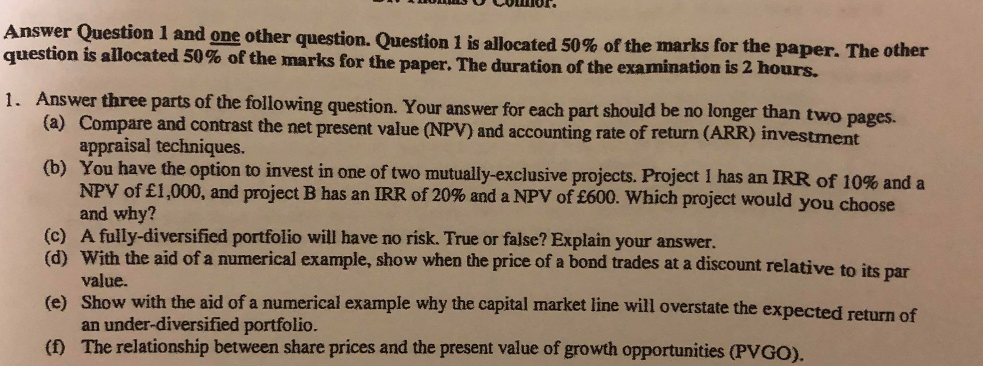

Question: Answer Question 1 and one other question. Question 1 is allocated 50 question is allocated 50% of the marks for the paper. The duration of

Answer Question 1 and one other question. Question 1 is allocated 50 question is allocated 50% of the marks for the paper. The duration of the examination is 2 % of the marks for the paper. The other hours. Answer three parts of the following question. Your answer for each part should be no longer th (a) 1. Compare and contrast the net present value (NPV) and accounting rate of return (ARR) investment appraisal techniques. (b) You have the option to invest in one of two mutually exclusive projects. Project l has an IRR of 10% and a NPV of 1,000, and project B has an IRR of 20% and a NPV of 600. Which project would you choose and why? A fully-diversified portfolio will have no risk. True or false? Explain your answer (c) (d) With the aid of a mumerical example, show when the price of a bond trades at a discount relative to its (e) Show with the aid of a numerical example why the capital market line will overstate the expected return of (1) The relationship between share prices and the present value of growth opportunities (PVGO). value. par an under-diversified portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts