Question: Answer problem 1 and 2 Problem 2 The trial balance of Speedy Delivery Services at the end of the two months operation is given as

Answer problem 1 and 2

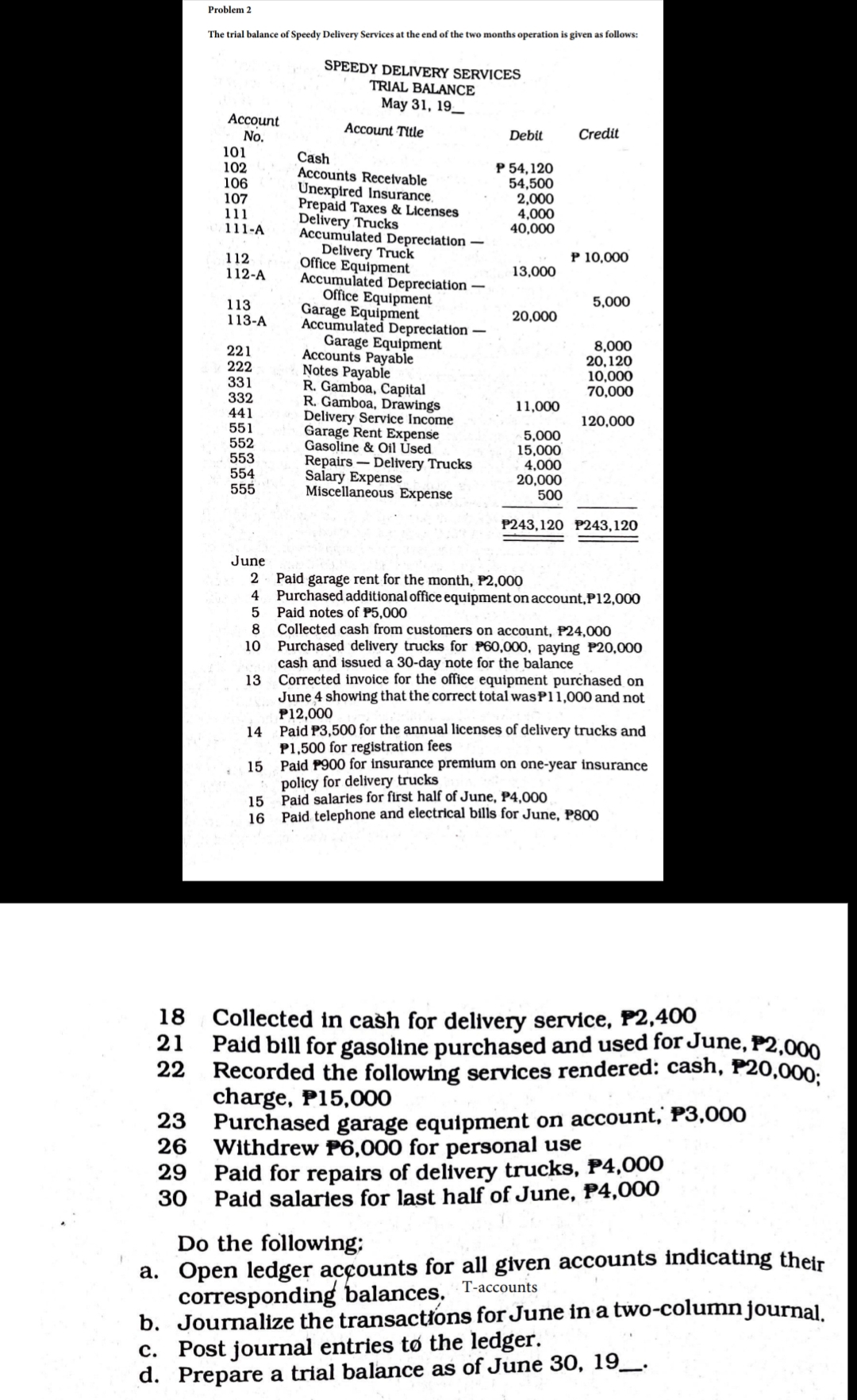

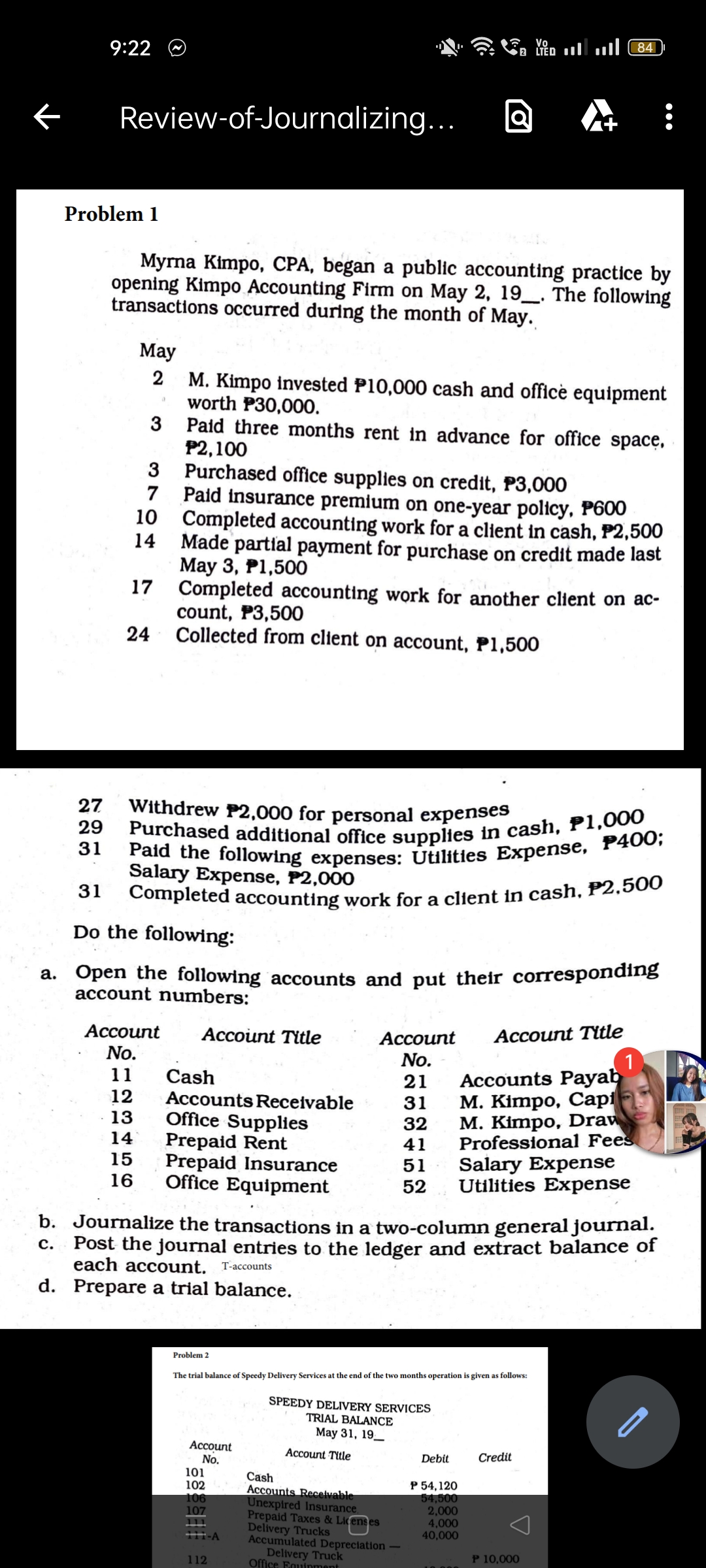

Problem 2 The trial balance of Speedy Delivery Services at the end of the two months operation is given as follows: SPEEDY DELIVERY SERVICES TRIAL BALANCE May 31, 19_ Account Account Title Debit Credit No. 101 Cash 102 P 54,120 Accounts Receivable 54.500 106 107 Unexpired Insurance. 2,000 111 Prepaid Taxes & Licenses 4,000 111-A Delivery Trucks 40,000 Accumulated Depreciation - Delivery Truck P 10,000 112 Office Equipment 1 12-A 13,000 Accumulated Depreciation - Office Equipment 5,000 113 Garage Equipment 20,000 1 13-A Accumulated Depreciation Garage Equipment 8,000 221 Accounts Payable 20,120 222 Notes Payable 10,000 331 R. Gamboa, Capital 70,000 332 R. Gamboa, Drawings 1 1,000 441 Delivery Service Income 120,000 551 Garage Rent Expense 5.000 552 Gasoline & Oil Used 15,000 553 Repairs - Delivery Trucks 4,000 554 Salary Expense 20,000 555 Miscellaneous Expense 500 P243,120 P243,120 June 2 Paid garage rent for the month, P2,000 Purchased additional office equipment on account, P12,000 Paid notes of P5,000 Collected cash from customers on account, P24,000 Purchased delivery trucks for P60,000, paying P20,000 cash and issued a 30-day note for the balance 13 Corrected invoice for the office equipment purchased on June 4 showing that the correct total was P1 1,000 and not P12,000 Paid P3,500 for the annual licenses of delivery trucks and P1,500 for registration fees 15 Paid P900 for insurance premium on one-year insurance policy for delivery trucks 15 Paid salaries for first half of June, P4,000 16 Paid telephone and electrical bills for June, P800 18 Collected in cash for delivery service, P2,400 21 Paid bill for gasoline purchased and used for June, P2,000 22 Recorded the following services rendered: cash, P20,000; charge, P15,000 23 Purchased garage equipment on account, P3,000 26 Withdrew P6,000 for personal use 29 Paid for repairs of delivery trucks, P4,000 30 Paid salaries for last half of June, P4,000 Do the following: a. Open ledger accounts for all given accounts indicating their corresponding balances. T-accounts b. Journalize the transactions for June in a two-column journal. c. Post journal entries to the ledger. d. Prepare a trial balance as of June 30, 19_.9:22 Review-of-Journalizing... Problem 1 Myrna Kimpo, CPA, began a public accounting practice by opening Kimpo Accounting Firm on May 2, 19_. The following transactions occurred during the month of May. May 2 M. Kimpo invested P10,000 cash and office equipment worth P30,000. 3 Paid three months rent in advance for office space. P2,100 3 Purchased office supplies on credit, P3,000 7 Paid insurance premium on one-year policy, P600 10 Completed accounting work for a client in cash, P2,500 14 Made partial payment for purchase on credit made last May 3, P1,500 17 Completed accounting work for another client on ac- count, P3,500 24 . Collected from client on account, P1,500 27 Withdrew P2,000 for personal expenses 29 Purchased additional office supplies in cash, P1,000 31 Paid the following expenses: Utilities Expense, P400; Salary Expense, P2,000 31 Completed accounting work for a client in cash, P2.500 Do the following: a. Open the following accounts and put their corresponding account numbers: Account Account Title Account Account Title No. No. 11 Cash 21 Accounts Payab 12 Accounts Receivable 31 M. Kimpo, Capi 13 Office Supplies 32 M. Kimpo, Draw 14 Prepaid Rent 41 Professional Fees 15 Prepaid Insurance 51 Salary Expense 16 Office Equipment 52 Utilities Expense b. Journalize the transactions in a two-column general journal. c. Post the journal entries to the ledger and extract balance of each account. T-accounts d. Prepare a trial balance. Problem 2 The trial balance of Speedy Delivery Services at the end of the two months operation is given as follows: SPEEDY DELIVERY SERVICES TRIAL BALANCE May 31, 19__ Account Account Title Credit No. Debit 101 Cash 102 P 54, 120 Accounts Receivable 1,500 106 Unexpired Insurance, 2,000 111 Prepaid Taxes & Licenses 4,000 Delivery Trucks 40,000 THI-A Accumulated Depreciation - Delivery Truck P 10,000 112

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts