Question: answer problem 5, by using problem 3. thank you. tment has been hedged? (LO 19-1) 3. Suppose a U.S. investor wishes to invest in a

answer problem 5, by using problem 3. thank you.

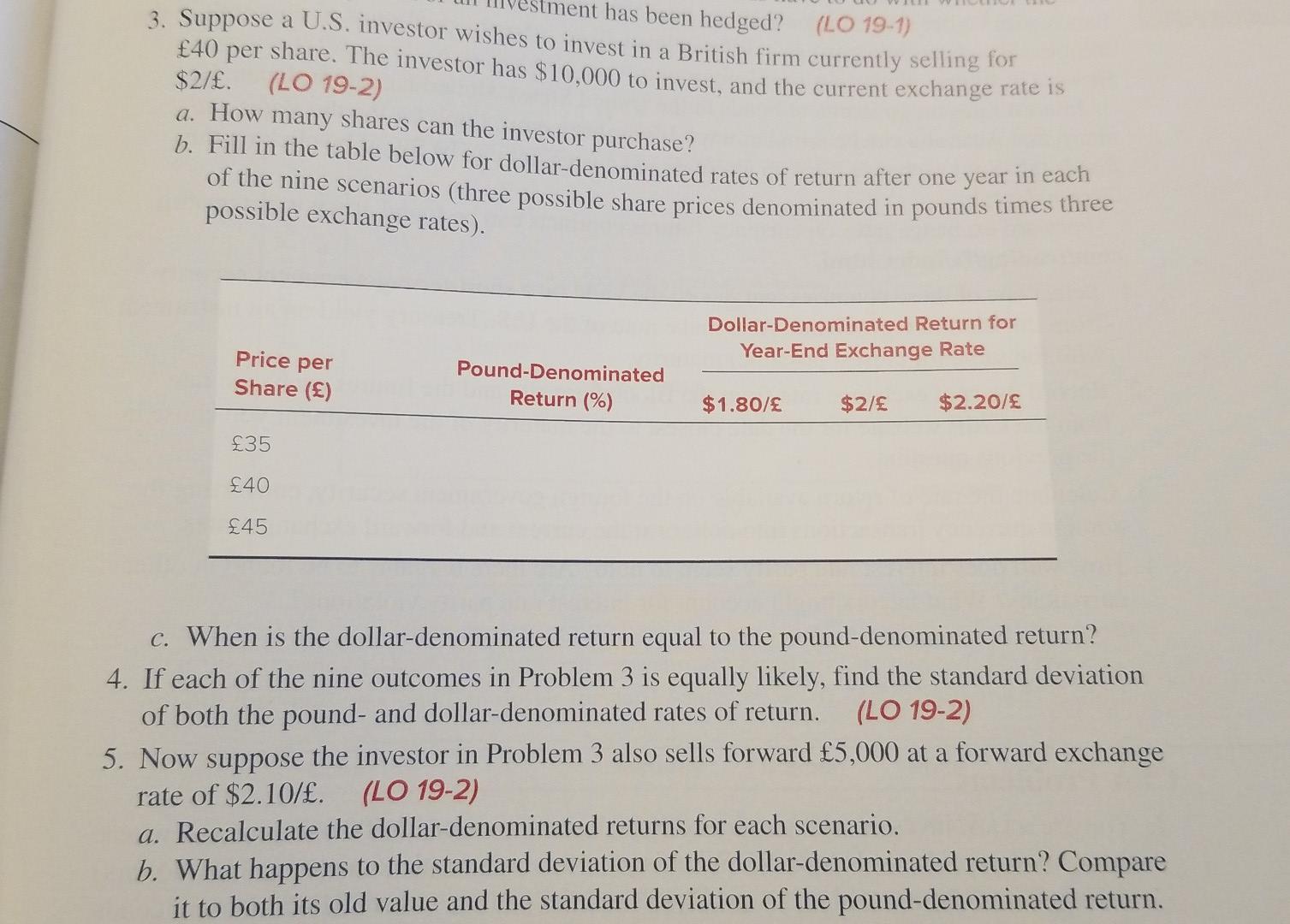

tment has been hedged? (LO 19-1) 3. Suppose a U.S. investor wishes to invest in a British firm currently selling for 40 per share. The investor has $10,000 to invest, and the current exchange rate is $2/. (LO 19-2) a. How many shares can the investor purchase? b. Fill in the table below for dollar-denominated rates of return after one year in each of the nine scenarios (three possible share prices denominated in pounds times three possible exchange rates). Dollar-Denominated Return for Year-End Exchange Rate Price per Share () Pound-Denominated Return (%) $1.80/ $2/ $2.20/ 35 40 45 c. When is the dollar-denominated return equal to the pound-denominated return? 4. If each of the nine outcomes in Problem 3 is equally likely, find the standard deviation of both the pound- and dollar-denominated rates of return. (LO 19-2) 5. Now suppose the investor in Problem 3 also sells forward 5,000 at a forward exchange rate of $2.10/. (LO 19-2) a. Recalculate the dollar-denominated returns for each scenario. b. What happens to the standard deviation of the dollar-denominated return? Compare it to both its old value and the standard deviation of the pound-denominated return. tment has been hedged? (LO 19-1) 3. Suppose a U.S. investor wishes to invest in a British firm currently selling for 40 per share. The investor has $10,000 to invest, and the current exchange rate is $2/. (LO 19-2) a. How many shares can the investor purchase? b. Fill in the table below for dollar-denominated rates of return after one year in each of the nine scenarios (three possible share prices denominated in pounds times three possible exchange rates). Dollar-Denominated Return for Year-End Exchange Rate Price per Share () Pound-Denominated Return (%) $1.80/ $2/ $2.20/ 35 40 45 c. When is the dollar-denominated return equal to the pound-denominated return? 4. If each of the nine outcomes in Problem 3 is equally likely, find the standard deviation of both the pound- and dollar-denominated rates of return. (LO 19-2) 5. Now suppose the investor in Problem 3 also sells forward 5,000 at a forward exchange rate of $2.10/. (LO 19-2) a. Recalculate the dollar-denominated returns for each scenario. b. What happens to the standard deviation of the dollar-denominated return? Compare it to both its old value and the standard deviation of the pound-denominated return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts