Question: answer only if 100% sure otherwise i will downvote for sure. i had got wrong answers hence posting it again. dont try if not sure.

answer only if 100% sure otherwise i will downvote for sure. i had got wrong answers hence posting it again. dont try if not sure. skip if not 100% sure

answer only if 100% sure otherwise i will downvote for sure. i had got wrong answers hence posting it again. dont try if not sure. skip if not 100% sure

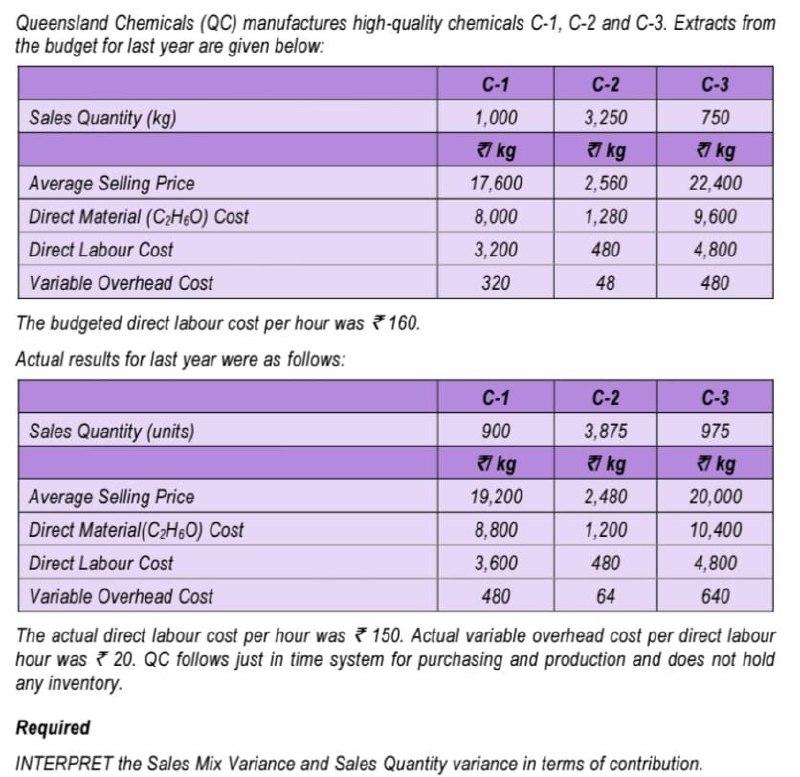

Queensland Chemicals (QC) manufactures high-quality chemicals C-1, C-2 and C-3. Extracts from the budget for last year are given below: C-1 C-2 C-3 Sales Quantity (kg) 1,000 37 kg 17,600 8,000 3,200 3.250 7 kg 2,560 1,280 Average Selling Price Direct Material (CHO) Cost Direct Labour Cost Variable Overhead Cost 750 37 kg 22,400 9,600 4,800 480 320 48 480 The budgeted direct labour cost per hour was 160. Actual results for last year were as follows: C-1 C-2 C-3 Sales Quantity (units) 900 975 Average Selling Price Direct Material(C2H60) Cost Direct Labour Cost Variable Overhead Cost 37 kg 19,200 8,800 3,600 480 3,875 37 kg 2,480 1,200 480 7 kg 20,000 10,400 4,800 640 64 The actual direct labour cost per hour was 150. Actual variable overhead cost per direct labour hour was 720. QC follows just in time system for purchasing and production and does not hold any inventory Required INTERPRET the Sales Mix Variance and Sales Quantity variance in terms of contribution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts