Question: answer on this 20 2020 Question 1 (Marks: 401 2.1.1 Hybrid Dealers bought computer equipment for R54 000 on 1 July 2018. The equipment is

answer on this

answer on this

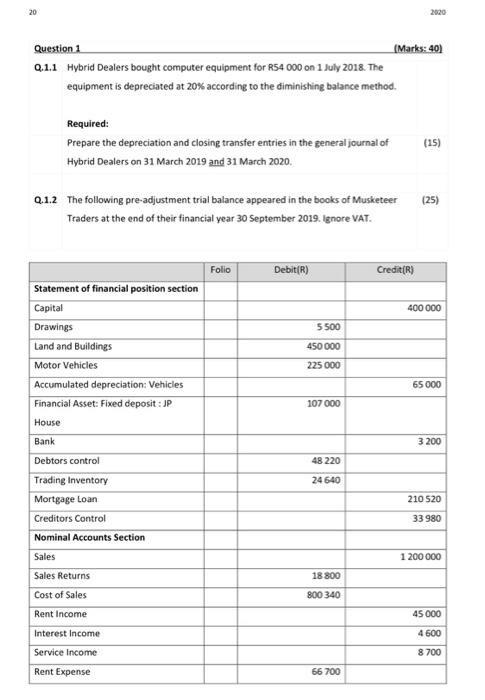

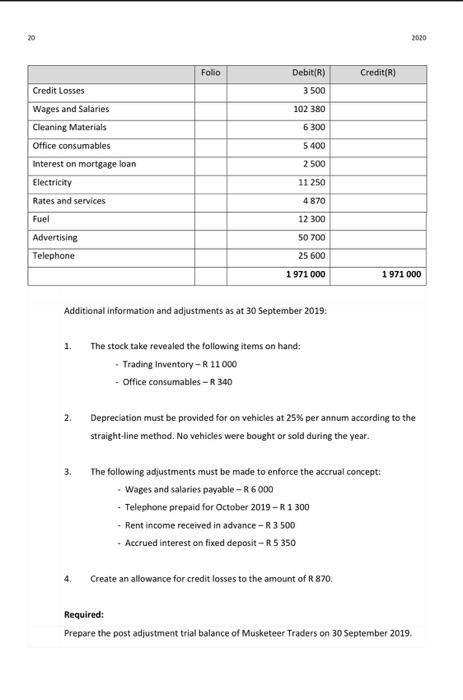

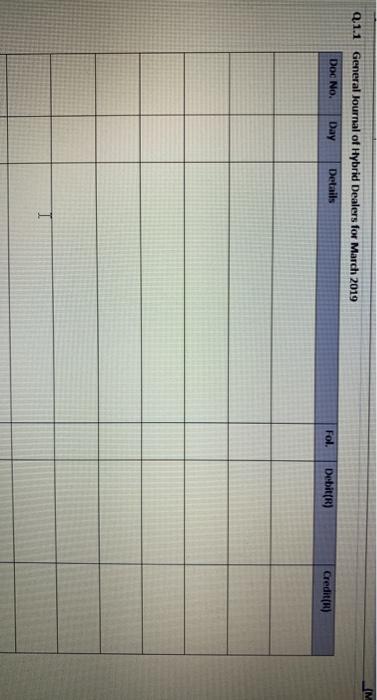

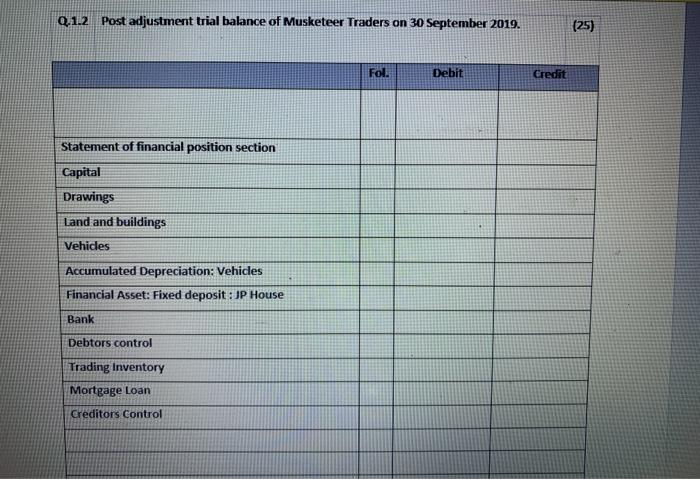

20 2020 Question 1 (Marks: 401 2.1.1 Hybrid Dealers bought computer equipment for R54 000 on 1 July 2018. The equipment is depreciated at 20% according to the diminishing balance method. Required: Prepare the depreciation and closing transfer entries in the general journal of Hybrid Dealers on 31 March 2019 and 31 March 2020. (15) (25) 2.1.2 The following pre-adjustment trial balance appeared in the books of Musketeer Traders at the end of their financial year 30 September 2019. ignore VAT. Folio Debit(R) Credit(R) 400 000 Statement of financial position section Capital Drawings Land and Buildings Motor Vehicles Accumulated depreciation: Vehicles 5500 450 000 225 000 65 000 107 000 Financial Asset: Fixed deposit : JP House Bank 3 200 Debtors control 48 220 24 640 210 520 Trading Inventory Mortgage Loan Creditors Control Nominal Accounts Section 33 980 Sales 1 200 000 18 800 800 340 Sales Returns Cost of Sales Rent Income Interest Income 45 000 4 600 Service Income 8700 Rent Expense 66 700 20 2020 Folio Credit(R) Credit Losses Debit(R) 3 500 102 380 6 300 Wages and Salaries Cleaning Materials 5 400 2 500 Office consumables Interest on mortgage loan Electricity Rates and services Fuel 11 250 4870 12 300 50 700 Advertising Telephone 25 600 1971 000 1971 000 Additional information and adjustments as at 30 September 2019: 1. The stock take revealed the following items on hand: - Trading Inventory - R 11000 - Office consumables - R 340 2. Depreciation must be provided for on vehicles at 25% per annum according to the straight-line method. No vehicles were bought or sold during the year. 3. The following adjustments must be made to enforce the accrual concept: Wages and salaries payable -R 6000 Telephone prepaid for October 2019-R1300 - Rent income received in advance - R3 500 Accrued interest on fixed deposit - R 5350 4. Create an allowance for credit losses to the amount of R 870. Required: Prepare the post adjustment trial balance of Musketeer Traders on 30 September 2019. Q.1.1 General Journal of Hybrid Dealers for March 2019 Doc No. Day Details Fol. Debit(R) Credit() Q.1.2 Post adjustment trial balance of Musketeer Traders on 30 September 2019. (25) Foll Debit Credit Statement of financial position section Capital Drawings Land and buildings Vehicles Accumulated Depreciation: Vehicles Financial Asset: Fixed deposit :JP House Bank Debtors control Trading Inventory Mortgage Loan Creditors Control

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts