Question: ANSWER PART B please Make sure that the calculations are done in Excel, and that the formulas you use are in the cells. If you

ANSWER PART B please

ANSWER PART B please

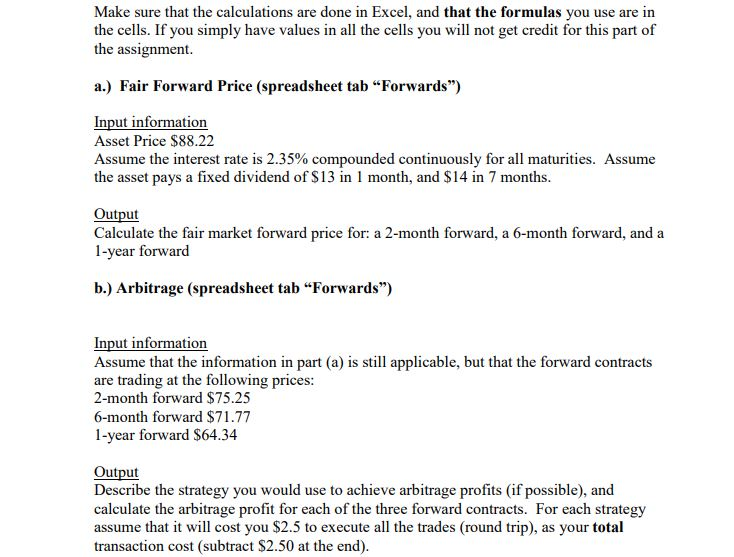

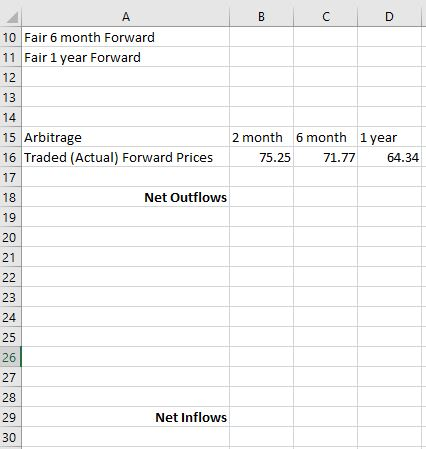

Make sure that the calculations are done in Excel, and that the formulas you use are in the cells. If you simply have values in all the cells you will not get credit for this part of the assignment. a.) Fair Forward Price (spreadsheet tab "Forwards") Input information Asset Price $88.22 Assume the interest rate is 2.35% compounded continuously for all maturities. Assume the asset pays a fixed dividend of $13 in 1 month, and $14 in 7 months. Output Calculate the fair market forward price for: a 2-month forward, a 6-month forward, and a 1-year forward b.) Arbitrage (spreadsheet tab "Forwards") Input information Assume that the information in part (a) is still applicable, but that the forward contracts are trading at the following prices: 2-month forward $75.25 6-month forward $71.77 1-year forward $64.34 Output Describe the strategy you would use to achieve arbitrage profits (if possible), and calculate the arbitrage profit for each of the three forward contracts. For each strategy assume that it will cost you $2.5 to execute all the trades (round trip), as your total transaction cost (subtract $2.50 at the end). B C D 10 Fair 6 month Forward 11 Fair 1 year Forward 13 15 Arbitrage 16 Traded (Actual) Forward Prices 2 month 6 month 1 year 75.25 71.77 64.34 Net Outflows Net Inflows Make sure that the calculations are done in Excel, and that the formulas you use are in the cells. If you simply have values in all the cells you will not get credit for this part of the assignment. a.) Fair Forward Price (spreadsheet tab "Forwards") Input information Asset Price $88.22 Assume the interest rate is 2.35% compounded continuously for all maturities. Assume the asset pays a fixed dividend of $13 in 1 month, and $14 in 7 months. Output Calculate the fair market forward price for: a 2-month forward, a 6-month forward, and a 1-year forward b.) Arbitrage (spreadsheet tab "Forwards") Input information Assume that the information in part (a) is still applicable, but that the forward contracts are trading at the following prices: 2-month forward $75.25 6-month forward $71.77 1-year forward $64.34 Output Describe the strategy you would use to achieve arbitrage profits (if possible), and calculate the arbitrage profit for each of the three forward contracts. For each strategy assume that it will cost you $2.5 to execute all the trades (round trip), as your total transaction cost (subtract $2.50 at the end). B C D 10 Fair 6 month Forward 11 Fair 1 year Forward 13 15 Arbitrage 16 Traded (Actual) Forward Prices 2 month 6 month 1 year 75.25 71.77 64.34 Net Outflows Net Inflows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts