Question: answer number 2 only !!! Directions: Analyze the balance sheet and compute for what is being asked. (2 items x 5 points) Exon Oil Company

answer number 2 only !!!

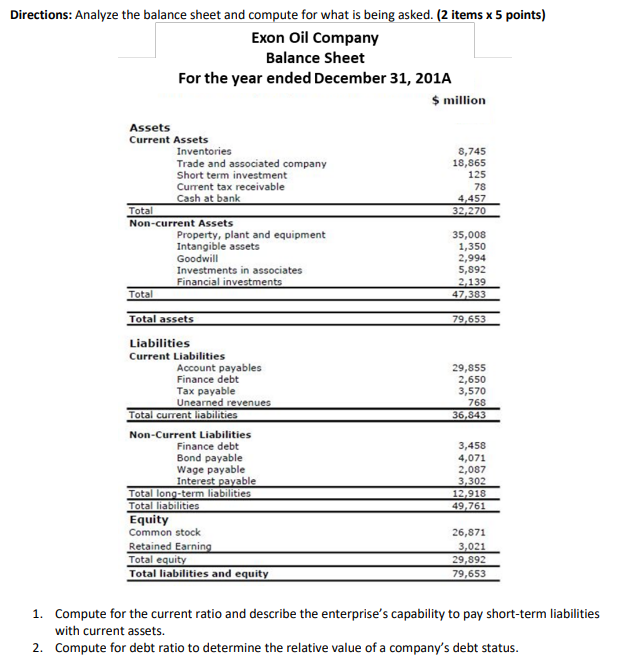

Directions: Analyze the balance sheet and compute for what is being asked. (2 items x 5 points) Exon Oil Company Balance Sheet For the year ended December 31, 201A $ million Assets Current Assets Inventories 8,745 Trade and associated company 18,865 Short term investment 125 Current tax receivable 78 Cash at bank 4,457 Total 32,270 Non-current Assets 35,008 Property, plant and equipment Intangible assets 1,350 Goodwill 2,994 5,892 Investments in associates Financial investments 2,139 Total 47,383 Total assets 79,653 Liabilities Current Liabilities 29,855 Account payables Finance debt Tax payable 2,650 3,570 Unearned revenues 768 Total current liabilities 36,843 Non-Current Liabilities 3,458 Finance debt Bond payable 4,071 Wage payable 2,087 Interest payable 3,302 12,918 Total long-term liabilities Total liabilities 49,761 Equity Common stock 26,871 Retained Earning 3,021 Total equity 29,892 Total liabilities and equity 79,653 1. Compute for the current ratio and describe the enterprise's capability to pay short-term liabilities with current assets. 2. Compute for debt ratio to determine the relative value of a company's debt status

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts