Question: ANSWER ONLY QUESTION # 2!!!!!! !!!!! Here is the first question and it is already solved: !!!!SOLUTION !!!!!!!!!!!!!!!!!!!!!!!HERE IS THE QUESTION: Harley-Davidson Inc. produces motorcycles,

ANSWER ONLY QUESTION # 2!!!!!!

!!!!! Here is the first question and it is already solved:

!!!!SOLUTION

!!!!!!!!!!!!!!!!!!!!!!!HERE IS THE QUESTION:

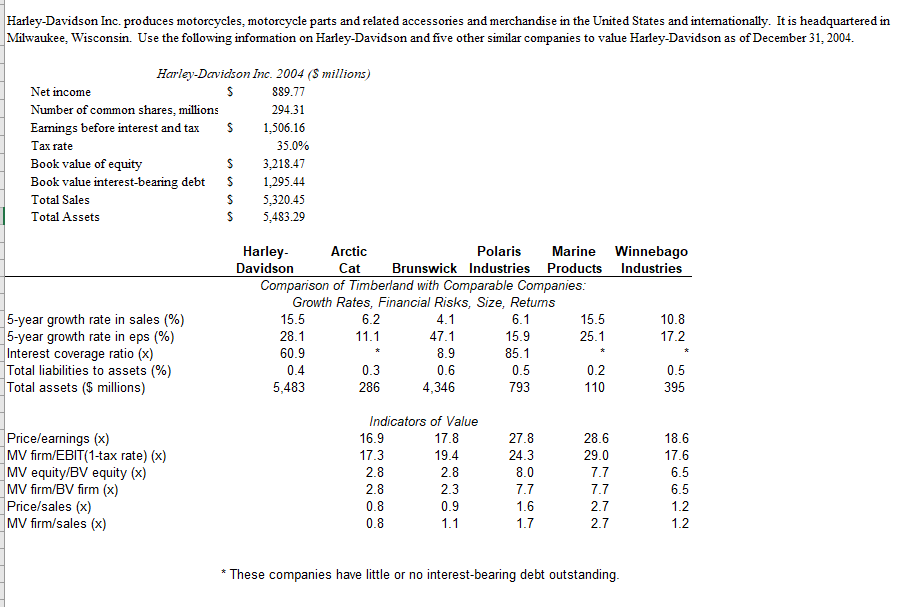

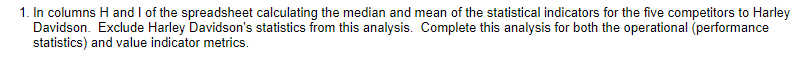

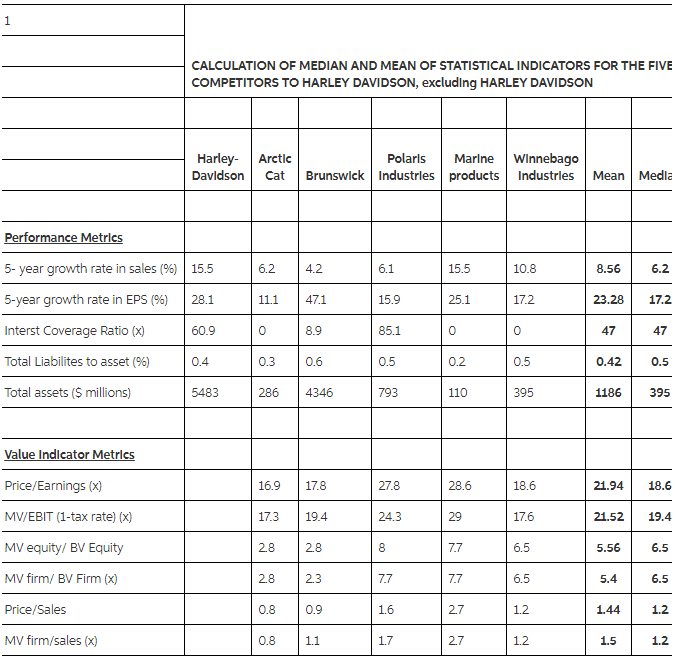

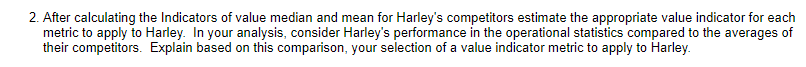

Harley-Davidson Inc. produces motorcycles, motorcycle parts and related accessories and merchandise in the United States and intemationally. It is headquartered in Milwaukee, Wisconsin. Use the following information on Harley-Davidson and five other similar companies to value Harley-Davidson as of December 31, 2004 Harley-Davidson Inc. 2004 (S millions) 889.77 294.31 Eamings before interest and tax1,506.16 Net income Number of common shares, millions Tax rate Book value of equity 35.0% 3,218.47 Book value interest-bearing debt S1,295.44 S 5,320.45 S 5,483.29 Total Sales Total Assets Harley Davidson Arctic Cat Polaris Marine Winnebago Brunswick Industries Products Industries Comparison of Timberland with Comparable Companies Growth Rates, Financial Risks, Size, Retums 5-year growth rate in sales (%) 5-year growth rate in eps (%) Interest coverage ratio (x) Total liabilities to assets (%) Total assets (S millions) 15.5 28.1 60.9 0.4 5,483 6.2 11.1 15.5 25.1 10.8 17.2 47.1 8.9 0.6 4,346 6.1 15.9 85.1 0.5 793 0.3 286 0.2 110 0.5 395 Indicators of Value 16.9 17.3 17.8 19.4 28.6 29.0 Price/earnings (x) MV firm/EBIT(1-tax rate) (x) MV equity/BV equity (x) MV firm/BV firm (x) Price/sales (x) MV firm/sales (x) 27.8 24.3 8.0 18.6 17.6 6.5 2.3 0.9 1.6 1.7 7.7 2.7 2.7 1.2 1.2 * These companies have little or no interest-bearing debt outstanding 1. In columns H and I of the spreadsheet calculating the median and mean of the statistical indicators for the five competitors to Harley Davidson. Exclude Harley Davidson's statistics from this analysis. Complete this analysis for both the operational (performance statistics) and value indicator metrics CALCULATION OF MEDIAN AND MEAN OF STATISTICAL INDICATORS FOR THE FIVE COMPETITORS TO HARLEY DAVIDSON, excluding HARLEY DAVIDSON Harley Arctic Davldson Cat Brunswick Industrles products Industrles MeanMedla PolarlsMarlneWInnebago rformance Metrl 5-year growth rate in sales (96) | 15.5 5-year growth rate in EPS (%) | 281 Interst Coverage Ratio (x) Total Liabilites to asset (96) Total assets ($ millions) 6.1 15.9 85.1 0.5 793 10.8 6.2 4.2 111 47.1 0 15.5 6.2 23.28 17.2 47 0.5 1186395 8.56 25.1 17.2 60.9 0.4 5483 8.9 0 47 0.3 0.6 0.2 0.5 0.42 286 4346 110 395 Value Indlcator Metrl Price/Earnings (x) MV/EBIT (1-tax rate) (x) MV equity/ BV Equity MV firm/ BV Firm (x) Price/Sales MV firm/sales (x) 16.9 17.8 17.3 19.4 28 28 28 23 0.8 0.9 0.8 11 18.6 17.6 6.5 6.5 12 12 27.8 28.6 29 7.7 7.7 2.7 2.7 21.9418.6 21.52 19.4 5.56 24.3 6.5 7.7 1.6 1.7 6.5 1.2 1.2 5.4 1.44 1.5 2. After calculating the Indicators of value median and mean for Harley's competitors estimate the appropriate value indicator for each metric to apply to Harley. In your analysis, consider Harley's performance in the operational statistics compared to the averages of their competitors. Explain based on this comparison, your selection of a value indicator metric to apply to Harley

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts