Question: answer of question G H And question I J K Spring Co. had two divisions: A and B. Division A created Product X, which could

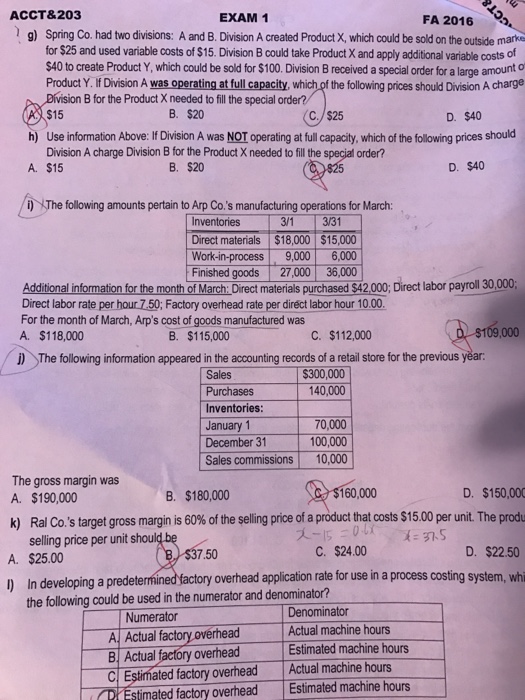

Spring Co. had two divisions: A and B. Division A created Product X, which could be sold on the outside for $25 and used variable costs of $15. Division B could take Product X and apply additional variable costs of $40 to create Product Y, which could be sold for $100. Division B received a special order for a large amount a Product Y. If Division A was operating at full capacity, which of the following prices should Division A charge Division B for the Product X needed to fill the special order? $15 $20 $25 $40 Use information Above: If Division A was NOT operating at full capacity, which of the following prices should Division A charge Division B for the Product X needed to fill the special order? $15 $20 $25 $40 The following amounts pertain to Arp Co.'s manufacturing operations for March: Additional information for the month of March: Direct materials purchased $42,000; Direct labor payroll 30,000; Direct labor rate per hour 7.50; Factory overhead rate per direct labor hour 10.00. For the month of March, Arp's cost of goods manufactured was $118,000 $115,000 $112,000 The following information appeared in the accounting records of a retail store for the previous year. The gross margin was $190,000 $180,000 $160,000 $150,000 Ral Co.'s target gross margin is 60% of the selling price of a product that costs $15,00 per unit The selling price per unit should be $25.00 $37.50 $24.00 $22.50 In developing a predetermined factory overhead application rate for use in a process costing system, the following could be used in the numerator and denominator

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts