Question: Answer Page 3 please v. iv. Prepare a consolidated statement of financial position for the group on 315 December 2018 (10 marks) Indicate three conditions

Answer Page 3 please

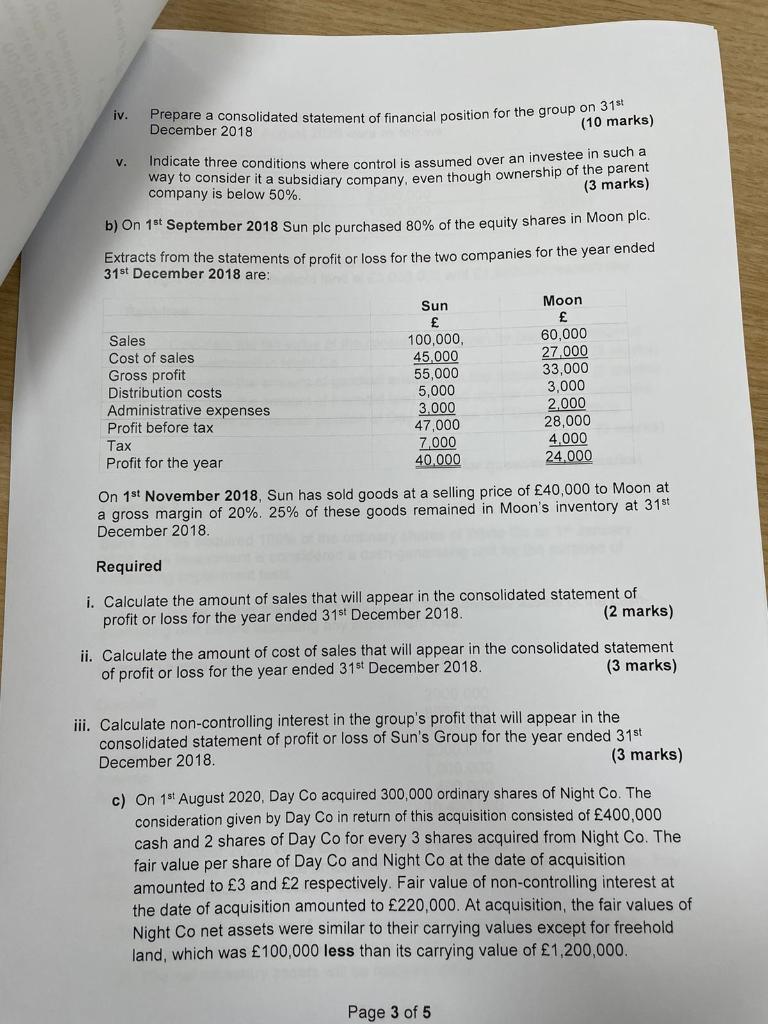

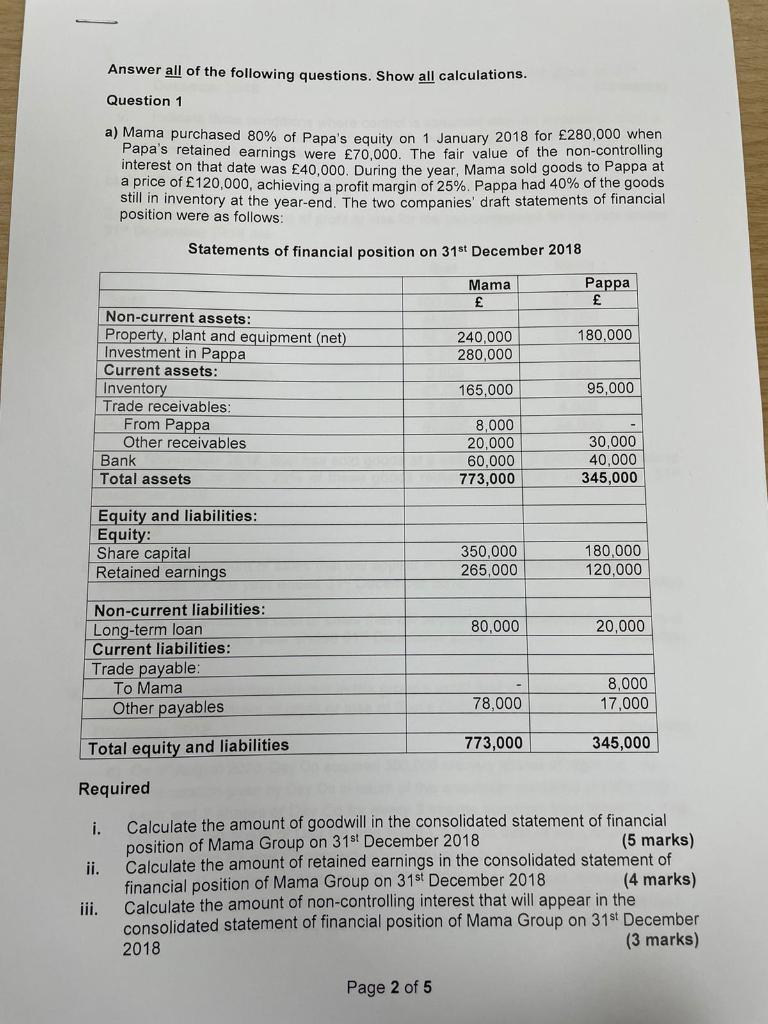

v. iv. Prepare a consolidated statement of financial position for the group on 315 December 2018 (10 marks) Indicate three conditions where control is assumed over an investee in such a way to consider it a subsidiary company, even though ownership of the parent company is below 50% (3 marks) b) On 18 September 2018 Sun plc purchased 80% of the equity shares in Moon plc. Extracts from the statements of profit or loss for the two companies for the year ended 31st December 2018 are: Sales Cost of sales Gross profit Distribution costs Administrative expenses Profit before tax Tax Profit for the year Sun 100,000 45,000 55,000 5,000 3.000 47,000 7.000 40.000 Moon 60,000 27,000 33,000 3,000 2.000 28,000 4,000 24.000 On 1st November 2018, Sun has sold goods at a selling price of 40,000 to Moon at a gross margin of 20%. 25% of these goods remained in Moon's inventory at 31st December 2018 Required i. Calculate the amount of sales that will appear in the consolidated statement of profit or loss for the year ended 31st December 2018 (2 marks) ii. Calculate the amount of cost of sales that will appear in the consolidated statement of profit or loss for the year ended 31st December 2018. (3 marks) iii. Calculate non-controlling interest in the group's profit that will appear in the consolidated statement of profit or loss of Sun's Group for the year ended 31st December 2018 (3 marks) c) On 1st August 2020, Day Co acquired 300,000 ordinary shares of Night Co. The consideration given by Day Co in return of this acquisition consisted of 400,000 cash and 2 shares of Day Co for every 3 shares acquired from Night Co. The fair value per share of Day Co and Night Co at the date of acquisition amounted to 3 and 2 respectively. Fair value of non-controlling interest at the date of acquisition amounted to 220,000. At acquisition, the fair values of Night Co net assets were similar to their carrying values except for freehold land, which was 100,000 less than its carrying value of 1,200,000. Page 3 of 5 Answer all of the following questions. Show all calculations. Question 1 a) Mama purchased 80% of Papa's equity on 1 January 2018 for 280,000 when Papa's retained earnings were 70,000. The fair value of the non-controlling interest on that date was 40,000. During the year, Mama sold goods to Pappa at a price of 120,000, achieving a profit margin of 25%. Pappa had 40% of the goods still in inventory at the year-end. The two companies' draft statements of financial position were as follows: Statements of financial position on 31st December 2018 Mama Pappa 180,000 240,000 280,000 Non-current assets: Property, plant and equipment (net) Investment in Pappa Current assets: Inventory Trade receivables: From Pappa Other receivables Bank Total assets 165,000 95,000 8,000 20,000 60,000 773,000 30,000 40.000 345,000 Equity and liabilities: Equity: Share capital Retained earnings 350,000 265,000 180,000 120,000 80,000 20,000 Non-current liabilities: Long-term loan Current liabilities: Trade payable: To Mama Other payables 8,000 17,000 78,000 Total equity and liabilities 773,000 345,000 Required i. ii. Calculate the amount of goodwill in the consolidated statement of financial position of Mama Group on 31st December 2018 (5 marks) Calculate the amount of retained earnings in the consolidated statement of financial position of Mama Group on 31st December 2018 (4 marks) Calculate the amount of non-controlling interest that will appear in the consolidated statement of financial position of Mama Group on 31st December 2018 (3 marks) iii. Page 2 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts