Question: Please show how to DO IT. Thank you ! :) Annuities and compounding Personal Finance Problem Janet Boyle intends to deposit $360 per year in

Please show how to DO IT. Thank you ! :)

Please show how to DO IT. Thank you ! :)

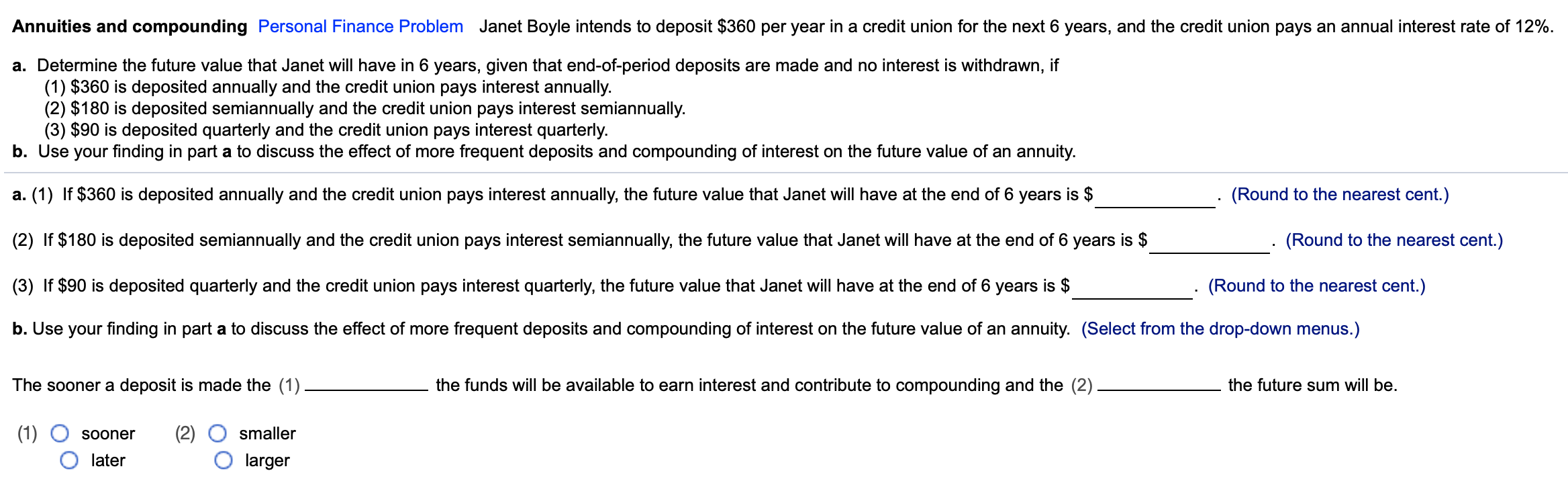

Annuities and compounding Personal Finance Problem Janet Boyle intends to deposit $360 per year in a credit union for the next 6 years, and the credit union pays an annual interest rate of 12%. a. Determine the future value that Janet will have in 6 years, given that end-of-period deposits are made and no interest is withdrawn, if (1) $360 is deposited annually and the credit union pays interest annually. (2) $180 is deposited semiannually and the credit union pays interest semiannually. (3) $90 is deposited quarterly and the credit union pays interest quarterly. b. Use your finding in part a to discuss the effect of more frequent deposits and compounding of interest on the future value of an annuity. a. (1) If $360 is deposited annually and the credit union pays interest annually, the future value that Janet will have at the end of 6 years is $ (Round to the nearest cent.) (2) If $180 is deposited semiannually and the credit union pays interest semiannually, the future value that Janet will have at the end of 6 years is $ (Round to the nearest cent.) (3) If $90 is deposited quarterly and the credit union pays interest quarterly, the future value that Janet will have at the end of 6 years is $ (Round to the nearest cent.) b. Use your finding in part a to discuss the effect of more frequent deposits and compounding of interest on the future value of an annuity. (Select from the drop-down menus.) The sooner a deposit is made the (1) the funds will be available to earn interest and contribute to compounding and the (2) the future sum will be. (1) sooner (2) smaller larger later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts