Question: answer only if u know.... otherwise I will straight away I will report answer and down vote ur answer A firm has an investment proposal,

answer only if u know.... otherwise I will straight away I will report answer and down vote ur answer

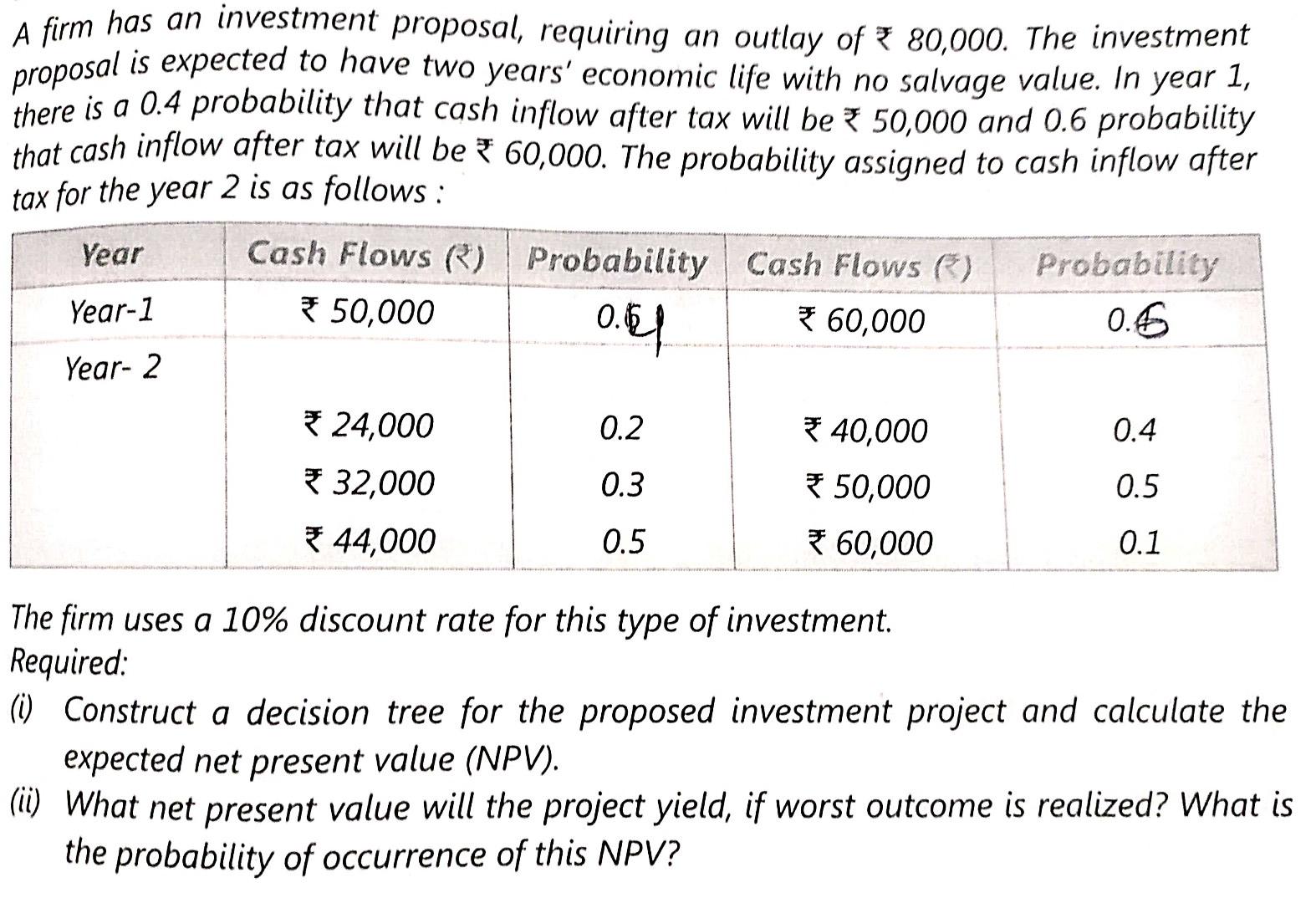

A firm has an investment proposal, requiring an outlay of * 80,000. The investment proposal is expected to have two years' economic life with no salvage value. In year 1, there is a 0.4 probability that cash inflow after tax will be * 50,000 and 0.6 probability that cash inflow after tax will be * 60,000. The probability assigned to cash inflow after tax for the year 2 is as follows: Year Cash Flows () Probability | Cash Flows (*) Probability Year-1 * 50,000 0.1 * 60,000 0.6 Year-2 24,000 0.2 40,000 0.4 0.3 * 50,000 0.5 $32,000 44,000 0.5 * 60,000 0.1 The firm uses a 10% discount rate for this type of investment. Required: (1) Construct a decision tree for the proposed investment project and calculate the expected net present value (NPV). (ii ) What net present value will the project yield, if worst outcome is realized? What is the probability of occurrence of this NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts