Question: answer only if excel is used and with the excel template expain every formula step and cell used cu celieldieu C UI VIACRS Seleuule, given

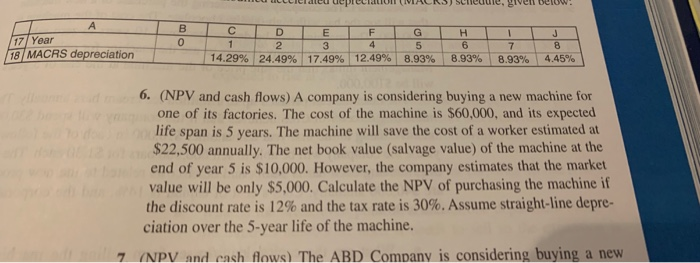

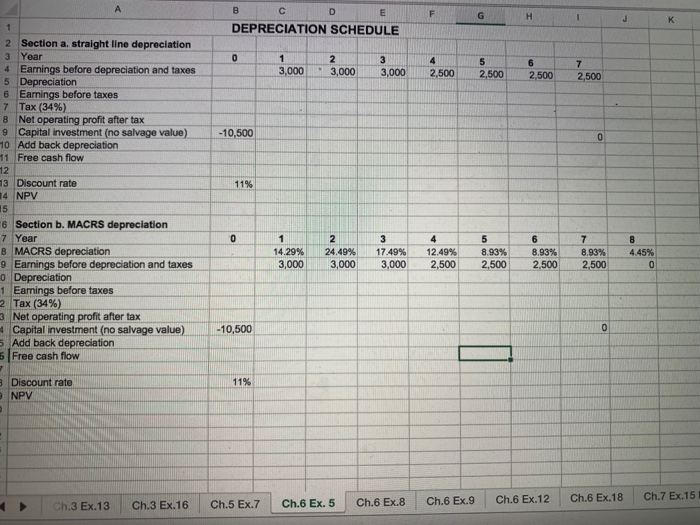

cu celieldieu C UI VIACRS Seleuule, given below: 17/ Year 18 MACRS depreciation B C D To 11 2 14.29% 24.49% E 3 17.49% F 4 12.49% G 5 8.93% H 6 8.93% I 7 8.93% J 8 4.45% 6. (NPV and cash flows) A company is considering buying a new machine for one of its factories. The cost of the machine is $60,000, and its expected life span is 5 years. The machine will save the cost of a worker estimated at $22,500 annually. The net book value (salvage value) of the machine at the end of year 5 is $10,000. However, the company estimates that the market value will be only $5,000. Calculate the NPV of purchasing the machine if the discount rate is 12% and the tax rate is 30%. Assume straight-line depre. ciation over the 5-year life of the machine. 7(NPV and cash flows) The ABD Company is considering buying a new C DEPRECIATION SCHEDULE 3,000 3,000 3,000 2,500 2,500 2,500 2,500 2 Section a, straight line depreciation 3 Year 4 Earnings before depreciation and taxes 5 Depreciation 6 Earnings before taxes 7 Tax (34%) 8 Net operating profit after tax 9 Capital investment (no salvage value) 10 Add back depreciation 11 Free cash flow -10,500 13 Discount rate 14 NPV 23 24.49% 17.49% 3,000 3,000 14.29% 3,000 4.45% 12.49% 2,500 8.93% 2,500 8.93% 2,500 8.93% 2,500 16 Section b. MACRS depreciation 7 Year 8 MACRS depreciation 9 Earnings before depreciation and taxes 0 Depreciation 1 Eamings before taxes 2 Tax (34%) 3 Net operating profit after tax 4 Capital investment (no salvage value) 5 Add back depreciation 5 Free cash flow -10,500 3 Discount rate NPV Ch.3 Ex.13 Ch.3 Ex.16 Ch.5 Ex.7 Ch.6 Ex. 5 Ch.6 Ex.8 Ch.6 Ex.9 Ch.6 Ex.12 Ch.6 Ex.18 Ch.7 Ex.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts