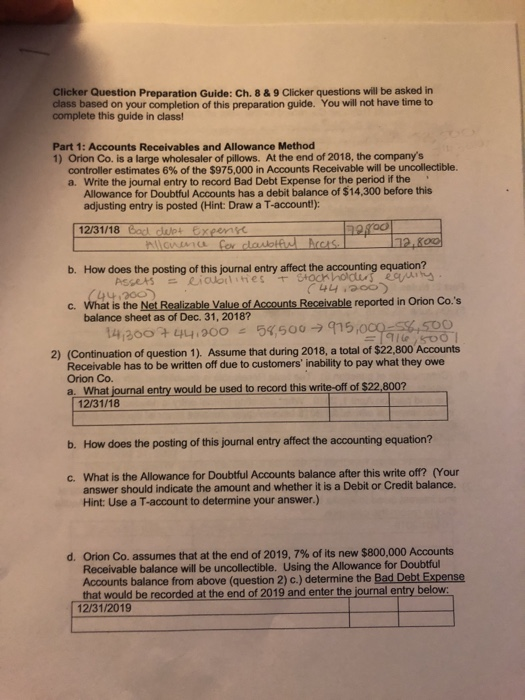

Question: Answer question 2 a-d please! Question one is just there for reference :) Clicker Question Preparation Guide: Ch. 8 &9 Clicker questions will be asked

Clicker Question Preparation Guide: Ch. 8 &9 Clicker questions will be asked in dlass based on your completion of this preparation guide. complete this guide in class You will not have time to Part 1: Accounts Receivables and Allowance Method 1) Orion Co. is a large wholesaler of pillows. At the end of 2018, the company's controller estimates 6% of the $975,000 in Accounts Receivable will be uncollectible. a. Write the journal entry to record Bad Debt Expense for the period if the Allowance for Doubtful Accounts has a debit balance of $14,300 before this adjusting entry is posted (Hint: Draw a T-accountl): 12/31/18 Bad cluot Exeems b. How does the posting of this journal entry affect the accounting equation? c. What is the Net Realizable Value of Accounts Receivable reported in Orion Co.'s balance sheet as of Dec. 31, 2018? 14,300-t 44:00 54500-) q15 2) (Continuation of question 1). Assume that during 2018, a total of $22,800 Accounts Receivable has to be written off due to customers' inability to pay what they owe Orion Co. a. What journal entry would be used to record this write-off of $22,800? 12/31/18 b. How does the posting of this journal entry affect the accounting equation? What is the Allowance for Doubtful Accounts balance after this write off? answer should indicate the amount and whether it is a Debit or Credit balance. Hint: Use a T-account to determine your answer.) (Your c. Orion Co. assumes that at the end of 2019, 7% of its new $800,000 Accounts Receivable balance will be uncollectible. Using the Allowance for Doubtful Accounts balance from above (question 2) c.) determine the Bad Debt Expense that would be recorded at the end of 2019 and enter the journal entry below 12/31/2019 d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts