Question: answer only 4 , 5 , and 6 the ((circled questions)) 30 50 16 24 be basis of the utility which investmentw s of the

answer only 4 , 5 , and 6 the ((circled questions))

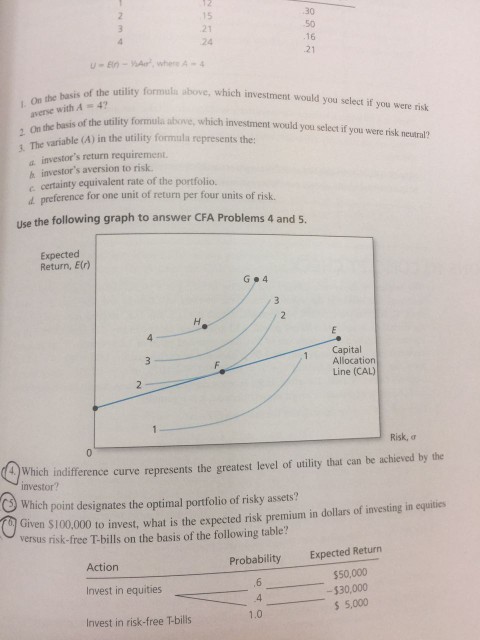

30 50 16 24 be basis of the utility which investmentw s of the utility formula above, which investment would you select if you were risk neutral? ula above, which investment would you select if you were risk the basis averse with A 4? On the basis The variable (A) in the utility formula represents the: utility 2 a investor's return requirement h investor's aversion to risk e certainty equivalent rate of the portfolio. d preference for one unit of return per four units of risk. Use the following graph t o answer CFA Problems 4 and 5. Expected Return, Elr) Capital 1 Allocation Line (CAL) Risk, indifference curve represents the greatest level of utility that can be achieved by the Which point designates the optimal portfolio of risky assets? Given $100,000 to invest, what is the expected risk premium in dollars of investing in equities versus risk-free T-bills on the basis of the following table? Expected Return $50,000 $30,000 s5,000 Probability Action Invest in equities Invest in risk-free T-bils 4 1.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts