Question: Answer Please The Question below with Explanation It has This Question related, So Ignore question 4, focus on Question 5 on solving it but Question

Answer Please The Question below with Explanation

It has This Question related, So Ignore question 4, focus on Question 5 on solving it but Question 4 is Related to Question 5

ANSWER QUESTION 4:

b) Best Feasible CAL is the one where the Sharpe Ratio is maximized. Using excel solver, we find weights of S and B funds such that Sharpe Ratio is the highest.

| S | B | Portfolio | |

| Returns | 15% | 9% | 12.88% |

| S.D. | 32% | 23% | 23.34% |

| Weight | 64.66% | 35.34% |

c) Sharpe Ratio = (Rp - Rf) / SDp = (12.88% - 5.5%) / 23.34% = 0.3162

This is the Answer for Question 4, I need you to Solve Question 5 ONLY Please

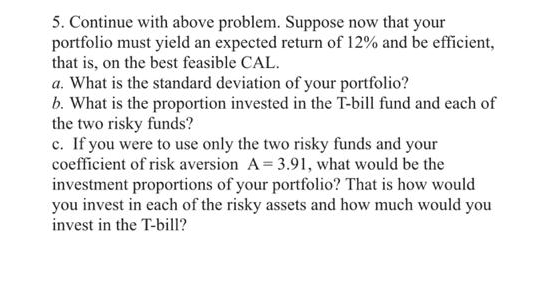

5. Continue with above problem. Suppose now that your portfolio must yield an expected return of 12% and be efficient, that is, on the best feasible CAL. a. What is the standard deviation of your portfolio? b. What is the proportion invested in the T-bill fund and each of the two risky funds? c. If you were to use only the two risky funds and your coefficient of risk aversion A= 3.91, what would be the investment proportions of your portfolio? That is how would you invest in each of the risky assets and how much would you invest in the T-bill? 5. Continue with above problem. Suppose now that your portfolio must yield an expected return of 12% and be efficient, that is, on the best feasible CAL. a. What is the standard deviation of your portfolio? b. What is the proportion invested in the T-bill fund and each of the two risky funds? c. If you were to use only the two risky funds and your coefficient of risk aversion A= 3.91, what would be the investment proportions of your portfolio? That is how would you invest in each of the risky assets and how much would you invest in the T-bill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts