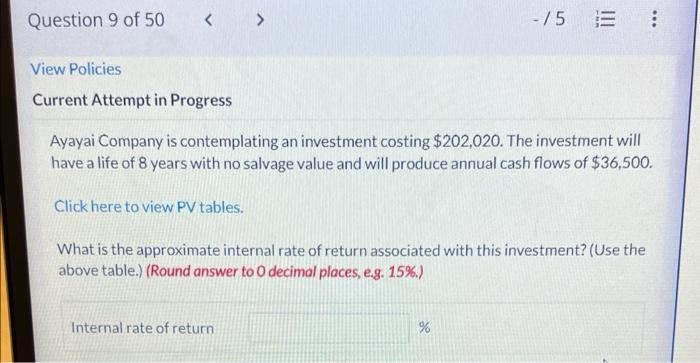

Question: answer only please Question 9 of 50 -15 E E: View Policies Current Attempt in Progress Ayayai Company is contemplating an investment costing $202,020. The

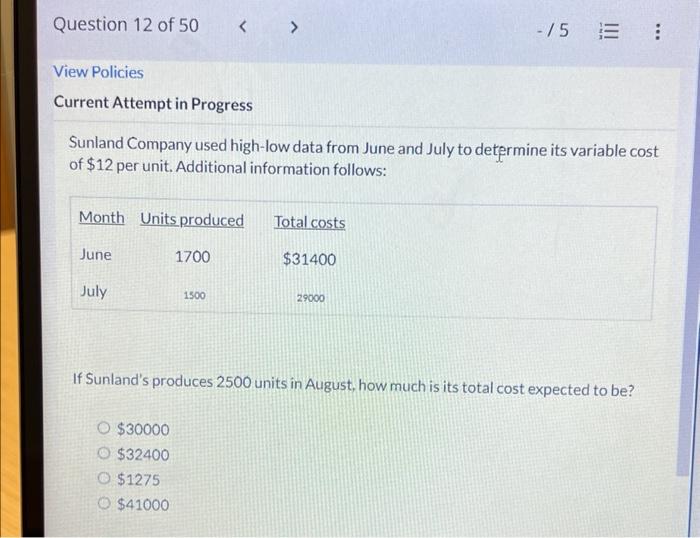

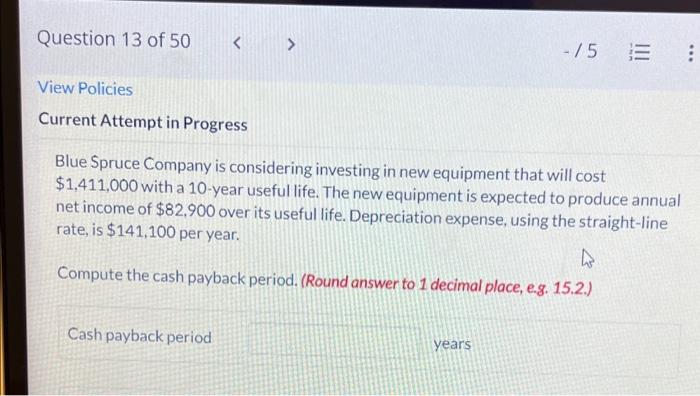

Question 9 of 50 -15 E E: View Policies Current Attempt in Progress Ayayai Company is contemplating an investment costing $202,020. The investment will have a life of 8 years with no salvage value and will produce annual cash flows of $36,500. Click here to view PV tables. What is the approximate internal rate of return associated with this investment? (Use the above table.) (Round answer to O decimal places, e.g. 15%.) Internal rate of return % ... Question 12 of 50 -15 View Policies Current Attempt in Progress Sunland Company used high-low data from June and July to determine its variable cost of $12 per unit. Additional information follows: Month Units produced Total costs June 1700 $31400 July 1500 29000 If Sunland's produces 2500 units in August, how much is its total cost expected to be? O $30000 $32400 O $1275 O $41000 Question 13 of 50 -/5 13 View Policies Current Attempt in Progress Blue Spruce Company is considering investing in new equipment that will cost $1.411,000 with a 10-year useful life. The new equipment is expected to produce annual net income of $82,900 over its useful life. Depreciation expense, using the straight-line rate, is $141,100 per year. 4 Compute the cash payback period. (Round answer to 1 decimal place, e.g. 15.2.) Cash payback period years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts