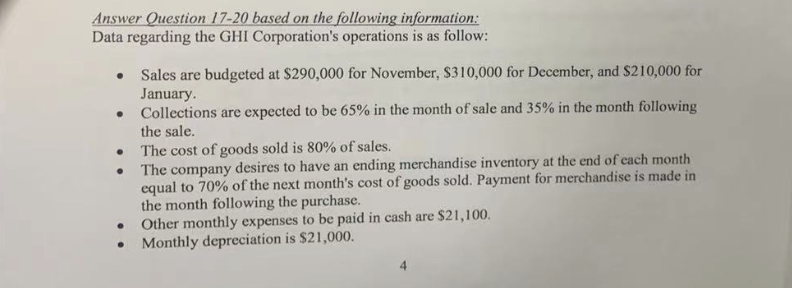

Question: Answer Question 17-20 based on the following information: Data regarding the GHI Corporation's operations is as follow: . Sales are budgeted at $290,000 for November,

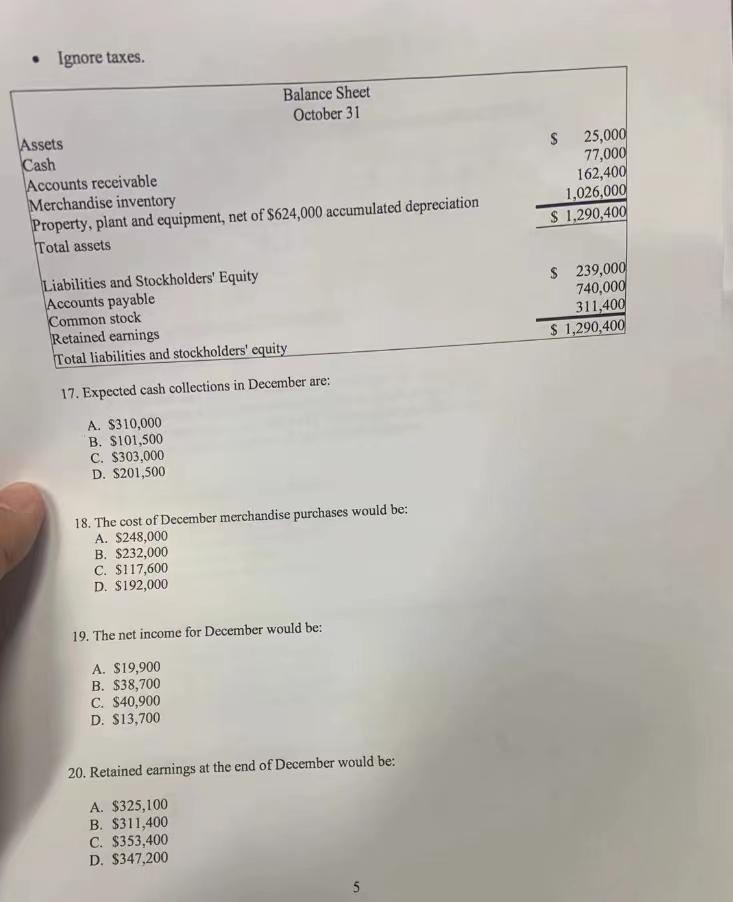

Answer Question 17-20 based on the following information: Data regarding the GHI Corporation's operations is as follow: . Sales are budgeted at $290,000 for November, $310,000 for December, and $210,000 for January. Collections are expected to be 65% in the month of sale and 35% in the month following the sale. The cost of goods sold is 80% of sales. The company desires to have an ending merchandise inventory at the end of each month equal to 70% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $21,100. Monthly depreciation is $21,000. . . Ignore taxes. Balance Sheet October 31 Assets Cash Accounts receivable Merchandise inventory Property, plant and equipment, net of $624,000 accumulated depreciation Total assets $ 25,000 77,000 162,400 1,026,000 $ 1,290,400 Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity $ 239,000 740,000 311,400 $ 1,290,400 17. Expected cash collections in December are: A. $310,000 B. $101,500 C. $303,000 D. S201,500 18. The cost of December merchandise purchases would be: A. $248,000 B. $232,000 C. $117,600 D. $192,000 19. The net income for December would be: A. $19,900 B. $38,700 C. $40,900 D. $13,700 20. Retained earnings at the end of December would be: A. $325,100 B. $311,400 C. $353,400 D. $347,200 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts