Question: Answer? Q Xpress Video, Inc. was the second largest chain of videocassetto rental stores in the greater Noida wron, begun in 1999 us a small

Answer?

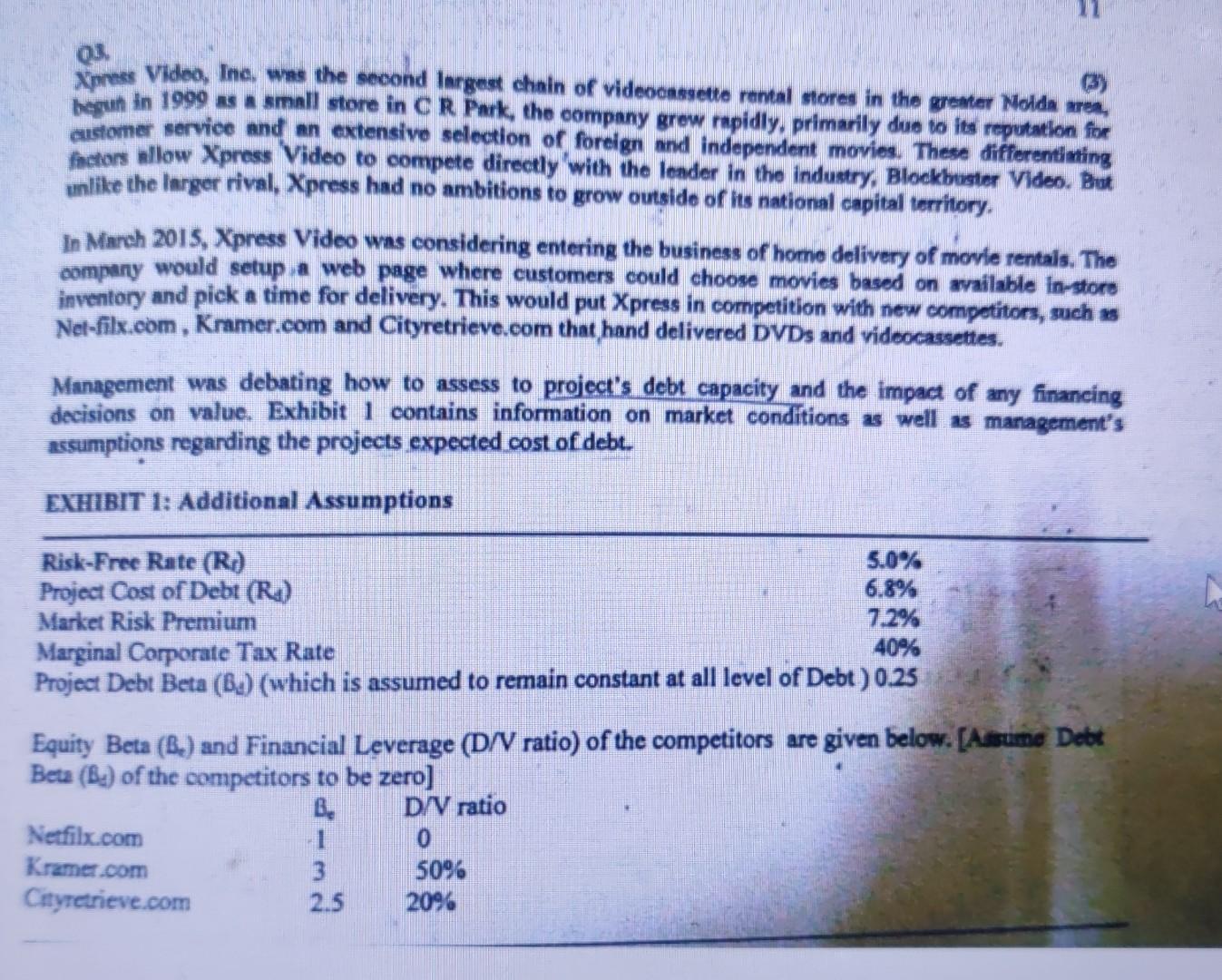

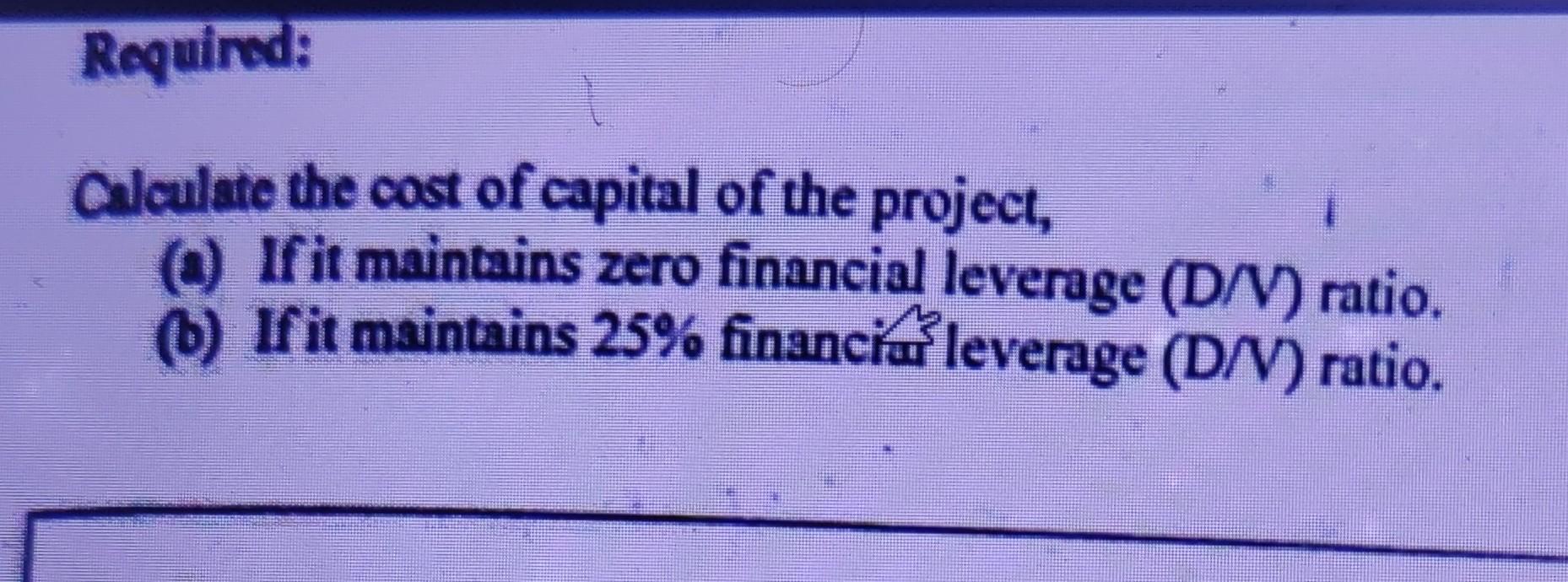

Q Xpress Video, Inc. was the second largest chain of videocassetto rental stores in the greater Noida wron, begun in 1999 us a small store in CR Park, the company grew rapidly, primarily due to its reputation for customer service and an extensivo selection of foreign and independent movies. These differentiating factors allow Xpress Video to compete directly with the londer in the industry, Blockbuster Viden. But unlike the larger rival, Xpress had no ambitions to grow outside of its national capital territory. In March 2015, Xpress Video was considering entering the business of home delivery of movie rentals. The company would setup a web page where customers could choose movies based on available in-store inventory and pick a time for delivery. This would put Xpress in competition with new competitors, such as Nel-filx.com, Kramer.com and Cityretrieve.com that hand delivered DVDs and videocassettes. Management was debating how to assess to project's debt capacity and the impact of any financing decisions on value. Exhibit 1 contains information on market conditions as well as management's assumptions regarding the projects expected cost of debt. EXHIBIT 1: Additional Assumptions Risk-Free Rate (R) 5.0% Project Cost of Debt (R) 6.8% Market Risk Premium 7.2% Marginal Corporate Tax Rate 40% Project Debt Beta (Bu) (which is assumed to remain constant at all level of Debt) 0.25 Equity Beta (B.) and Financial Leverage (D/V ratio) of the competitors are given below. [Abrune Debt Beta (B.) of the competitors to be zero] . D/V ratio Netfilx.com Kramer.com 3 5096 Cityretrieve.com 2.5 2096 0 Required: Calculate the cost of capital of the project, If it maintains zero financial leverage (D/V) ratio. 6) If it maintains 25% financia leverage (D/V) ratio. Q Xpress Video, Inc. was the second largest chain of videocassetto rental stores in the greater Noida wron, begun in 1999 us a small store in CR Park, the company grew rapidly, primarily due to its reputation for customer service and an extensivo selection of foreign and independent movies. These differentiating factors allow Xpress Video to compete directly with the londer in the industry, Blockbuster Viden. But unlike the larger rival, Xpress had no ambitions to grow outside of its national capital territory. In March 2015, Xpress Video was considering entering the business of home delivery of movie rentals. The company would setup a web page where customers could choose movies based on available in-store inventory and pick a time for delivery. This would put Xpress in competition with new competitors, such as Nel-filx.com, Kramer.com and Cityretrieve.com that hand delivered DVDs and videocassettes. Management was debating how to assess to project's debt capacity and the impact of any financing decisions on value. Exhibit 1 contains information on market conditions as well as management's assumptions regarding the projects expected cost of debt. EXHIBIT 1: Additional Assumptions Risk-Free Rate (R) 5.0% Project Cost of Debt (R) 6.8% Market Risk Premium 7.2% Marginal Corporate Tax Rate 40% Project Debt Beta (Bu) (which is assumed to remain constant at all level of Debt) 0.25 Equity Beta (B.) and Financial Leverage (D/V ratio) of the competitors are given below. [Abrune Debt Beta (B.) of the competitors to be zero] . D/V ratio Netfilx.com Kramer.com 3 5096 Cityretrieve.com 2.5 2096 0 Required: Calculate the cost of capital of the project, If it maintains zero financial leverage (D/V) ratio. 6) If it maintains 25% financia leverage (D/V) ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts