Question: answer it with explanation a. (1 point) What is the expected return of an investor that invests 40% of his capital in Asset A and

answer it with explanation

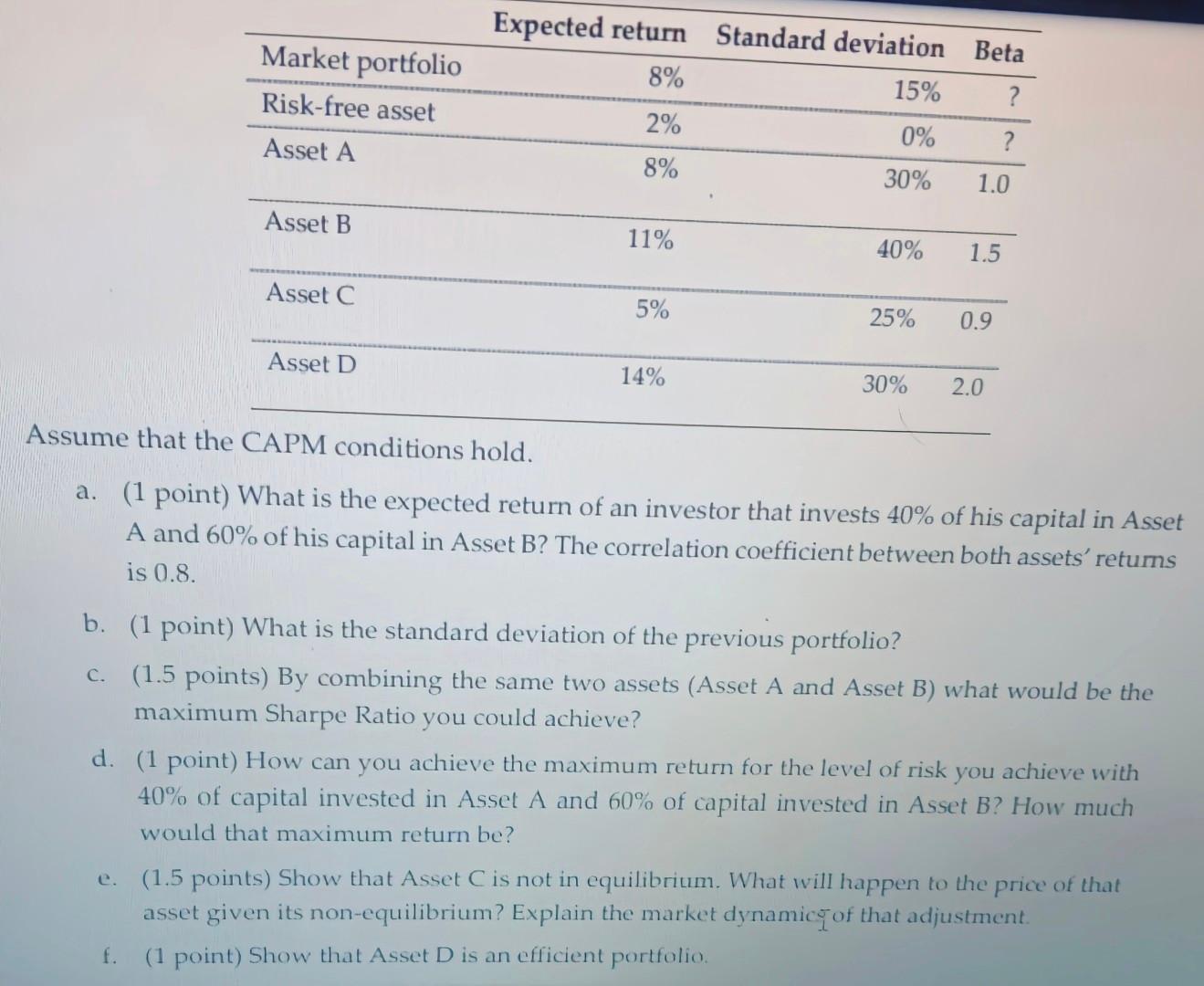

a. (1 point) What is the expected return of an investor that invests 40% of his capital in Asset A and 60% of his capital in Asset B? The correlation coefficient between both assets' returns is 0.8 . b. (1 point) What is the standard deviation of the previous portfolio? c. (1.5 points) By combining the same two assets (Asset A and Asset B) what would be the maximum Sharpe Ratio you could achieve? d. (1 point) How can you achieve the maximum return for the level of risk you achieve with 40% of capital invested in Asset A and 60% of capital invested in Asset B? How much would that maximum return be? e. (1.5 points) Show that AssetC is not in equilibrium. What will happen to the price of that asset given its non-equilibrium? Explain the market dynamiof that adjustment. f. (1 point) Show that Asset D is an efficient portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts