Question: Answer question 1 to 4 1:44 Search U Problem Set #6.pdf ... ECN 410: Topics in Financial Economics Jet Kubik Spring 2021 Problem Set WG

Answer question 1 to 4

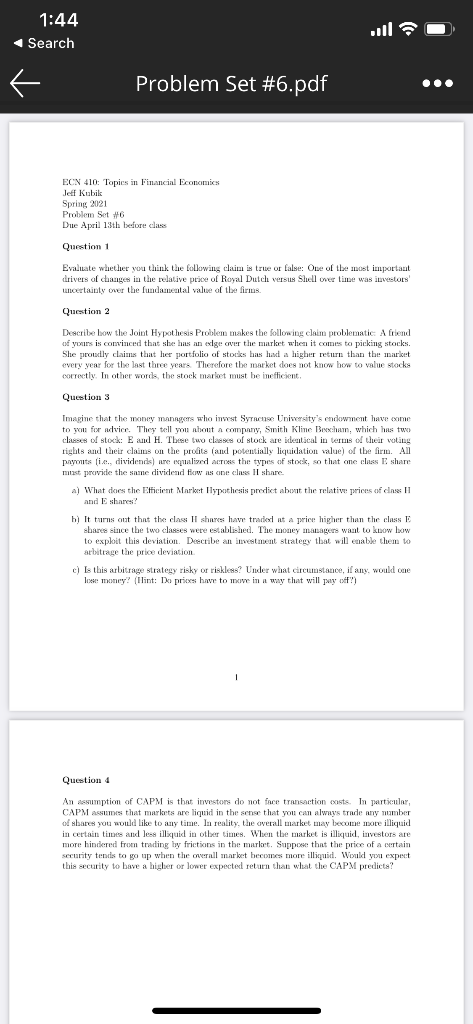

1:44 Search U Problem Set #6.pdf ... ECN 410: Topics in Financial Economics Jet Kubik Spring 2021 Problem Set WG Due April 13th before class Question 1 Evaluate whether you think the following claim is true or false: One of the most important drivers of changes in the relative price of Royal Dutch versus Shell over time was investors uncertainty over the fundamental value of the firs Question 2 Describe how the Joint Hypothesis Problem makes the following claim problematic A friend of yours is convinced that she has an exige over the market when it comes to picking stocks. She proudly claims that her portfolio of stocks has had a higher return than the market every year for the last three years. Therefore the market does not know how to value stocks correctly. In other words, the stock market must be inefficient Question 3 Imagine that the money managers who invest Syracuse University's endowment have come to you for advice. They tell you about a company, Smith Kline Bescham, which has two classes of stock: E and H. These two cases of stock are identical in terms of their voting rights and their claius on the prodit and potentially liquidation value) of the firm. All payouts (ie., dividends) are equalized as the types of stock, so that one class E share must purcvide the same dividend fill is ce clues I share A) What does the Efficient Market Hypothesis predict about the relative prices of class 11 and share! h) It turns out that the class I shares have traried at a price higher than the class E sbares since the two clases were established. The money managers want to know how to exploit this deviation. Describe an investment strategy that will enable them to arbitrage the price deviation c) Is this arbitrage strategy risky or riskless? Under what circumstance, if any, would one Toe money? (llint: De prices have to move in a way that will pay off?) 1 Question 4 An assumption of CAPM is that investors do not face transaction exists. In particular, CAPM assumes that markets are liquid in the sense that you can always trade any number of shares you would like to any time. In reality, the averall market may become more illiquid in certain times and les illiquid in other times. When the market is illiquid, investors are more hindered from trading by frictions in the market. Suppose that the price of a certain security tends to go up when the wall market becomes more illiquid. Would you expect this security to bave a higher or lower expected return than what the CAPM predicta? 1:44 Search U Problem Set #6.pdf ... ECN 410: Topics in Financial Economics Jet Kubik Spring 2021 Problem Set WG Due April 13th before class Question 1 Evaluate whether you think the following claim is true or false: One of the most important drivers of changes in the relative price of Royal Dutch versus Shell over time was investors uncertainty over the fundamental value of the firs Question 2 Describe how the Joint Hypothesis Problem makes the following claim problematic A friend of yours is convinced that she has an exige over the market when it comes to picking stocks. She proudly claims that her portfolio of stocks has had a higher return than the market every year for the last three years. Therefore the market does not know how to value stocks correctly. In other words, the stock market must be inefficient Question 3 Imagine that the money managers who invest Syracuse University's endowment have come to you for advice. They tell you about a company, Smith Kline Bescham, which has two classes of stock: E and H. These two cases of stock are identical in terms of their voting rights and their claius on the prodit and potentially liquidation value) of the firm. All payouts (ie., dividends) are equalized as the types of stock, so that one class E share must purcvide the same dividend fill is ce clues I share A) What does the Efficient Market Hypothesis predict about the relative prices of class 11 and share! h) It turns out that the class I shares have traried at a price higher than the class E sbares since the two clases were established. The money managers want to know how to exploit this deviation. Describe an investment strategy that will enable them to arbitrage the price deviation c) Is this arbitrage strategy risky or riskless? Under what circumstance, if any, would one Toe money? (llint: De prices have to move in a way that will pay off?) 1 Question 4 An assumption of CAPM is that investors do not face transaction exists. In particular, CAPM assumes that markets are liquid in the sense that you can always trade any number of shares you would like to any time. In reality, the averall market may become more illiquid in certain times and les illiquid in other times. When the market is illiquid, investors are more hindered from trading by frictions in the market. Suppose that the price of a certain security tends to go up when the wall market becomes more illiquid. Would you expect this security to bave a higher or lower expected return than what the CAPM predicta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts