Question: answer only Using a computerized Inventory Management System, a Paint Supply Store franchise continuously monitors the inventory of all the paint located at each of

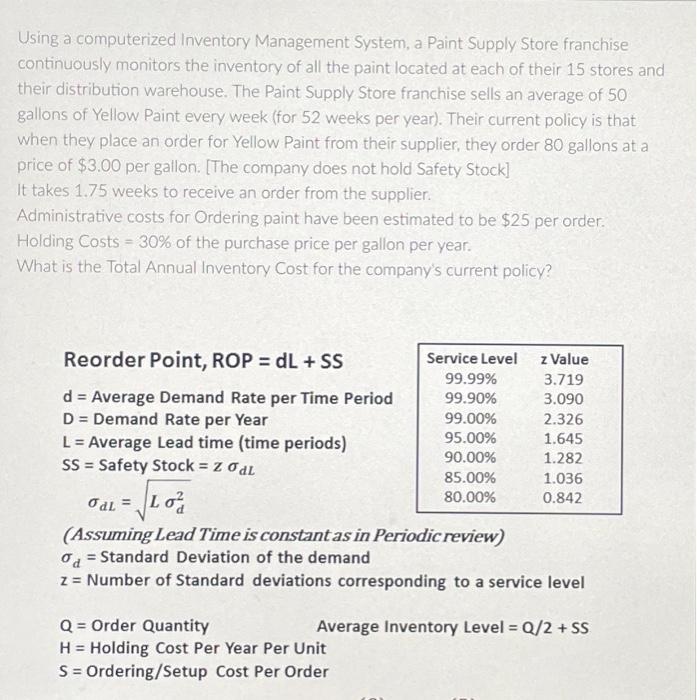

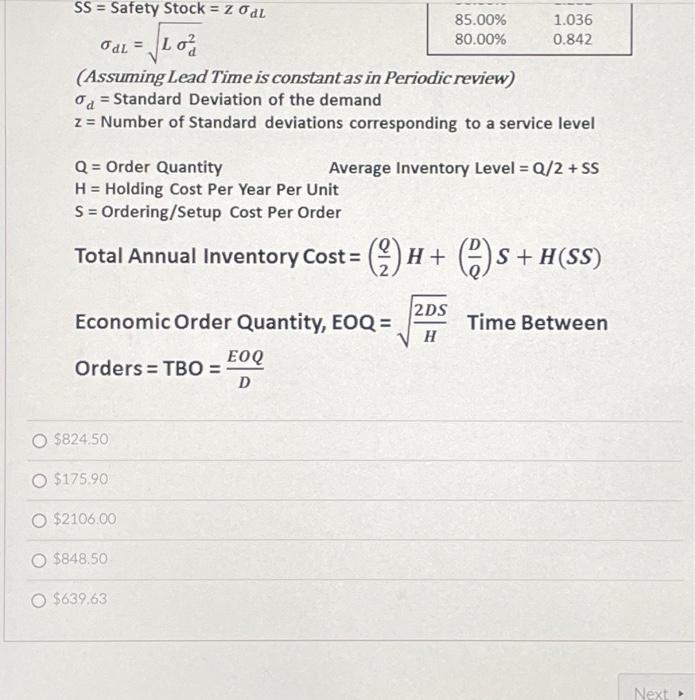

Using a computerized Inventory Management System, a Paint Supply Store franchise continuously monitors the inventory of all the paint located at each of their 15 stores and their distribution warehouse. The Paint Supply Store franchise sells an average of 50 gallons of Yellow Paint every week (for 52 weeks per year). Their current policy is that when they place an order for Yellow Paint from their supplier, they order 80 gallons at a price of \$3.00 per gallon. [The company does not hold Safety Stock] It takes 1.75 weeks to receive an order from the supplier. Administrative costs for Ordering paint have been estimated to be $25 per order. Holding Costs =30% of the purchase price per gallon per year. What is the Total Annual Inventory Cost for the company's current policy? Reorder Point, ROP=dL+SS d = Average Demand Rate per Time Period D= Demand Rate per Year L= Average Lead time (time periods) SS= Safety Stock =zdL dL=Ld2 (Assuming Lead Time is constant as in Periodic review) d= Standard Deviation of the demand z= Number of Standard deviations corresponding to a service level Q= Order Quantity Average Inventory Level =Q/2+SS H= Holding Cost Per Year Per Unit S= Ordering/Setup Cost Per Order SS= Safety Stock =zdL dL=Ld2 (Assuming Lead Time is constant as in Periodic review) d= Standard Deviation of the demand z= Number of Standard deviations corresponding to a service level Q = Order Quantity Average Inventory Level =Q/2+SS H= Holding Cost Per Year Per Unit S= Ordering/Setup Cost Per Order Total Annual Inventory Cost =(2Q)H+(QD)S+H(SS) Economic Order Quantity, EOQ =H2DS Time Between Orders =TBO=DEOQ $824.50 $175.90 $2106.00 $848.50 $639.63

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts