Question: ANSWER ONLY 1FIRST QUASION PLEASE SECTION: C ((Answer all Questions = 2 x 20 Marks = 40 Marks - 20% weight age) 1. a. A

ANSWER ONLY 1FIRST QUASION PLEASE

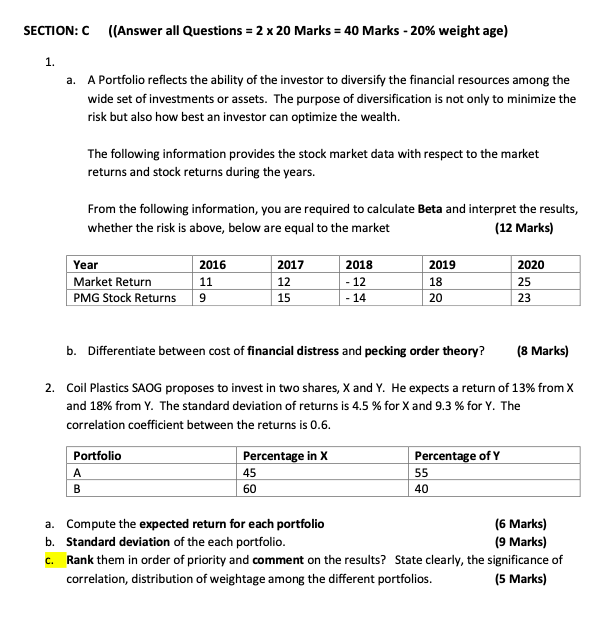

SECTION: C ((Answer all Questions = 2 x 20 Marks = 40 Marks - 20% weight age) 1. a. A Portfolio reflects the ability of the investor to diversify the financial resources among the wide set of investments or assets. The purpose of diversification is not only to minimize the risk but also how best an investor can optimize the wealth. The following information provides the stock market data with respect to the market returns and stock returns during the years. From the following information, you are required to calculate Beta and interpret the results, whether the risk is above, below are equal to the market (12 Marks) Year 2016 2017 2018 2019 2020 11 12 - 12 25 Market Return PMG Stock Returns 18 20 9 15 - 14 23 b. Differentiate between cost of financial distress and pecking order theory? (8 Marks) 2. Coil Plastics SAOG proposes to invest in two shares, X and Y. He expects a return of 13% from X and 18% from Y. The standard deviation of returns is 4.5 % for X and 9.3 % for Y. The correlation coefficient between the returns is 0.6. Portfolio Percentage in X 45 Percentage of Y 55 A B 60 40 a. Compute the expected return for each portfolio (6 Marks) b. Standard deviation of the each portfolio. (9 Marks) C. Rank them in order of priority and comment on the results? State clearly, the significance of correlation, distribution of weightage among the different portfolios. (5 Marks) SECTION: C ((Answer all Questions = 2 x 20 Marks = 40 Marks - 20% weight age) 1. a. A Portfolio reflects the ability of the investor to diversify the financial resources among the wide set of investments or assets. The purpose of diversification is not only to minimize the risk but also how best an investor can optimize the wealth. The following information provides the stock market data with respect to the market returns and stock returns during the years. From the following information, you are required to calculate Beta and interpret the results, whether the risk is above, below are equal to the market (12 Marks) Year 2016 2017 2018 2019 2020 11 12 - 12 25 Market Return PMG Stock Returns 18 20 9 15 - 14 23 b. Differentiate between cost of financial distress and pecking order theory? (8 Marks) 2. Coil Plastics SAOG proposes to invest in two shares, X and Y. He expects a return of 13% from X and 18% from Y. The standard deviation of returns is 4.5 % for X and 9.3 % for Y. The correlation coefficient between the returns is 0.6. Portfolio Percentage in X 45 Percentage of Y 55 A B 60 40 a. Compute the expected return for each portfolio (6 Marks) b. Standard deviation of the each portfolio. (9 Marks) C. Rank them in order of priority and comment on the results? State clearly, the significance of correlation, distribution of weightage among the different portfolios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts