Question: ** Answer only if you are sure about the right answer: *Please answer all the listed questions: The Ajax Corporation has the following set of

** Answer only if you are sure about the right answer:

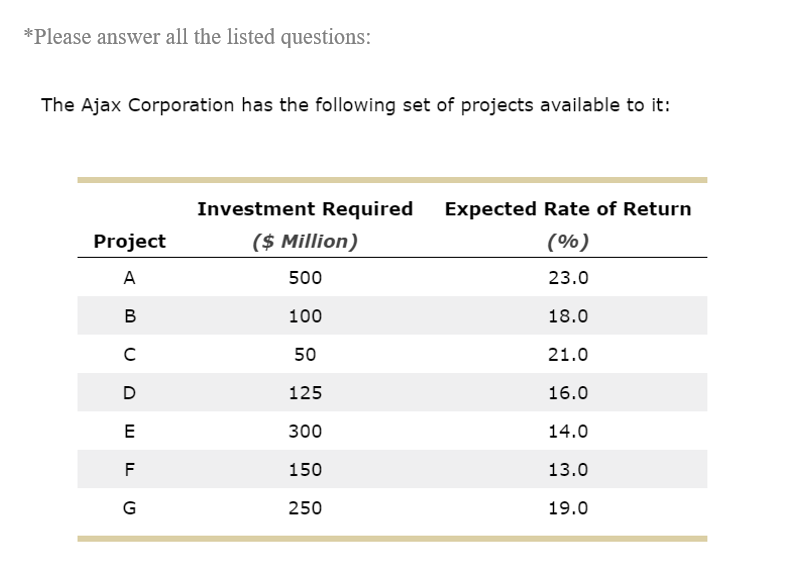

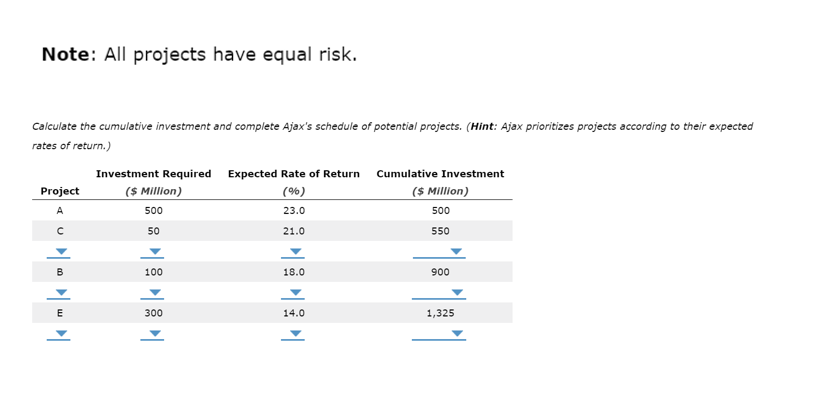

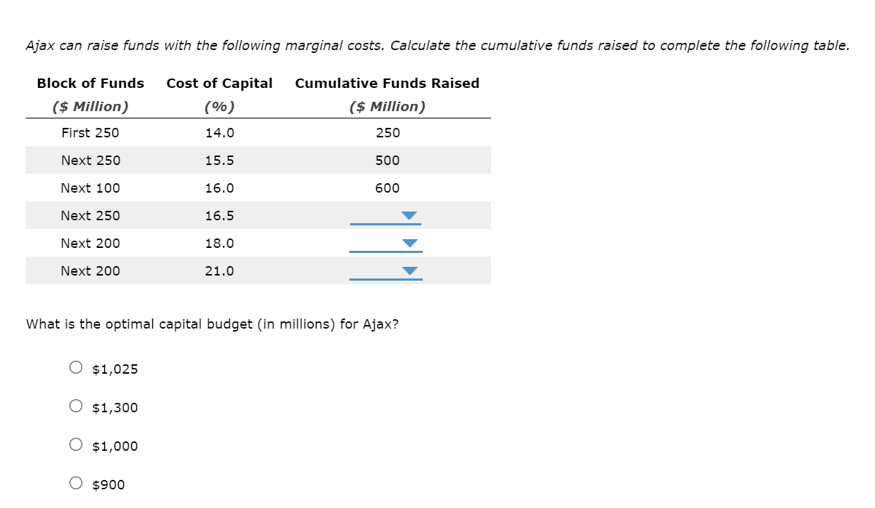

*Please answer all the listed questions: The Ajax Corporation has the following set of projects available to it: Investment Required ($ Million) 500 Expected Rate of Return (%) Project 23.0 100 18.0 50 21.0 D 0 125 16.0 300 14.0 150 13.0 G 250 19.0 Note: All projects have equal risk. Calculate the cumulative investment and complete Ajax's schedule of potential projects. (Hint: Ajax prioritizes projects according to their expected rates of return.) Investment Required Expected Rate of Return Cumulative Investment Project ($ Million) (%) ($ Million) 500 23.0 500 n D 50 21.0 550 B 100 18.0 900 se } E 300 14.0 1,325 Ajax can raise funds with the following marginal costs. Calculate the cumulative funds raised to complete the following table. Block of Funds Cost of Capital Cumulative Funds Raised ($ Million) (%) ($ Million) First 250 14.0 250 Next 250 15.5 500 Next 100 16.0 600 Next 250 16.5 Next 200 18.0 Next 200 21.0 What is the optimal capital budget (in millions) for Ajax? $1,025 O $1,300 $1,000 O $900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts