Question: answer only if 100% sure otherwise i will downvote for sure. i had got wrong answers hence posting it again. dont try if not sure.

answer only if 100% sure otherwise i will downvote for sure. i had got wrong answers hence posting it again. dont try if not sure. skip if not 100% sure

answer only if 100% sure otherwise i will downvote for sure. i had got wrong answers hence posting it again. dont try if not sure. skip if not 100% sure

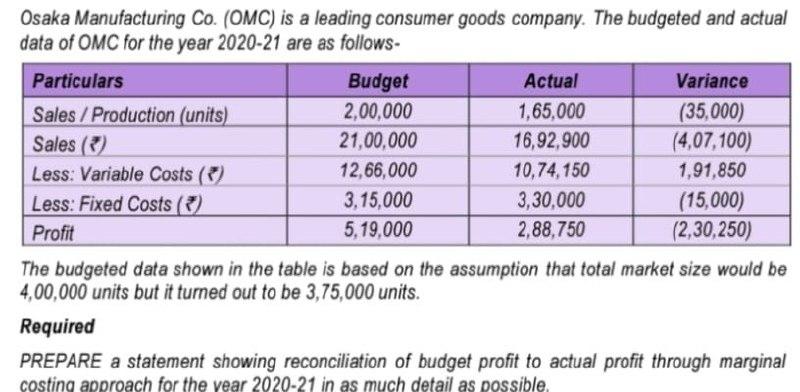

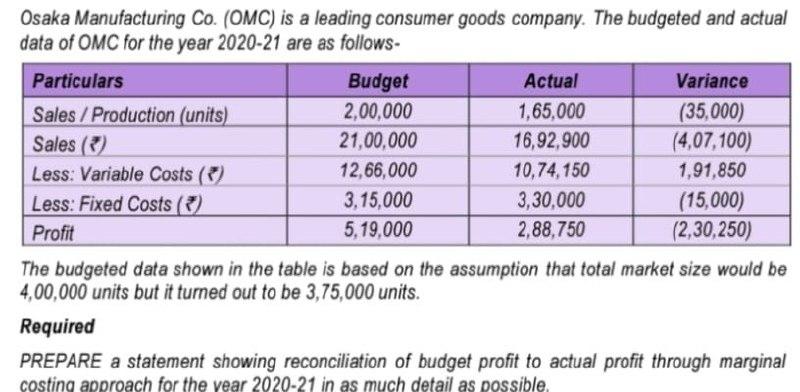

Osaka Manufacturing Co. (OMC) is a leading consumer goods company. The budgeted and actual data of OMC for the year 2020-21 are as follows- Particulars Budget Actual Variance Sales / Production (units) 2,00,000 1,65,000 (35,000) Sales (3) 21,00,000 16,92,900 (4,07,100) Less: Variable Costs (3) 12,66,000 10,74,150 1,91,850 Less: Fixed Costs (3) 3,15,000 3,30,000 (15,000) Profit 5.19.000 2.88.750 (2,30,250) The budgeted data shown in the table is based on the assumption that total market size would be 4,00,000 units but it turned out to be 3,75,000 units. Required PREPARE a statement showing reconciliation of budget profit to actual profit through marginal costing approach for the vear 2020-21 in as much detail as possible. Osaka Manufacturing Co. (OMC) is a leading consumer goods company. The budgeted and actual data of OMC for the year 2020-21 are as follows- Particulars Budget Actual Variance Sales / Production (units) 2,00,000 1,65,000 (35,000) Sales (3) 21,00,000 16,92,900 (4,07,100) Less: Variable Costs (3) 12,66,000 10,74,150 1,91,850 Less: Fixed Costs (3) 3,15,000 3,30,000 (15,000) Profit 5.19.000 2.88.750 (2,30,250) The budgeted data shown in the table is based on the assumption that total market size would be 4,00,000 units but it turned out to be 3,75,000 units. Required PREPARE a statement showing reconciliation of budget profit to actual profit through marginal costing approach for the vear 2020-21 in as much detail as possible

answer only if 100% sure otherwise i will downvote for sure. i had got wrong answers hence posting it again. dont try if not sure. skip if not 100% sure

answer only if 100% sure otherwise i will downvote for sure. i had got wrong answers hence posting it again. dont try if not sure. skip if not 100% sure