Question: Answer question 12 and 13 using the following income statement and balance sheet. Intermediate Finance-Exam 1 Q Search in Document Home Insert Design Layout References

Answer question 12 and 13 using the following income statement and balance sheet.

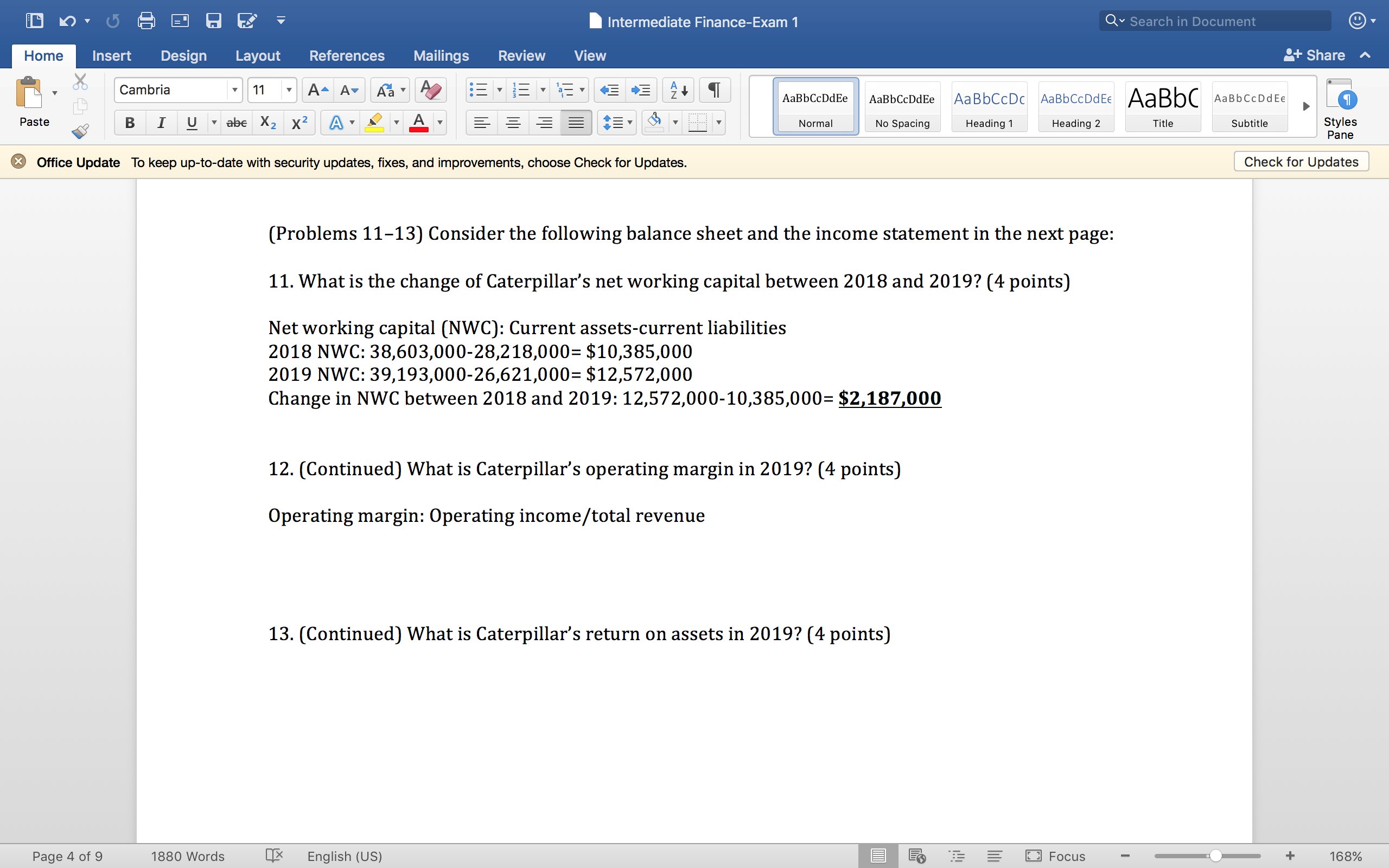

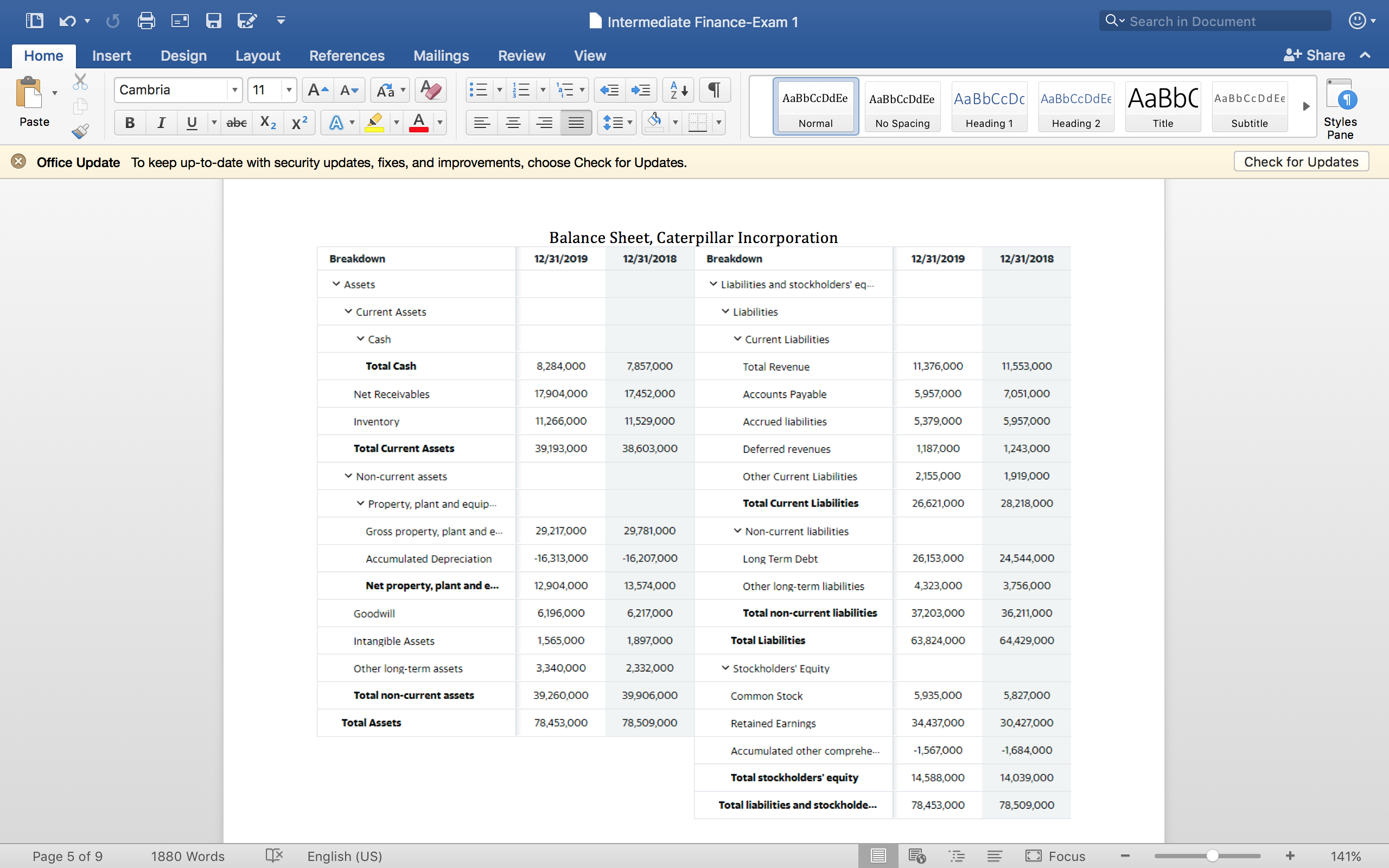

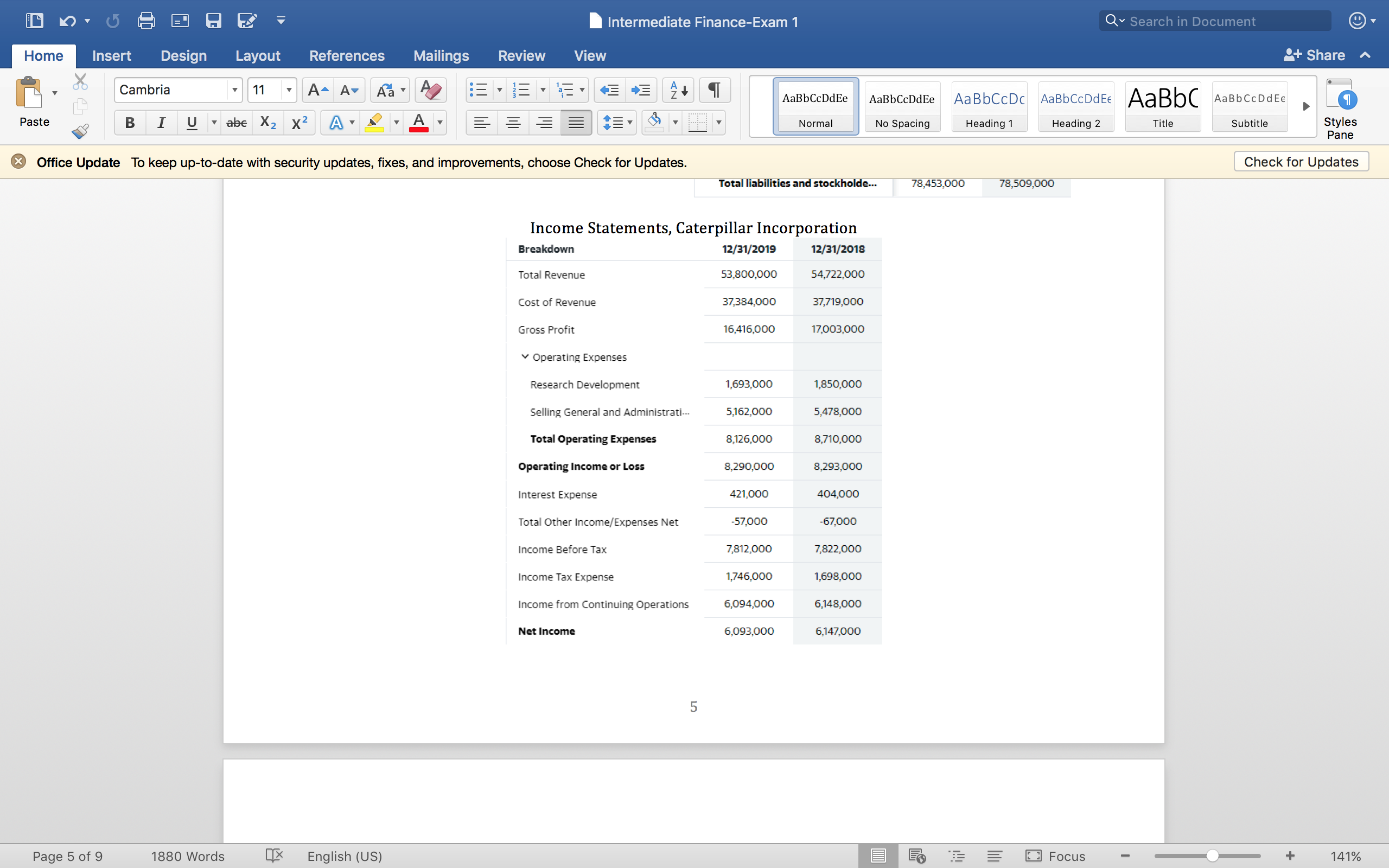

Intermediate Finance-Exam 1 Q Search in Document Home Insert Design Layout References Mailings Review View '+ Share Cambria 11 A A Aa A AaBbCcDdEe AaBbCcDdEe AaBbCcDc AaBbCcDdEE AaBbC AaBbCcDdEE Paste BI U abe X2 X2 A & A Normal No Spacing Heading 1 Heading 2 Title Subtitle Styles Pane x Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates (Problems 11-13) Consider the following balance sheet and the income statement in the next page: 11. What is the change of Caterpillar's net working capital between 2018 and 2019? (4 points) Net working capital (NWC): Current assets-current liabilities 2018 NWC: 38,603,000-28,218,000= $10,385,000 2019 NWC: 39,193,000-26,621,000= $12,572,000 Change in NWC between 2018 and 2019: 12,572,000-10,385,000= $2,187,000 12. (Continued) What is Caterpillar's operating margin in 2019? (4 points) Operating margin: Operating income/total revenue 13. (Continued) What is Caterpillar's return on assets in 2019? (4 points) Page 4 of 9 1880 Words English (US) E Focus + 168%Intermediate Finance-Exam 1 Q Search in Document Home Insert Design Layout References Mailings Review View '+ Share Cambria 11 A A Aa A AaBbCcDdEe AaBbCcDdEe AaBbCcDc AaBbCcDdEE AaBbC AaBbCcDdEE BI U abe X2 X2 A & A Normal No Spacing Heading 1 Heading 2 Title Subtitle Styles Paste Pane x Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates Balance Sheet, Caterpillar Incorporation Breakdown 12/31/2019 12/31/2018 Breakdown 12/31/2019 12/31/2018 Assets Liabilities and stockholders' eq.. Current Assets Liabilities Cash Current Liabilities Total Cash 8,284,000 7,857,000 Total Revenue 11,376,000 11,553,000 Net Receivables 17,904,000 17,452,000 Accounts Payable 5,957,000 7,051,000 Inventory 11,266,000 11,529,000 Accrued liabilities 5,379,000 5,957,000 Total Current Assets 39,193,000 38,603,000 Deferred revenues 1,187,000 1,243,000 Non-current assets Other Current Liabilities 2,155,000 1,919,000 v Property, plant and equip-. Total Current Liabilities 26,621,000 28,218,000 Gross property, plant and e... 29,217,000 29,781,000 Non-current liabilities Accumulated Depreciation -16,313,000 -16,207,000 Long Term Debt 26,153,000 24,544,000 Net property, plant and e... 12,904,000 13,574,000 Other long-term liabilities 4,323,000 3,756,000 Goodwill 6,196,000 6,217,000 Total non-current liabilities 37,203,000 36,211,000 Intangible Assets 1,565,000 1,897,000 Total Liabilities 63,824,000 64,429,000 Other long-term assets 3,340,000 2,332,000 Stockholders' Equity Total non-current assets 39,260,000 39,906,000 Common Stock 5,935,000 5,827,000 Total Assets 78,453,000 78,509,000 Retained Earnings 34,437,000 30,427,000 Accumulated other comprehe 1,567,000 -1.684,000 Total stockholders' equity 14,588,000 14,039,000 Total liabilities and stockholde 78,453,000 78,509,000 + Page 5 of 9 1880 Words English (US) Focus 141%Intermediate Finance-Exam 1 Q Search in Document Home Insert Design Layout References Mailings Review View '+ Share Cambria 11 A A Aa A AaBbCcDdEe AaBbCcDdEe AaBbCcDc AaBbCcDdEE AaBbC AaBbCcDdEE Paste BI U abe X2 X2 AL. A Normal No Spacing Heading 1 Heading 2 Title Subtitle Styles Pane x Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates Total liabilities and stockholde 78,453,000 78,509,000 Income Statements, Caterpillar Incorporation Breakdown 12/31/2019 12/31/2018 Total Revenue 53,800,000 54,722,000 Cost of Revenue 37,384,000 37,719,000 Gross Profit 16,416,000 17,003,000 v Operating Expenses Research Development 1,693,000 1,850,000 Selling General and Administrati-.. 5,162,000 5,478,000 Total Operating Expenses 8,126,000 8,710,000 Operating Income or Loss 8,290,000 8,293,000 Interest Expense 421,000 404,000 Total Other Income/Expenses Net 57,000 67,000 Income Before Tax 7,812,000 7,822,000 Income Tax Expense 1,746,000 1,698,000 Income from Continuing Operations 6,094,000 6,148,000 Net Income 6,093,000 6,147,000 5 1880 Words English (US) E Focus + 141% Page 5 of 9