Question: Answer parts A and B please 2. (10 points) Impact of government spending: Tax on consumption with government spending Consider a two-period economy where the

Answer parts A and B please

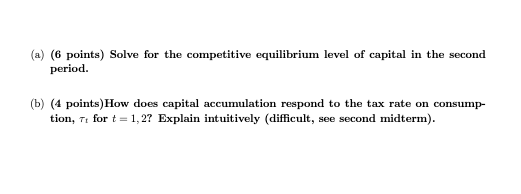

2. (10 points) Impact of government spending: Tax on consumption with government spending Consider a two-period economy where the representative consumer has a lifetime utility over consumption, C, for t=1,2, defined as U(C1, C2) = log C + Blog C, where 8 >0. In each period t= 1, 2, the consumer provides Ns = 1 units of labor to firms at wage rate w, receives profits, IIc, from firms. The government levies a tax T, on consumption and uses the revenue in each period to finance government expenditures, G. The total amount of taxes paid by the representative consumer in period t are given by 7.C. The consumer can borrow or lend between period 1 and period 2 at real interest rate r and chooses consumption (C1, C2) and savings to maximize their utility. The representative firm has a production technology given by Y = AF(K,N) = AKN1-4, 00. In each period t= 1, 2, the consumer provides Ns = 1 units of labor to firms at wage rate w, receives profits, IIc, from firms. The government levies a tax T, on consumption and uses the revenue in each period to finance government expenditures, G. The total amount of taxes paid by the representative consumer in period t are given by 7.C. The consumer can borrow or lend between period 1 and period 2 at real interest rate r and chooses consumption (C1, C2) and savings to maximize their utility. The representative firm has a production technology given by Y = AF(K,N) = AKN1-4, 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts