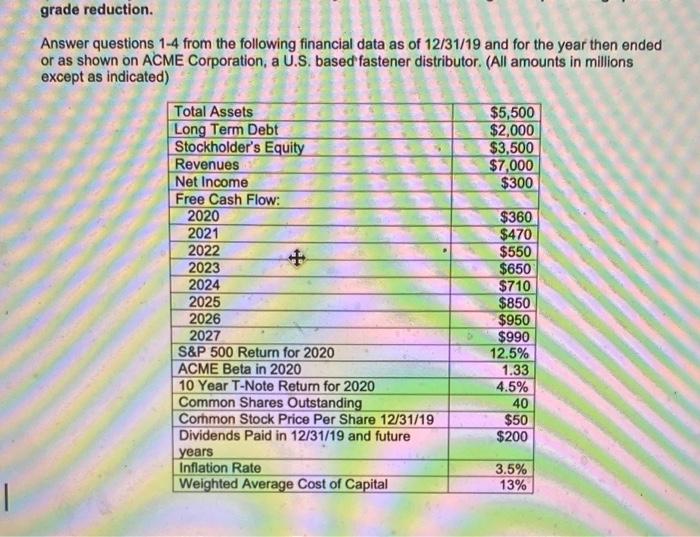

Question: grade reduction. Answer questions 1-4 from the following financial data as of 12/31/19 and for the year then ended or as shown on ACME Corporation,

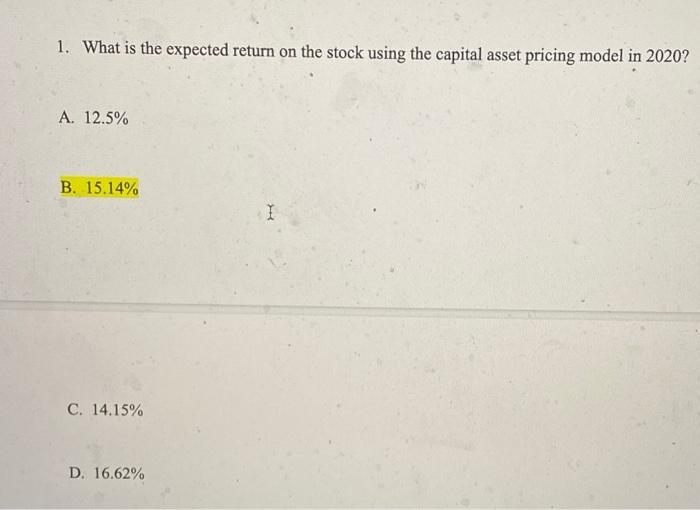

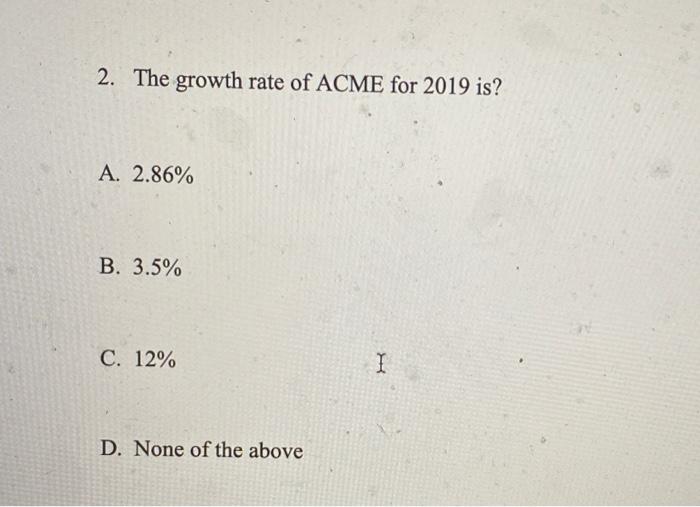

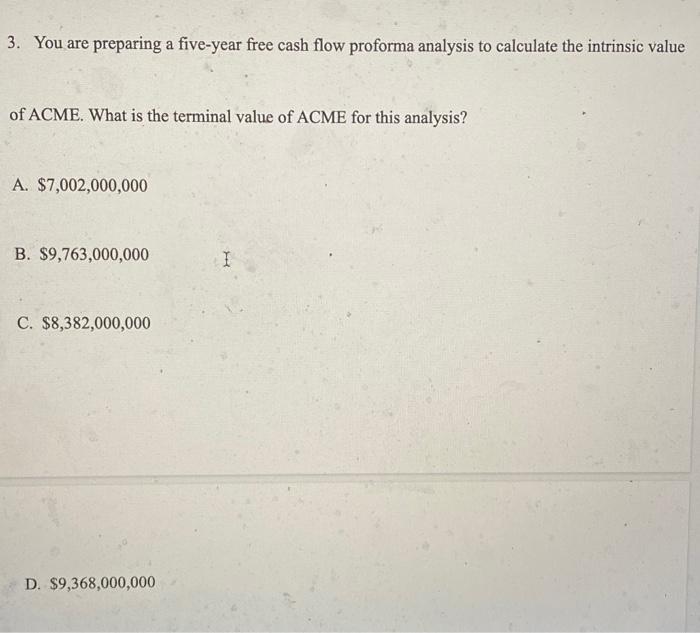

grade reduction. Answer questions 1-4 from the following financial data as of 12/31/19 and for the year then ended or as shown on ACME Corporation, a U.S. based fastener distributor. (All amounts in millions except as indicated) $5,500 $2,000 $3,500 $7,000 $300 Total Assets Long Term Debt Stockholder's Equity Revenues Net Income Free Cash Flow: 2020 2021 2022 2023 2024 2025 2026 2027 S&P 500 Return for 2020 ACME Beta in 2020 10 Year T-Note Return for 2020 Common Shares Outstanding Common Stock Price Per Share 12/31/19 Dividends Paid in 12/31/19 and future years Inflation Rate Weighted Average Cost of Capital $360 $470 $550 $650 $710 $850 $950 $990 12.5% 1.33 4.5% 40 $50 $200 3.5% 13% 1 1. What is the expected return on the stock using the capital asset pricing model in 2020? A. 12.5% B. 15.14% I C. 14.15% D. 16.62% 2. The growth rate of ACME for 2019 is? A. 2.86% B. 3.5% C. 12% I D. None of the above 3. You are preparing a five-year free cash flow proforma analysis to calculate the intrinsic value of ACME. What is the terminal value of ACME for this analysis? A. $7,002,000,000 B. $9,763,000,000 I C. $8,382,000,000 D. $9,368,000,000 4. Using a five-year free cash flow proforma, what is the Intrinsic Value per share of ACME? A. $116 1 B. $277 C. $110 D. $129

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts