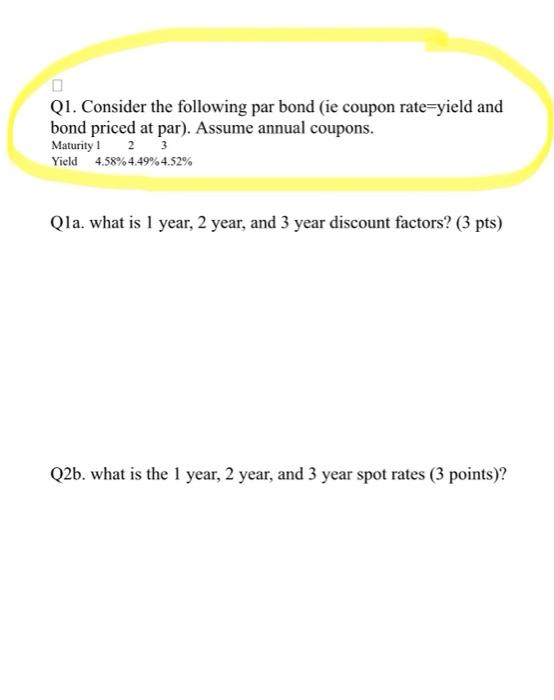

Question: answer Q2B only! based on Q1 on the top Q1. Consider the following par bond (ie coupon rate=yield and bond priced at par). Assume annual

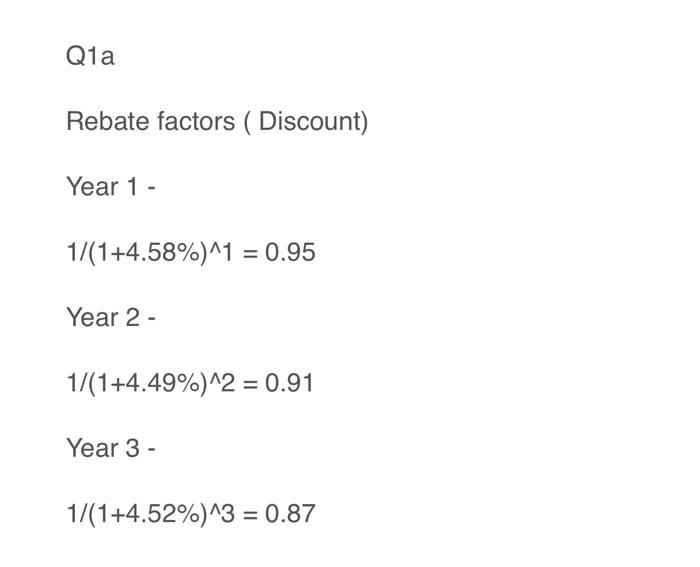

Q1. Consider the following par bond (ie coupon rate=yield and bond priced at par). Assume annual coupons. Maturity 122 Yield 4.58%4.49%4.52% Qla. what is 1 year, 2 year, and 3 year discount factors? 3 pts) Q2b. what is the 1 year, 2 year, and 3 year spot rates ( 3 points)? Q1a Rebate factors ( Discount) Year 1 - 1/(1+4.58%)1=0.95 Year 2 - 1/(1+4.49%)2=0.91 Year 3 - 1/(1+4.52%)3=0.87

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts