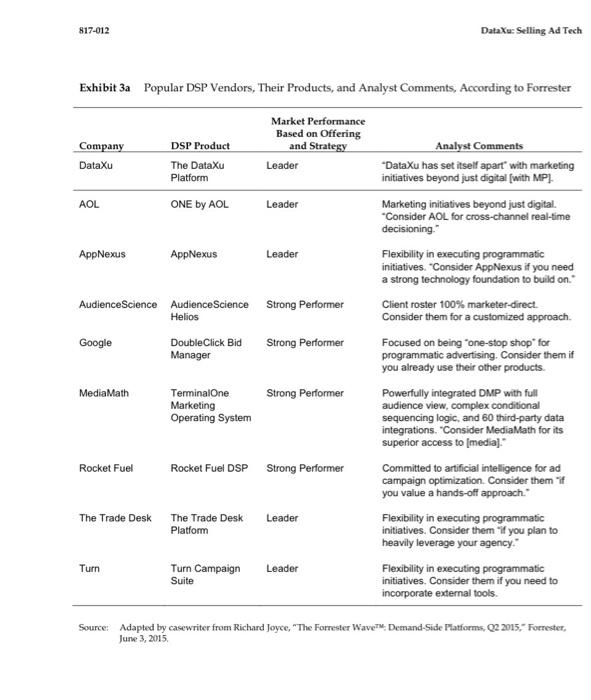

DataXu: Selling Ad Tech On June 20, 2016, DataXu CEO Mike Baker surveyed the beachfront at the Cannes Lions International Festival of Creativity. Each year, Cannes, a seaside town on the French Riviera, played host to the largest gathering in the advertising world. Cannes Lions had begun as an award show attended exclusively by ad agencies. But the festival had shifted as new industry players joined Beneath the Palais convention center, where the year's best creative work in advertising was displayed, cabanas named "YouTube Beach" "Facebook Beach," and "Twitter Beach" deed the shoreline, and the harbor was crowded with so many yachts sponsored by ad technology companies (including DataXu) that observers had dubbed it "ad tech row Back at DataXu's Boston, Massachusetts, headquarters the following week. Baker turned his attention to improving customer adoption of his firm's two new advertising software products- Market Pulse (MP) and Marketing Intelligence Center (MIC). Baker had founded Data (pronounced "Data Zoo") in 2009 with Senior Vice President Sandro Catanzaro, Chief Technology Officer Willard Simmons, and others around a product known as a demand-side platform (DSP) which helped marketers target consumers using mathematical algorithms that facilitated programmatic ad buying Ranked fifth among the fastest growing private companies in the United States in 2013, DataXu had clients in a variety of industries, including automobiles (eg. Food). consumer packaged goods (eg. General Mills), hotels (eg. Hiltori, manufacturing (eg. XM), and financial services (eg, MasterCard, SunTrust DataXu had spent two years building the two new platforms. MP can experiments that analyzed how different levels of regional ad spending affected sales MIC aggregated and presented sales date digital media budgets, and key performance indicators (KPb) streamlined reporting and gave a holistic view of a client's digital ad spending and ad campaign performance Both products were opportunities to establish a longer-term recurring revenue stram in the programmatic ad buying market. Dataku's sales force was good at selling the DSP and had outperformed revenue and profit targets over the past six months by wide margins For over a year. spanning multiple marketplace including demand plation date management plation and male bidding changes for display, meble and sidence Carte, hipe//www.gar.com, March 2 Weing the and apply thwarted by Hand by C2027ands of and des Tops Nad e Sched Pading gow photoorndand pod os K27002 an denied f madnie 1 Dalling Tack the company had been operating profitably. But there was evidence that the clients and the buying process for the new products were different. Would DataXu need to change its sales organization pricing approach, or hiring criteria in order to sell MP and MIC Programmatic Ad Buying In the early days of online advertising, advertisers bought website ad space directly from the publisher (the website owner) if they thought potential customers might visit the site Markers purchased ad impressions in bulk on a cost per thousand impressions (CPM) or a cest per action (CPA) basis (an action consisted of a click, a bank account signup, a vehicle test-drive, or other such behavior) Programmatic ad buying emerged to automate the buying and selling of online ads. In Apel 20 Right Media opened the first ad exchange," a central marketplace where ads were bought and sold via algorithms and real-time bidding (RTB), a process by which advertisers bid for individual ad impressions based on information about the viewer's past digital behavior" (See Exhibit la for a diagram on RTB) Lach auction took place in the time it took to load a new web page Many marketers favored programmatic ad transactions because they were more efficient and prethan manual ad buying" Marketers used demand-side platform (DSP) software to represent their ad campaign needs on ad exchanges, DSP algorithms indicated which ad impressions to purchase based on instructions from the marketer. For example, a marketer could tell a DSP to spend $1 for every 1000 adi displayed to viewers of a certain gender, age group, and geographic region DSP's could be either independent (like Data arketer in-house. Because large advertisers typically hired an agency to execute their ad campaigns, DSP clients tended to be ad the company had been operating profitably. But there was evidence that the clients and the buying process for the new products were different. Wild Data eed to change its sales organizations pricing approach or hiring criteria in onder to sell and M Programmatic Ad Buying In the early days of online advertising, advertisen boughe website all space directly from the publisher (the website owner) if they thought potential casters might visit the site Marketers purchased ad impressions in bulk on a cost per thousand impress (CPM) or a cost per action (CPA) basis (an active consisted of a dick, a bank account signup a vehicle test-drive, or other such behavior, Programmatic ad buying emerged to automate the buying and selling of online. In April 2005 Right Media opened the first ad exchange" a central marketplace where ads were bought and sold via algorithms and real-time bidding (KTB) a process by which aduti bid for individual ad impressions based on information about the viewer's past digital behavior" See Exhibit la for a diagram on KTB) Each auction took place in the time it took to and a new web page. Many marketers favored programmatic ad transactions because they were more efficient and precise than manual ad buying. age group and Marketers used demand-side platform (DSP) software to present their ad campaign nends on ad exchanges DSP algorithms indicated which ad imposions to parchase based on instructions from the marketer. For example, a marketer could sa DSP to spend $1 for every 1,000 ads displayed to viewers of a certain be independent (like Data), operated by an ad agmey, or operated by the marketer in-house. Because large advertisers typically hired an agency to execute their al campaigns, DSP dients tended to be ad agencies, though experts expected to see more brands working dictly with DSP's in the future. One observer noted, however, that "many agencies are nellactant to allow their clients to bypass them and speak with the ad tech vender, and this has created an atmosphere of mistrst Buyers chose DSP's based on flexibility, customization jeg ability to incorporate external tools and data sources into the platform, integration of the marketer's existing data vendors, machine learning abilities, data management tool integration, sablity, depth of reporting, integration of addressable channels such as email or audie, and cudemer service, among other considerations To carry out targeted online ad campaigns across channels, marketers used data management platforms (DMP) to store and interpt data DMPS gathel cookies to help the right audience for an ad impression D made it possible for marketers to segment consumers and augmenta marketer's own data (or "in-party date with infirmation obtained from outside sources. A marketing company explained that "a publisher could pair their un fine-party data on yachting enthusiasts with third-party data on people looking to buy a yach, thereby eating a yachting audience wegment within the DP When the DP had created all the customer segments the marketer desired. DMP's could be linked to DSPs to help exate the ad campaign Cesty dded when die helped y and their bha Awardy d Dating Ad Tech 117412 On the other side of the market, publishers looked to supply-side platforms (SSP) to represent their needs. These software tools, roughly the counterpart to a D helped online publishers sell the impressions their websites generated. As one observer summarized "where DSPs are used by marketers to buy ad impressions from exchanges as cheaply and an efficiently as possible. SPs are designed by publishers to do the opposite to mimine the prices their impressions sell at Exhibits 1 and 1c for diagrams describing the ad tech landscape) The DMP relied on user identities to differentiate ben. While cookies did this for computer browsers, tracking mobile device user behar was dient Instead, mobile device operating systems, such as Apple's 10S and Google's Andeid, ond machine identifiers for marketers (Apple used Identifiers for Advertising IDEAL, while Google usol Google Advertising ID) Large social media players such as Facebook and Google cold identify the same user across different devices because users logged in to the same act acrom their devices. These different types of identifiers also had different useful lives. The life of a cookie was relatively brief, machine IDs had long but device specific lives, and logins penisted longest of all and across devies Social media players, such as Google and Facebook, had the largest login audiences. These websites, termed "walled gardens did not allow advertisers to track wens behavior while on their "As one observer framed it some saw walled gandes" a puttially positive development that could cut down on traud and provide acces to mone high-quality audiences [while others see walled gardens as representative of a disconcerting lack of control for marketers who will have no choice but to work cally identify users across devices. The same comparties, not incide of drital media Berhad h A On thut tEl horolio Beir w markets to buy a ourtarpatinit ing from exchanges as chapy designed by publishers to do the opposite Exhibits 1b and le for diagrama dcribing the a ich landa) The DEPwtiontier bee1krt otagster perating wemand Caop markets (Apple uwd identities for Adverting Awhile Google Google Ading IDLargmtlmco and Google endlyana ditimmil devikte tecaumen denumee types of dental had different fulles. The face w IDshadsapaif Iinna gem eminen olreerseedch Be ergotene Tw stmo one godm tutorldcuttr and promideacoalatia ternsey poltiee demelym walled gardens representative of a doverting lack of cars who will have no ute oal tor trookw devsets fhce Site (onganics tota wif theerkallon Thnoraml hakfranho art building your own dats, you' a Let in ther fooromn buying their medis whit Digital Advertising in 2016: Advaneed Ads and Advanced lus The main oling poist of ourmmutomoctr tBe abBity to choose Creopni tectedt turtpfhuttac yer's entine a.T +TV peachte lin 2015568me otlag oum ortal UsThoatmey ome plheresands and the The marbreadfrmingbeVT HDty on ngitent ilerden (on dike bheems. wome mall M& 25% of 2015omum p UCTC) (04S) vion (1255%e (32%), Targeted digital ating had its changes and today dats had to terjgrand alsor foreire rigucinAle on bytutnsand or optim and p in 2013eo difficult to verify whether a human or a robot was "viewing ecking on an ad One 2015 sepoton e Jy Diiedee 2018 ineer 305telu grprooples in 3014 oftosailte Paying Data Xu Dalada 2008 by Wland SamID Tered g Maiswichotom g Sand Catania, the MBA MT, helped Intully the team coded applica eventually settled on ad sech an enging field that one e purtuee ond hal aagly 2011 2008 tutoh Cog andone transacting dileeb we can buy from you rCataruraner writ cDaliyClick Mahihasarate KiaData participating in the exchange. In 2013, the company raised 527 Son San Francis Smmosed mal The product artuk.onvwest ad f e captal By 201 the world lading integrated a labentensive proposition. Also, because billet ad impress millions of publishers on all exchanges each day, buyers could not be certain where a context their impressions would each an audience Video ads for Nin and Se made news in 2013 when they appeared before footage at an apparere betaling difficult to verify whether a human or a nobot was "viewing or clicking on an ad Ohe Intet robots (bot found that programmatic buys had a higher rad nate than di by December 2015, almost 10% ofben had installed ad block, with higher t younger people all, in 2006, 96% of marketers said they had participated in pratic buying sports s DataXu Data was founded to commercialize an automated decision-making plan developed in 2008 by Willard Simms, a PhD student at MIT" "I was applying the methodologie deved to design Mans mssion, which as a combinatorial optimization problem, Sande Cataan, then an MBA student at MIT, helped adapt the s Initially the team considered applications in the finance, airline, and healthcare eventually settled on ad tech, an emerging field that and early more advantage The ned algorithm to temate the purchase of digital ad space on an impression by p ad exchange by 2000, the tool had becom In November 2008 Dataku's cofounders met with Google and Yaher to do the publity of acting digital ad space through real-time badding"They were willing ads in ba we can buy from you one by one." Catanzaro said. Within a year, Google launched a ne its ad exchange, DoubleClick, which incorporated RTB Dat was one of about a do participating in the change in 2013, the company sabed 27 million in vetta capital By 2004 Datas had over 700 dan 330 employees, and 16 offen in cities and the world ing Bo San Francisco New York City: Sydney, Australia and Bangalore, Inda DSP their primuiry weventurine. Datu's front sellers were known as account executives (AB By June 2016 De employed 24 All in North America and 10 outside North America Als we may graduates who had five or more years of experience in the media business working competitors or companies like Apple Google, Microsoft NBC, and Yahoo Als med on target camins (OT) in base salary and 50% in Intive pay. An AE was die ei pay if she met her annual quots, which was set by the regional vi presidents of sales (West Contra and Eart, for North American sales) according to a combination of net ever expectations for new and existing diens. Once the AE had reached her new dem ser quota, she was die unlimited common, termed "acoderator land" in 2006, the Al in net rever, with some quotes in the millions of dollars for the latter Qu increased each year and were based on the Al's previous performance at Dutaka the low qua were aged to new Allis, especially those hand mad-year in g. 5000 so need that inaming curve. The compensation structure had been in place for North American Al since January 2016 previously, account executives had ben aged different quota 1 new and existing clients, with higher camings rates for new bu found that w png r ches but we we't getting the growth out of existing clients Chid Ben Oo Lwand Modes said. "We're new growing at a higher rate year www year, so the plan s DSP Data's DP was an ad-beying talverens and agencies led to cry campaign "Our machine leaming platicem construch models for each aber evaluates each ad impression based on that model and renders a bid for that para p then chooses the creative message that is most likely to create a conversion event Baker explained Chests could log in to the D check performance, and view the reports the plan 2005 DSP products, Forester Research gave Dataku's DSP the highest rang its machine kaming capabilities and predictive analytics su "By trying to she mater challenges that go b o beyond digital media 1 a buying Dataka ha solution for market the analyst wrote. Datu abe had a 75 fraud- noted, "If we were selling cars, we would be the full-featured Feman will come Chur algorithm can interpret website data in der to eat news for det Clents d un campaign using model-band tactics, nies based tactical the model-based structure, clients specified the KPIs for the campaign, and the machine leng technology of the DS would buy and measure every ad impressions, continually option c met the client's KPIs Alematively, clients could opt for a nies-based model terms of what ad impressions could be bought what we what carry more hard-wired targeting DSP Clients and Pricing Datau seged Als into two teams One w do including their agencies of record (AOR), calling General Mith directly and the other wo agencies. Als discovered potential clients with the help of two other team computer marketing and imide sales, Marketing received leads primarily through the Dataka website, we ill out a contact for request a demo, or enter their contact information for or white paper. The information ented in the website and at condence bed the lead database. The inde s marketing and d t DataXu: Selling Ad Tech On June 20, 2016, DataXu CEO Mike Baker surveyed the beachfront at the Cannes Lions International Festival of Creativity. Each year, Cannes, a seaside town on the French Riviera, played host to the largest gathering in the advertising world. Cannes Lions had begun as an award show attended exclusively by ad agencies. But the festival had shifted as new industry players joined Beneath the Palais convention center, where the year's best creative work in advertising was displayed, cabanas named "YouTube Beach" "Facebook Beach," and "Twitter Beach" deed the shoreline, and the harbor was crowded with so many yachts sponsored by ad technology companies (including DataXu) that observers had dubbed it "ad tech row Back at DataXu's Boston, Massachusetts, headquarters the following week. Baker turned his attention to improving customer adoption of his firm's two new advertising software products- Market Pulse (MP) and Marketing Intelligence Center (MIC). Baker had founded Data (pronounced "Data Zoo") in 2009 with Senior Vice President Sandro Catanzaro, Chief Technology Officer Willard Simmons, and others around a product known as a demand-side platform (DSP) which helped marketers target consumers using mathematical algorithms that facilitated programmatic ad buying Ranked fifth among the fastest growing private companies in the United States in 2013, DataXu had clients in a variety of industries, including automobiles (eg. Food). consumer packaged goods (eg. General Mills), hotels (eg. Hiltori, manufacturing (eg. XM), and financial services (eg, MasterCard, SunTrust DataXu had spent two years building the two new platforms. MP can experiments that analyzed how different levels of regional ad spending affected sales MIC aggregated and presented sales date digital media budgets, and key performance indicators (KPb) streamlined reporting and gave a holistic view of a client's digital ad spending and ad campaign performance Both products were opportunities to establish a longer-term recurring revenue stram in the programmatic ad buying market. Dataku's sales force was good at selling the DSP and had outperformed revenue and profit targets over the past six months by wide margins For over a year. spanning multiple marketplace including demand plation date management plation and male bidding changes for display, meble and sidence Carte, hipe//www.gar.com, March 2 Weing the and apply thwarted by Hand by C2027ands of and des Tops Nad e Sched Pading gow photoorndand pod os K27002 an denied f madnie 1 Dalling Tack the company had been operating profitably. But there was evidence that the clients and the buying process for the new products were different. Would DataXu need to change its sales organization pricing approach, or hiring criteria in order to sell MP and MIC Programmatic Ad Buying In the early days of online advertising, advertisers bought website ad space directly from the publisher (the website owner) if they thought potential customers might visit the site Markers purchased ad impressions in bulk on a cost per thousand impressions (CPM) or a cest per action (CPA) basis (an action consisted of a click, a bank account signup, a vehicle test-drive, or other such behavior) Programmatic ad buying emerged to automate the buying and selling of online ads. In Apel 20 Right Media opened the first ad exchange," a central marketplace where ads were bought and sold via algorithms and real-time bidding (RTB), a process by which advertisers bid for individual ad impressions based on information about the viewer's past digital behavior" (See Exhibit la for a diagram on RTB) Lach auction took place in the time it took to load a new web page Many marketers favored programmatic ad transactions because they were more efficient and prethan manual ad buying" Marketers used demand-side platform (DSP) software to represent their ad campaign needs on ad exchanges, DSP algorithms indicated which ad impressions to purchase based on instructions from the marketer. For example, a marketer could tell a DSP to spend $1 for every 1000 adi displayed to viewers of a certain gender, age group, and geographic region DSP's could be either independent (like Data arketer in-house. Because large advertisers typically hired an agency to execute their ad campaigns, DSP clients tended to be ad involved in selecting us and knows us Baker explained. Ditxu preferred to work directly with large advertisers and their ACR "The lifetime value of the brand relationship is higher because it has a lower cham rate," Baker said. According to one estimate, the average relationship between clits and ad agencies had dropped from seven years in 1984 to less than three years by 2013 Data sented clients into tiers by revenue. The first tier and largest reg included large enterprises, which Baker defined as clients buying millions of dollars in advertising through the Data platforms-they were among the largest 1000 global advertisers. The second tier included companies ranked in the top 5,000 global advertis, while the third tier was comprised of small firms such as local car dealerships and startups While DutaXs generally pursued dict wlationships with fint and second-tier clients, it tended to manage indirect relationships with third- ter clients. "We want to reduce the amount of dit engagement with smaller accounts and have that business go through agency users of our software. Baker said. "As programmatic marketing starts to mature there are more staff at the agencies familiar with platforms like Dataka, and they manage across multiple accounts Setup costs for the DSP were similse regardless of client sine, and becane DataXu charged clients according to how many ads they bought through the platform, large brands presented a larger revenue opportunity Large marketers that worked with an AOR typically had a dedicated account team, while smaller shared a team with other firms. In a typical ad campaign, the agency media buyer and/or the media planner decided how much to spend per channel and where to spend it fe, which ad inventory to purchase), under the supervision of a media sepervisor. On a yearly basis, these buyers and plannen each coordinated the purchase of millions of dollars in advertising Buyers and planners said they most often purchased media on an annual basis froughly 35% of respondent followed by sporadic (31%) quarterly (22%), (%), and other (25) bas "Perhaps than any other agency department, media is a place where young huntlers-go-or-broke buyer and planners who have grown up playing across digital platforms-can make a mark" Alenk wrote in 2011 In one metropolitan ama, intry-level buyers earned an average salary of $35,000 to $40,000 "There's huge churn in the jobs" Baker said. "They're very p iar Adverts and agencies othen purchased a DSP as they would traditional media, ung "inton orders despite the fact that the DSP was not media inventory but a technology platform that optimized media buying "It's not a category. It's a how, not a what" Baker said "I's coming the industry because it's new. Many advertisers are overwhelmed by the complexity of marketing in a digital world Datau typically charged dients a technology fee for every 1000 ad apri purchased on the adverter's behalf through the DSP Clients in maltiyear agreements got a volume discount. Ditaku chose the CPM pricing model because it could be easily compared with a aditional media sale to reveal cost efficiencies Many clients contracted with more than one DSP at the same time, Data's Vice President of Products, Alan Bragi, elaborated "DSP relationships with agencies or even within a brand can be highly transactional and often lack any kind of long-term commitment to the DSP. Even with some of A typical sales cycle for the DSP began with a meeting with the brand and its apy), followed by a plot six-wek DSP coordinated campaign typically involving a $300,000 to $500,000 media budget. The company would set KPIs for the pilot and identily a target audience-for example, men who shop in the from food aisle. Following the test, the Imand typically evaluated the DSP's performance again in curtent media buys. From there, the brand might commit to a three-month Dalling Ad Tech VIT campaign in Data's ideal semarie that three-month dead would evolve into an orpsing whip with the brand In one direct sale, a global cosmetics company conducted a 10-week search for a DSP that could be aged in-house. To start the firm released a request for information, followed by a series of interviews, a request for proposals and a presentation before an audience Out included the marketing officer and the head of advertising, along with outside consultants and other staff. Once the firm selected DataXu, it commissioned a six-week test run to evaluate its current D performance against that of other DSPs and other modes of media buying Following the test, the company began contract negotiations regarding pricing, scope, and the transition from its current extemaly managed DSP, including staffing and training needs. The main decision maker, and the er of the first request for information, was the firm's global head of media, who relied heady on input from the external consultancy. The sale involved high-level executives because it marked a significant transition for the firm Montes said, adding Their plan is to invest more programmatically. This is typical of packaged goods companies which are looking for com efficiencies by running DSP software themselves In another sale, a large media agency, which was already familiar with Data, comida sest to evaluate the performance of its current DSP "The client had a strong desire for more aparency in the media pricing" Montes said. Even though the agency's paret holding company had its own trading platform, and was part owner of another programmatic vender the client sought independent, transparent alkemative" Montes said. Dataku managed the software on behalf of the agency and the client, and was compensated on the volume of media tramacted through s DSP This transactional model was typical of deals with agency chents, while brands were more likely to signa long-term con ramyake h Daata's Me rnt ueend pomaga wanap ang puma wwwapt the props and to be a authating other and tae rot r of offee tandong ottolangaan thermiss ponganttingin mirmy ming Doa, incaling and mcne of the Sunil miput h eBhen in for the firm, Madding "The polly The bying the heatuidet alhea large mage?); = to the press many in the media pricing Montes id Even though the apmey's pa uniaomandr alwady lam with T 02 "The chang Vd egy and the cand was on the vole of meda ensglogeshmeretna- The Shifting DSP Landscape The wed by spod plegat sepasang senangan 22 P 2015 ke gandschon G's Deck had an ang kotse Rocket F and F Rocket Faded Seipitroder 2003 on 2015 Tuour,aaporeerindr de mem peigirietaryiodi Thee oe ending 2430%gen and again ang digala.com 35 in 2015, Google and Facebook shared 54% of the digital ad indus in 2010, one analyseported alle companies will indedy'd players another analyse wreng msgrew tirthaving the prades p True wrocerone According to The Flangan Det's Do in acto partis la but thique. I get by sme p pt Songte Gen via regina v ang bata Sang Ak 2014, huding Pund des Mul2 ang mga que por jo oglasa sapa sining mapana p MrGKganaldabo Imodara bulingar113 DataXu and Marketing Analytics hafeof Marlartngoo at Der Jmart emigouhemating arms tforDacthi, DR app and grow fast there as we c can But being cy ipinte Dr wandighede budgeting pag guestimat a com D TO pala mukrgin marked ang mga panepa Market (MP) MP retsmed the temepot of af copyriges by daconate af wyend n Lahiha Sa). Battheticing ooti and nterta fit eutem tie satietet lnding Sui ince M DataXu: Selling Ad Tech 817-012 to sell the analytics products via a MP curriculum and certification process. In a combined pitch, the AE would talk to the buyer about DSP, but would also request a meeting with the media buyer's supervisor to discuss MP. Baker argued, "Customers get excited about MP and see it as a capability that is proximate to our DSP. Combining those conversations helps prospects view us as a strategic vendor who brings more to the table and who helps solve bigger marketing challenges." Baker also wondered if a combined offering might make the sales force more efficient. He was thinking about pulling MIC off the market as a stand-alone product and integrating it into MP. "We don't want to get into a bespoke services business by customizing MIC for each client," he said. "We want the economic scale and margins of a technology company." However, he wondered if a costlier integrated analytics offering might limit DataXu's total addressable market to very large marketers. Baker felt the analytics products presented a significant opportunity for DataXu and its clients, who clamored for transparent ways to evaluate their marketing investments. But which was the right course to market? In the summer of 2013, Dataku conducted a similar test for Les acres 13 de as (DMA Employing a methodology used in clinical drug trials, MP took a brand's ad campaig halt and perated randomised weekly spend levels to determine the optional mix for a give prographic region. The stware also allowed brands to amess the return on investment of their ad pland with Facebook and Google, which did not les comer-level data to as "You can't meet the consumer level, but at least you can mean it at the investment level Baker "You know what you invested in Facebook. How many new customen did that drive At the end of the 13-ok "pube," or experiment Data analyzed "lat" in the number of text drives at Lesin dealerships in each market. MP produod demand curves for each channel (we Exhibit being where brands were overspending and underopending and what the optimal al spend allocation across the analysed channels would be For example, MP might determine that a hand was overspending in puid seech and social and suggest adjusting those investments and wing the money to spend more in TV, mobile, and out of home channel in g. bilboard MF Clients and Pricing MP had a different byer than the typical DSP cntcontece the soft cot more and produced strategy recommendations that required more decision-making p"You can't de MP with $30,000 Flanagan said. "You typically need $300,000 $400,000 make the methodology held. So you're talking to a morte sence media or digital person, and laely having to get buy-in from someone in an analytics or measurement role as well and perhaps from the CMC CFO or COO, 's a slow sales cycle to get money into the execution budgets Data depended units As to generate intent in MP, king to clients that had adopted Dutakuan an approved partner and those with larger budgets, which could experiment on ne technologies. The media supervisor anually signed off on a company-wide partnership with an ad tech firm, after a medu buyer had selected Datalu as part of an accounts media plan. There when selling M, Dataka's AEs targeted the media persor or the head of analyties and strategy. Catinar and Phamakar handed the sale once a meeting with the chant had been it because they felt they could more fully reps the MP product in its early stage Pharreled "We have created emaghsales collateral that the sales team understands the product at a high level Oce they get some artin Sand and I get involved. According to Dubrands teded to be more receptive to MP while we agencies were cage to part with Datasme felt atened by the sea that a stware programs would advise the din about marketing investment strategy and others balked at the extra work mpired to provide data to Data ad ade spending levels according to MP"commendations Market Peeds champion at the buyer and the champions are the marks in the corporation who are saying 1 want to take on marketing RO, one and for all Baker said Under Data's sales compensation plan, puting Mo an exting chat was wr and helped Alsach "acolator land" Als MP codd help Ats differentiate their DSP ag competion "Chants always ask, "How are you diferent? Mertes said. "The real answer is a very technical one that will bore the media buyer and is hard to prees, but with MP we have a technology that others de MP also typically boasted the client's use of the DSP "By selling it, Alls get MP fees as well as the DSP volume going through it i In early 2016 Dat began ploting MP he dents. Aside from the cost of the might cost $30,000 per test for a lime fer, requiring a spending minimum of $75,000 via the X DSP Prices for Mer the pilot were calculated as a percentage of the climt's tal media spend, and the percentage typically beton 30% and 20% of execated medial varied depending on the number of channels types of churbs (eg, diptal search social TV) number of prographies/markets and complexity of the digital al campaign Chers could choose from tiers which (depending on the member of channels and regions and whether the clant wanted experiments in both online and offine charel) started in price from appresimately $200,000 reading media spend and the MP fapt 22 In one call sale, a CPG firm purchased MP to understand how digital marketing boosted in store sale For 5000 in doing budget. Datako tracked spending on three digital channels and 10 markets in a falled sale, a large media firm had exposed unterest in MP but feared that adopting prove the fine's editing stribution model is not suited for the incrementalist, Brand would By J 2116, Baker was considering the pricing models for MP (1) a recurring monthly home fee (2) netime upfront fee, and a reman sharing model. The first approach aligned with a common software model in which customers paid a monthly fee and vendors enjoyed predictable revmesin Baker's view, the challenge of that appenach was that Dataku's primary clients in the agency of brands media department did not typically spend their campaigs budgets on sowe their purchases were mostly smed around a single campaign Charging a vee-time sport fee would allow marketers to puhaw MP cut of a campaign budget, is the same transactional buying process they used to buy the DSP The revenue-shuring model would charge clients a percentage. 50%) of the sales lit realized after implementing the MP set Baker thought this and pricing might be most lucrative for Data, but he worried that it would be difficult to negotiate the t ing how to real lift and over what period of time) and would slow the sales process even further. egy Baker was also considering a channel sales strategy, in which Datatu would sell MP as a "whose label product without the CataXe brand) by partnering with other data companies or oming fem that approach would expose the product to the partner firmi chent base, but it would require pring model Competition umakar said MP was well-positioned to solve a core spend allocation is in programmatic ad buying "This is a dynamic trading market, wo things change all the time. The right this month may be different next month" in 2006, at least two other fiems offered to the Market Pub MarketShare Fartners and Marketing Evolution MarketShare described in Decision Casoftware marketing planning ation and allocation tood Marketing Evolution fed Impact Bed f plan a marketing budget erall complexity of the digital al campaign Clients could chum ters, which depending the number of channels and regions and whether the client wanted experiments in both online and fine che stated in price from approximately $200.000 (including media spend and the MP lime fee) for a "pulofto 12 wek In cul sale, CPG firm purchased MP to understand how digital marketing houted in store sales For $500,000 in advertising budget, Dutca tracked spending across the digital channel and 10 markets. In a failed sale, a large media fim had expressed interest in MP but fand that adopting would disprove the fim's exiding arbution modd MP is not sud for the incremental, Faker vemmarized By J2006, Baker was comiding the pricing model for MP (1) securing monthly c for (2) e-time upfront fee and One-sharing model. The first approach aligned with a common soft model in which cantors paid a monthly fee and vendors el predictable In Baker's view, the challenge of that appeach was that Dataka's primary chants in the agency or brand's media department did not typically spend their campaign budgets on softwa the purchases were mostly omed around a single campaign Changing a one-time apfront fee would allow market to purchase MP out of a campaign budget in the same transactial buying pr they used to buy the DSP. The reveshuning model would charge dients a percentage (eg, 50%) of the sales and after implementing the MP and Baker thought this third ping strategy might be for Data e oried that it would be difficult to (eg. w tour sales lift and over what period of time and would show the sales process further the Baker was also considering a channel sales strategy, in which Data wild MP "white label product (without the Dutaka brand) by partnering with other das companies or conting firm That appeach would expose the product to the partner firm chen have, but it would repre developing a channel marketing in a Date and finding an appropriate pricing modd, a consulting firms typically billed their services on an hourly or perpet Competition Pakar said MP was well-positioned to solve a co spend allocation in programmatic ad hying "This is a dynamic trading market, we things chung all the time. The right arower this month may be different next month" In 2006, at least two other firme offered tools like Market Ple Markbare Parts and Marketing Evolution Markethare dentbed its Decision Cload waren marketing planning, abution, and allocation tool Marketing ton fed Impact Band Planning (1) software, which hdped advertisers plan a marketing budget ung fine and third-party data According to Dutaka, both products were priced on an annual or thly recurring b and advice about where and how much to spend from all ages of cancies, some of which ind on econometric modding to advise their clients. The services we priced on a "per-project has. Others employed A/B ting software, which allowed marketers to test the fact of one variable, voch as marketing spend, in a given geographic area For A/B mark merally split the audience into a tant group (apon whereas were placed on behalf of the marketer) and a control group a region where no ad dollars we spent Marketing Intelligence Center (MIC) MIC was tol advertiers could use to view digital marketing data and trends. It linked to multiple vendors to populate data in one dabboard e Exhibit 6 In 2004 Data began work on a 18 Typically, DatXachets managed as many as 10 dient platforms during a digital marketing campaign, including a DSP, an ad vertation partners. Each system , a DMP, social media dumnes, paid search, and various pared a separate log-in and reported data in separate Exod info Generally, a brand or agency employed a team of 5 si 10 people to parse and report data from the portals. "It's a big pain point for them, Betag sad. "The advertion and brands want to be more strategic with their colomers and not spend their time in Ex With year, Dataxa had built a product that could gether, cleanse, segment, and manage data "The vale proposition here is that MIC through AP application program interfaces can pull data for you and put it in one flexible dashboard, so you just ng into one dashboard rather than 3 or 10 w that the appearing d MIC Clients and Pricing Dutau began ing MIC in the third quarter of 2005 for anal subscription for. There was market demand, but, as with MP, it was unclear whow budget within a client company would cover MIC. While an ad apmey's CIO typically purchased softwa Dataka did not send to have stationships with CO Whem dia bus expedit lacked budget authority and often led to a drawn-net sales cycle involving many decision makers they Clients also tended to switch all vendors fondly, quiring Data to continuously integrate new data uron into the dashboard. The variable costs drove the price of MIC above At cont levels. "The sales team didn't understand why the cost was high meanwhile, engineering wa saying. The fed costs are what it costs to support these products" said Nicole McDonald Sen Product Manager at DataNa Baker was targeting a to%go mangin on the MIC product, but he was feble on pricing Bragi elaborated "Our goal was to find recurring, predictable wr Therefore, we tried different combinations to achieve this including annual subfist bord matrix and connections, and later boom pre-defined packages, and from 30 day trial, followed by monthly or subscription for McDonald explained We started with an unlimited number of connectors-dats or for digital medi e diferent campaigns running on Google AdWords, Facebook and other al channels That was one of the main selling features we know you're already gring into our DSP application, and we're providing you reporting e DS, but what about all the ter places you go to put together your reports? Why not port your data into our pla The key selling point was operational efficiency Inne example, a cl tedy digital and piple ww pursT indtemmena data the ph beancw. me hteiM Vlragm nald The n aue MIC Clients and Pricing alroon fierre wha de company would Thatsthot chan athan and it atheteel tie Che weats inying Then ando a wengin Thenafote, we m dar thala the d That was application and w places you go to p they suing roo e for work to prepare them After m DCple the work and and I ther Byly lich from the win you datlates spat odiof margmeTary alle and ch Mata Coospetitiveut 306 thusamsfectedtserr irring seed Fagan Decisions Canwu about the gat g old g hig weigter, Koon baumed pts pundaksh ng a het mister anythm lad both competencies we difficult penced by tarpoo dm during a digital marketing pt hand van a data i arterio 10 people and theme Theatre and sr coo spaldata) ad que 2015 was and we b es ving many do version of MIC) standand package, which dem Cogle Search, Siek, De Fantaka)& cro yaltagera The prite of the antBe Co poak pse data from dat privider Experiente of the pring the content ter penkitnatkid and anke cont dig "Wie hu dunveAl schule, engering pro said Nich margin n the MKC podch ewma mual madingtonas reeho 5&Domullie all the 11 0 palrmt plats "Thund nan the rendy degiealit: oceeautadiuitoelnoducts that caisset to a oortuineal that Dri growing whose co Leg was preparing to go poble de dan condi pourt otlant tedy ply t prompted Datau to make MC "simplied large +Thwyte ggTHVe anal late C TE rt MIC, aky upon vast of The Jof the undeemukany utMP anMIC Balar laid onjam of S done tition Proosionals with rad impact deal margins. "Every customer is unique" Bagi said. "They're changing DSP and data sources all the time, and each is using a different method to comedate data with each MIC customer, DataXu incurred setup costs and curring monthly cons for plato mainance and data analytic Competitive Set in 2016, at least the other vendors offered dissimilar to MIC Datorama described its product as "the world's first marketing data hob to help esecutive analysts and IT professionals quickly manage and confidently cute pa ts of data The data and view offering to through a centralized platiem Software providers Done and Origin Loge also sold products that claimed to simplify data reporting acne marketing channels In 2006 held that Dom the National Football fast-growing up whose customer huse included eay, MarCand a League, was preparing to go public Domo charged dients a monthly subscription fee as part of an annual contract These competiton offerings were priced slightly below MIC "We thought we could justify the increased pricing based on the strength of our DSP Bagsid Decisions Sales of MIC and MP were behind Dutaka's forecast for the first half of 26 Baker faced chces about the go-to-market strategy in areas ranging from sales organization and ment to brand and pricing Initial market feedback indicated substantial interest in MP and MC But Duta's comment brand and agency contacts did not typically have the budgeting authority that MP and MIC required Fanagan commented, "Seling advertising automation Stane and willing enterprise analytics are different a animals. Different buyers, different sales cycles det types of services. Se our core sales team members may not be best equipped to sell the products and neither their skills or their relationships and the types of business we typically and According t Baker, DSP eller leveraged their emotional intelligence to all with media buyers in contrast, analytics buyers were looking for a more quantitative sales con Pials with both competencies were difficult to find "The question is Can they adapt to the new processes and competencies required by a more analytical buyer Baker said Others pointed to compensation and incentives Agencies and brands were enthusiastic about "ging programmatic" with Dataku's high-ranking DSP, but it took me will the analytics products, Baker said. "Getting a senior executive interested in MP requires a different set of skills than building relationship with a media planner and prting them to target their desktop ad campaign on mobile devices. Another issue was DataXu's brand. "Some potential customers for and MP probably see DataNu as a DSP vendor" Flanagan said. "They might think the MP and und highbrow for DataXu. 1 get that kind of advisory from McKimey and pay them a lot of money for Your job is to save me peneies on each ad I buy" But there was also evidence that the analytics products improved DataXu's image as an innovative technology company As Bakerit, he could either (a) develop a separate, technical sales fotce to sell MP and MC, or (b) instruct his current sales force to sell the analytics products alompide the DSP Many at DatX including board members, advocated for the first appeach. Because the new products required a technical sales pitch and buy-in from higher-level executives, they ended a separate rom with separate incentives. But the head of North American sales wanted to train the stor sales forc 12 to sell the analytics products via a MP curriculum and certification process. In a combid pithe AE would talk to the buyer about DSP, but would also request a meeting with the media buyer's supervisor to discuss M, Baker argued, "Customers get excited about and see as a capability that is proximate to our DSP Combining the commations helps prospects view a strateg vendor who brings move to the table and who helps sobe bigger marketing challenges Baker also wondered it a combined offering might make the sales for more efficient. He was thinking about pulling MIC off the market as a stand alone product and integrating it into MP. "We don't want to get into a bespoke services business by customizing MC for each client" he said. "We want the economic scale and margins of a technology company. How he wondered if a contr integrated analytics offering might limit Dutaka's total addable market to very large marketers Baker felt the analytics product presented a significant opportunity for Data and its clients who clamored for transparent ways to evaluate their marketing investments. But which was the right course to market 817-012 Exhibit 3a Popular DSP Vendors, Their Products, and Analyst Comments, According to Forrester Market Performance Based on Offering and Strategy Company DataXu AOL AppNexus Google AudienceScience AudienceScience MediaMath Rocket Fuel DSP Product The DataXu Platform ONE by AOL AppNexus Turn Helios DoubleClick Bid Manager TerminalOne Marketing Operating System Rocket Fuel DSP The Trade Desk The Trade Desk Platform Turn Campaign Suite Leader Leader Leader Strong Performer Strong Performer Strong Performer Strong Performer Leader DataXu: Selling Ad Tech Leader Analyst Comments "DataXu has set itself apart" with marketing initiatives beyond just digital [with MP]. Marketing initiatives beyond just digital. "Consider AOL for cross-channel real-time decisioning." Flexibility in executing programmatic initiatives. "Consider AppNexus if you need a strong technology foundation to build on." Client roster 100% marketer-direct. Consider them for a customized approach. Focused on being "one-stop shop for programmatic advertising. Consider them if you already use their other products. Powerfully integrated DMP with full audience view, complex conditional sequencing logic, and 60 third-party data integrations. "Consider MediaMath for its superior access to [media]." Committed to artificial intelligence for ad campaign optimization. Consider them "if you value a hands-off approach." Flexibility in executing programmatic initiatives. Consider them if you plan to heavily leverage your agency." Flexibility in executing programmatic initiatives. Consider them if you need to incorporate external tools. Source: Adapted by casewriter from Richard Joyce, "The Forrester Wave Demand-Side Platforms, Q2 2015," Forrester, June 3, 2015. Exhibit 4a DataXu Personas, 2016 Customer Type Job Title Challenges Looking to Buy Fortune 1000 Brands - Brand CMO Bethany SVPVP of Marketing Sr. Director of Marketing Analytics Programmatic Leveraging data to reach specific audiences Effectively target and engage customers in a crowded market Breaking down digital silos Squeezing the most out of digital budget Connecting marketing to sales revenue Creating media mix that delivers ROI Worrying about fraud & transparency - Market Pulse to link marketing to sales Marketing Intelligence Center for reporting OneView Source: Company documents. Independent Agency lan Independent Media Buying Agency or Agency of Record SVPVP of Media Media Planning VP of Digital Account Director Building & maintaining team that stays on forefront of technology & trends Investing media budget wisely and delivering results for demanding clients Having answers for media quality issues- fraud, viewability, brand safety, etc. Knowing when to partner with vendors or bring programmatic in-house Media Activation (test campaigns) Managed Services or Self-Serve Platform OneView Programmatic Newbie Paul Buyer distrustful of programmatic or new to Wide-range of es Feels like he/she should be using programmatic but doesn't understand it Overwhelmed by array of vendors in space Traditional organization resistant to change An out-of-the-box comprehensive solution to his/her marketing problems Questions: Overall, how would you define and describe DataXu's market? How would you characterize DataXu's market (e.g., size, trends, growth, products, services, participants, competition, demand, customer needs, segments, etc.)? Instructor guideline: in your marketing analysis, include as many elements as you would like which a) should be relevant and important to Mike Baker (CEO) for marketing planning and management purposes at DataXu (it can be any), and b) should include a minimum of five (5) elements which are measurable using one or more specific marketing metrics. DataXu: Selling Ad Tech On June 20, 2016, DataXu CEO Mike Baker surveyed the beachfront at the Cannes Lions International Festival of Creativity. Each year, Cannes, a seaside town on the French Riviera, played host to the largest gathering in the advertising world. Cannes Lions had begun as an award show attended exclusively by ad agencies. But the festival had shifted as new industry players joined Beneath the Palais convention center, where the year's best creative work in advertising was displayed, cabanas named "YouTube Beach" "Facebook Beach," and "Twitter Beach" deed the shoreline, and the harbor was crowded with so many yachts sponsored by ad technology companies (including DataXu) that observers had dubbed it "ad tech row Back at DataXu's Boston, Massachusetts, headquarters the following week. Baker turned his attention to improving customer adoption of his firm's two new advertising software products- Market Pulse (MP) and Marketing Intelligence Center (MIC). Baker had founded Data (pronounced "Data Zoo") in 2009 with Senior Vice President Sandro Catanzaro, Chief Technology Officer Willard Simmons, and others around a product known as a demand-side platform (DSP) which helped marketers target consumers using mathematical algorithms that facilitated programmatic ad buying Ranked fifth among the fastest growing private companies in the United States in 2013, DataXu had clients in a variety of industries, including automobiles (eg. Food). consumer packaged goods (eg. General Mills), hotels (eg. Hiltori, manufacturing (eg. XM), and financial services (eg, MasterCard, SunTrust DataXu had spent two years building the two new platforms. MP can experiments that analyzed how different levels of regional ad spending affected sales MIC aggregated and presented sales date digital media budgets, and key performance indicators (KPb) streamlined reporting and gave a holistic view of a client's digital ad spending and ad campaign performance Both products were opportunities to establish a longer-term recurring revenue stram in the programmatic ad buying market. Dataku's sales force was good at selling the DSP and had outperformed revenue and profit targets over the past six months by wide margins For over a year. spanning multiple marketplace including demand plation date management plation and male bidding changes for display, meble and sidence Carte, hipe//www.gar.com, March 2 Weing the and apply thwarted by Hand by C2027ands of and des Tops Nad e Sched Pading gow photoorndand pod os K27002 an denied f madnie 1 Dalling Tack the company had been operating profitably. But there was evidence that the clients and the buying process for the new products were different. Would DataXu need to change its sales organization pricing approach, or hiring criteria in order to sell MP and MIC Programmatic Ad Buying In the early days of online advertising, advertisers bought website ad space directly from the publisher (the website owner) if they thought potential customers might visit the site Markers purchased ad impressions in bulk on a cost per thousand impressions (CPM) or a cest per action (CPA) basis (an action consisted of a click, a bank account signup, a vehicle test-drive, or other such behavior) Programmatic ad buying emerged to automate the buying and selling of online ads. In Apel 20 Right Media opened the first ad exchange," a central marketplace where ads were bought and sold via algorithms and real-time bidding (RTB), a process by which advertisers bid for individual ad impressions based on information about the viewer's past digital behavior" (See Exhibit la for a diagram on RTB) Lach auction took place in the time it took to load a new web page Many marketers favored programmatic ad transactions because they were more efficient and prethan manual ad buying" Marketers used demand-side platform (DSP) software to represent their ad campaign needs on ad exchanges, DSP algorithms indicated which ad impressions to purchase based on instructions from the marketer. For example, a marketer could tell a DSP to spend $1 for every 1000 adi displayed to viewers of a certain gender, age group, and geographic region DSP's could be either independent (like Data arketer in-house. Because large advertisers typically hired an agency to execute their ad campaigns, DSP clients tended to be ad the company had been operating profitably. But there was evidence that the clients and the buying process for the new products were different. Wild Data eed to change its sales organizations pricing approach or hiring criteria in onder to sell and M Programmatic Ad Buying In the early days of online advertising, advertisen boughe website all space directly from the publisher (the website owner) if they thought potential casters might visit the site Marketers purchased ad impressions in bulk on a cost per thousand impress (CPM) or a cost per action (CPA) basis (an active consisted of a dick, a bank account signup a vehicle test-drive, or other such behavior, Programmatic ad buying emerged to automate the buying and selling of online. In April 2005 Right Media opened the first ad exchange" a central marketplace where ads were bought and sold via algorithms and real-time bidding (KTB) a process by which aduti bid for individual ad impressions based on information about the viewer's past digital behavior" See Exhibit la for a diagram on KTB) Each auction took place in the time it took to and a new web page. Many marketers favored programmatic ad transactions because they were more efficient and precise than manual ad buying. age group and Marketers used demand-side platform (DSP) software to present their ad campaign nends on ad exchanges DSP algorithms indicated which ad imposions to parchase based on instructions from the marketer. For example, a marketer could sa DSP to spend $1 for every 1,000 ads displayed to viewers of a certain be independent (like Data), operated by an ad agmey, or operated by the marketer in-house. Because large advertisers typically hired an agency to execute their al campaigns, DSP dients tended to be ad agencies, though experts expected to see more brands working dictly with DSP's in the future. One observer noted, however, that "many agencies are nellactant to allow their clients to bypass them and speak with the ad tech vender, and this has created an atmosphere of mistrst Buyers chose DSP's based on flexibility, customization jeg ability to incorporate external tools and data sources into the platform, integration of the marketer's existing data vendors, machine learning abilities, data management tool integration, sablity, depth of reporting, integration of addressable channels such as email or audie, and cudemer service, among other considerations To carry out targeted online ad campaigns across channels, marketers used data management platforms (DMP) to store and interpt data DMPS gathel cookies to help the right audience for an ad impression D made it possible for marketers to segment consumers and augmenta marketer's own data (or "in-party date with infirmation obtained from outside sources. A marketing company explained that "a publisher could pair their un fine-party data on yachting enthusiasts with third-party data on people looking to buy a yach, thereby eating a yachting audience wegment within the DP When the DP had created all the customer segments the marketer desired. DMP's could be linked to DSPs to help exate the ad campaign Cesty dded when die helped y and their bha Awardy d Dating Ad Tech 117412 On the other side of the market, publishers looked to supply-side platforms (SSP) to represent their needs. These software tools, roughly the counterpart to a D helped online publishers sell the impressions their websites generated. As one observer summarized "where DSPs are used by marketers to buy ad impressions from exchanges as cheaply and an efficiently as possible. SPs are designed by publishers to do the opposite to mimine the prices their impressions sell at Exhibits 1 and 1c for diagrams describing the ad tech landscape) The DMP relied on user identities to differentiate ben. While cookies did this for computer browsers, tracking mobile device user behar was dient Instead, mobile device operating systems, such as Apple's 10S and Google's Andeid, ond machine identifiers for marketers (Apple used Identifiers for Advertising IDEAL, while Google usol Google Advertising ID) Large social media players such as Facebook and Google cold identify the same user across different devices because users logged in to the same act acrom their devices. These different types of identifiers also had different useful lives. The life of a cookie was relatively brief, machine IDs had long but device specific lives, and logins penisted longest of all and across devies Social media players, such as Google and Facebook, had the largest login audiences. These websites, termed "walled gardens did not allow advertisers to track wens behavior while on their "As one observer framed it some saw walled gandes" a puttially positive development that could cut down on traud and provide acces to mone high-quality audiences [while others see walled gardens as representative of a disconcerting lack of control for marketers who will have no choice but to work cally identify users across devices. The same comparties, not incide of drital media Berhad h A On thut tEl horolio Beir w markets to buy a ourtarpatinit ing from exchanges as chapy designed by publishers to do the opposite Exhibits 1b and le for diagrama dcribing the a ich landa) The DEPwtiontier bee1krt otagster perating wemand Caop markets (Apple uwd identities for Adverting Awhile Google Google Ading IDLargmtlmco and Google endlyana ditimmil devikte tecaumen denumee types of dental had different fulles. The face w IDshadsapaif Iinna gem eminen olreerseedch Be ergotene Tw stmo one godm tutorldcuttr and promideacoalatia ternsey poltiee demelym walled gardens representative of a doverting lack of cars who will have no ute oal tor trookw devsets fhce Site (onganics tota wif theerkallon Thnoraml hakfranho art building your own dats, you' a Let in ther fooromn buying their medis whit Digital Advertising in 2016: Advaneed Ads and Advanced lus The main oling poist of ourmmutomoctr tBe abBity to choose Creopni tectedt turtpfhuttac yer's entine a.T +TV peachte lin 2015568me otlag oum ortal UsThoatmey ome plheresands and the The marbreadfrmingbeVT HDty on ngitent ilerden (on dike bheems. wome mall M& 25% of 2015omum p UCTC) (04S) vion (1255%e (32%), Targeted digital ating had its changes and today dats had to terjgrand alsor foreire rigucinAle on bytutnsand or optim and p in 2013eo difficult to verify whether a human or a robot was "viewing ecking on an ad One 2015 sepoton e Jy Diiedee 2018 ineer 305telu grprooples in 3014 oftosailte Paying Data Xu Dalada 2008 by Wland SamID Tered g Maiswichotom g Sand Catania, the MBA MT, helped Intully the team coded applica eventually settled on ad sech an enging field that one e purtuee ond hal aagly 2011 2008 tutoh Cog andone transacting dileeb we can buy from you rCataruraner writ cDaliyClick Mahihasarate KiaData participating in the exchange. In 2013, the company raised 527 Son San Francis Smmosed mal The product artuk.onvwest ad f e captal By 201 the world lading integrat Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock