Question: Answer problem and show work please 27. Northeast Airlines has a current dividend of $1.80. Dividends are expected to grow at 7% into the foreseeable

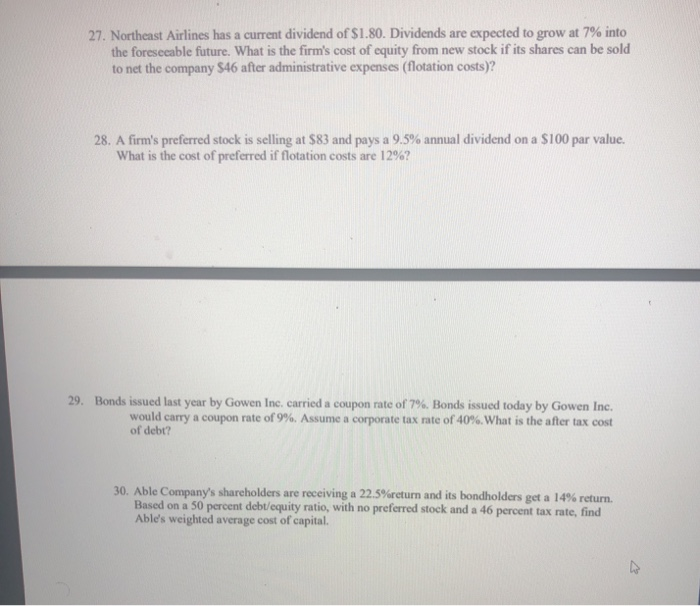

27. Northeast Airlines has a current dividend of $1.80. Dividends are expected to grow at 7% into the foreseeable future. What is the firm's cost of equity from new stock if its shares can be sold to net the company $46 after administrative expenses (flotation costs)? 28. A firm's preferred stock is selling at $83 and pays a 9.5% annual dividend on a $100 par value. What is the cost of preferred if flotation costs are 12%? 29. Bonds issued last year by Gowen Inc. carried a coupon rate of 7%. Bonds issued today by Gowen Inc. would carry a coupon rate of 9%. Assume a corporate tax rate of 40%. What is the after tax cost of debt? 30. Able Company's shareholders are receiving a 22.5%return and its bondholders get a 14% return. Based on a 50 percent debt/equity ratio, with no preferred stock and a 46 percent tax rate, find Able's weighted average cost of capital. w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts