Question: Answer problems in excel Jefferson City has decided to build a downtown parking garage to house city employee's vehicles. Since the city has to demolish

Answer problems in excel

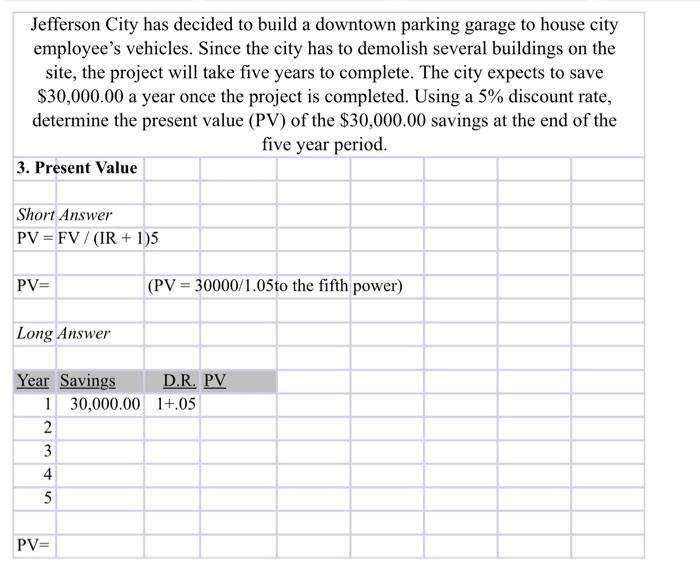

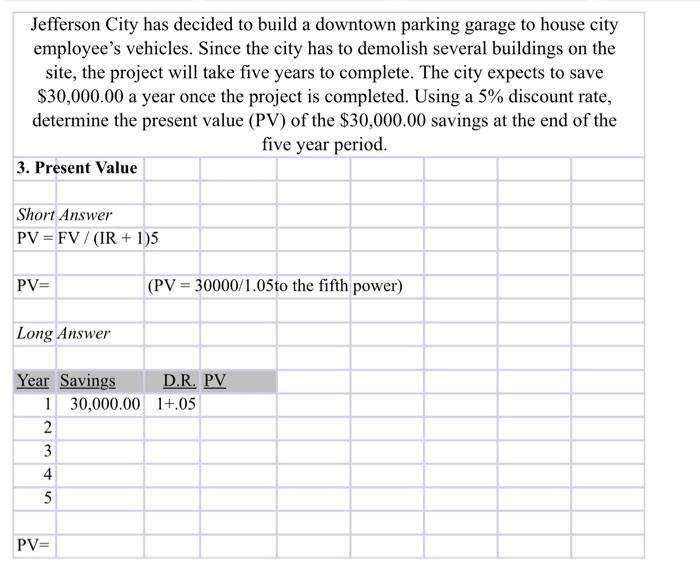

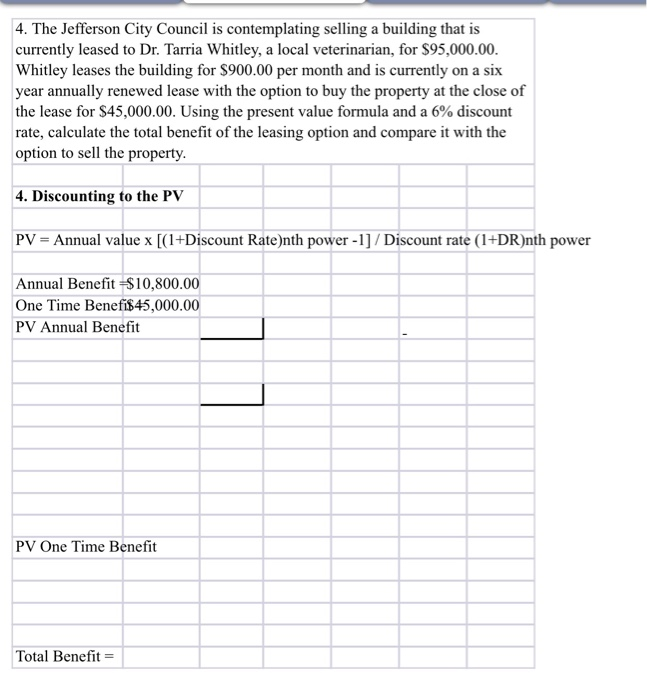

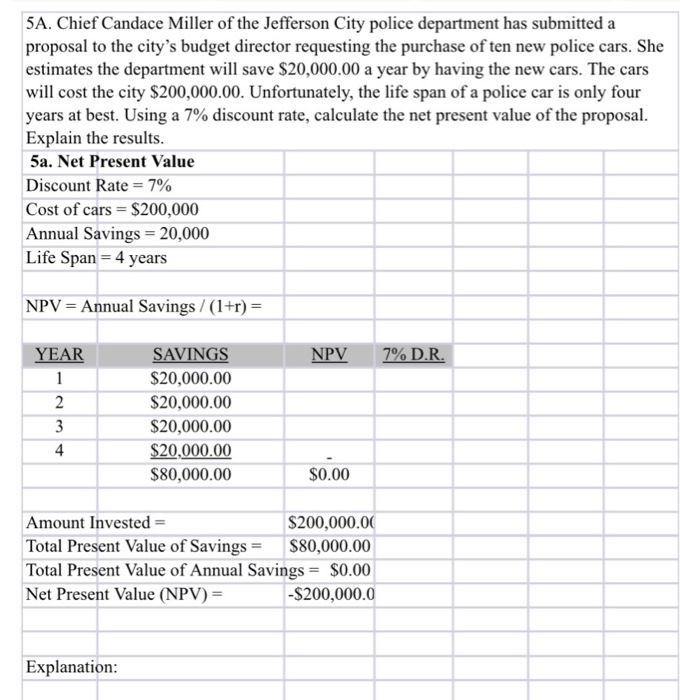

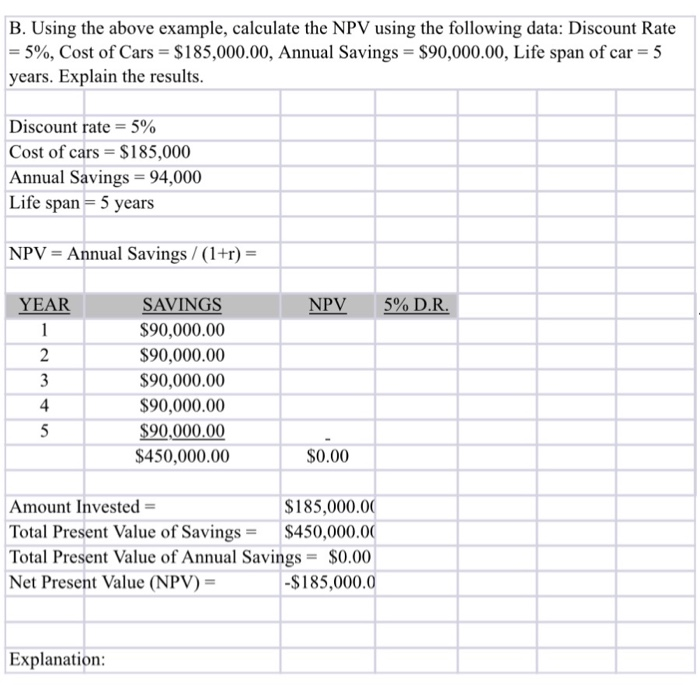

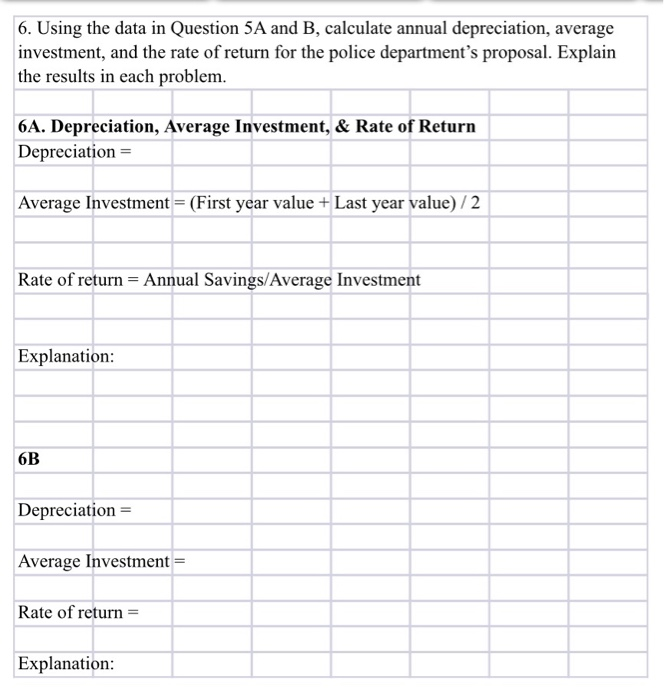

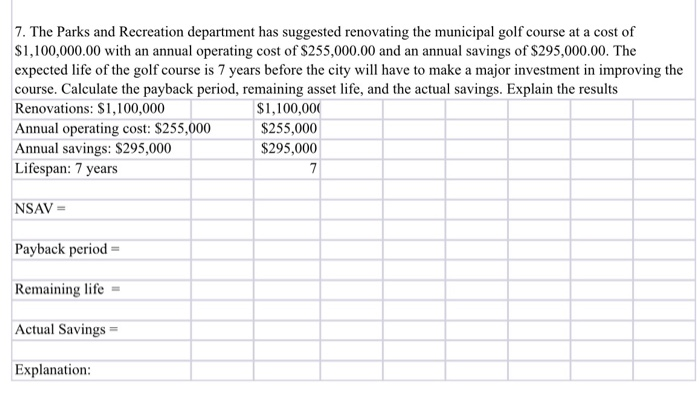

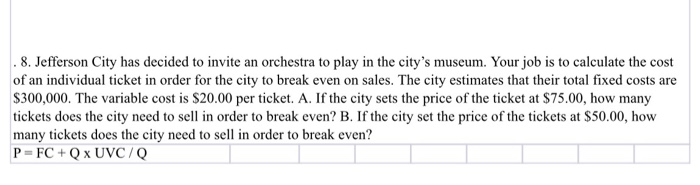

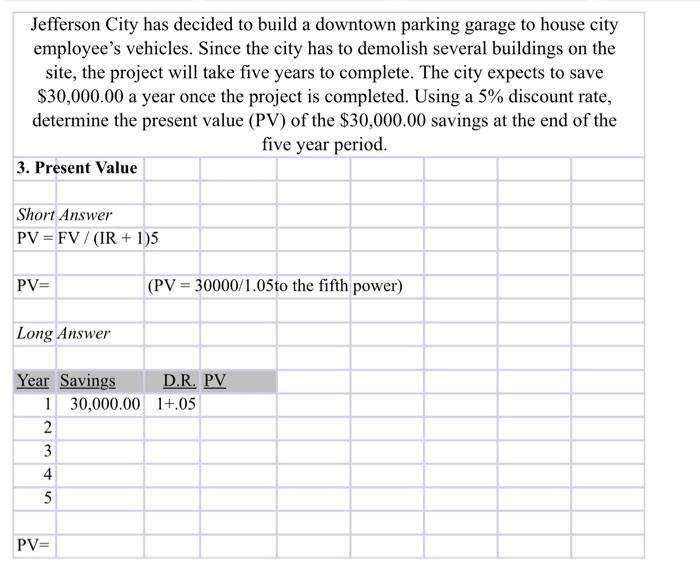

Jefferson City has decided to build a downtown parking garage to house city employee's vehicles. Since the city has to demolish several buildings on the site, the project will take five years to complete. The city expects to save $30,000.00 a year once the project is completed. Using a 5% discount rate, determine the present value (PV) of the $30,000.00 savings at the end of the five year period. 3. Present Value Short Answer PV = FV / (IR + 1)5 PV= (PV = 30000/1.05to the fifth power) Long Answer Year Savings D.R. PV 1 30,000.00 17.05 PV= 4. The Jefferson City Council is contemplating selling a building that is currently leased to Dr. Tarria Whitley, a local veterinarian, for $95,000.00 Whitley leases the building for $900.00 per month and is currently on a six year annually renewed lease with the option to buy the property at the close of the lease for $45,000.00. Using the present value formula and a 6% discount rate, calculate the total benefit of the leasing option and compare it with the option to sell the property. 4. Discounting to the PV PV = Annual value x [(1+Discount Rate)nth power-1] /Discount rate (1+DR)nth power Annual Benefit $10,800.00 One Time Benefi$45,000.00 PV Annual Benefit PV One Time Benefit Total Benefit = 5A. Chief Candace Miller of the Jefferson City police department has submitted a proposal to the city's budget director requesting the purchase of ten new police cars. She estimates the department will save $20,000.00 a year by having the new cars. The cars will cost the city $200,000.00. Unfortunately, the life span of a police car is only four years at best. Using a 7% discount rate, calculate the net present value of the proposal. Explain the results. 5a. Net Present Value Discount Rate = 7% Cost of cars = $200,000 Annual Savings = 20,000 Life Span= 4 years NPV = Annual Savings / (1+r) = YEAR NPV 7%D.R. 2 SAVINGS $20,000.00 $20,000.00 $20,000.00 $20,000.00 $80,000.00 4 $0.00 Amount Invested = $200,000.00 Total Present Value of Savings = $80,000.00 Total Present Value of Annual Savings = $0.00 Net Present Value (NPV) = -$200,000.0 Explanation: B. Using the above example, calculate the NPV using the following data: Discount Rate = 5%, Cost of Cars = $185,000.00, Annual Savings = $90,000.00, Life span of car = 5 years. Explain the results. Discount rate = 5% Cost of cars = $185,000 Annual Savings = 94,000 Life span = 5 years NPV = Annual Savings /(1+r) = YEAR NPV 5%D.R. SAVINGS $90,000.00 $90,000.00 $90,000.00 $90,000.00 $90,000.00 $450,000.00 5 $0.00 Amount Invested = $185,000.00 Total Present Value of Savings = $450,000.00 Total Present Value of Annual Savings = $0.00 Net Present Value (NPV) = -$185,000.0 Explanation: 6. Using the data in Question 5A and B, calculate annual depreciation, average investment, and the rate of return for the police department's proposal. Explain the results in each problem. 6A. Depreciation, Average Investment, & Rate of Return Depreciation = Average Investment = (First year value + Last year value)/2 Rate of return = Annual Savings/Average Investment Explanation: 6B Depreciation = Average Investment = Rate of return = Explanation: 7. The Parks and Recreation department has suggested renovating the municipal golf course at a cost of $1,100,000.00 with an annual operating cost of $255,000.00 and an annual savings of $295,000.00. The expected life of the golf course is 7 years before the city will have to make a major investment in improving the course. Calculate the payback period, remaining asset life, and the actual savings. Explain the results Renovations: $1,100,000 $1,100,000 Annual operating cost: $255,000 $255,000 Annual savings: $295,000 $295,000 Lifespan: 7 years NSAV = Payback period = Remaining life = Actual Savings = Explanation: . 8. Jefferson City has decided to invite an orchestra to play in the city's museum. Your job is to calculate the cost of an individual ticket in order for the city to break even on sales. The city estimates that their total fixed costs are $300,000. The variable cost is $20.00 per ticket. A. If the city sets the price of the ticket at $75.00, how many tickets does the city need to sell in order to break even? B. If the city set the price of the tickets at $50.00, how many tickets does the city need to sell in order to break even? P=FC + Q x UVC/