Question: Answer Question 2 to 4 using the following information. Stanley Corp. paid a dividend of $3.00 in the year that just ended. Analysts expect that

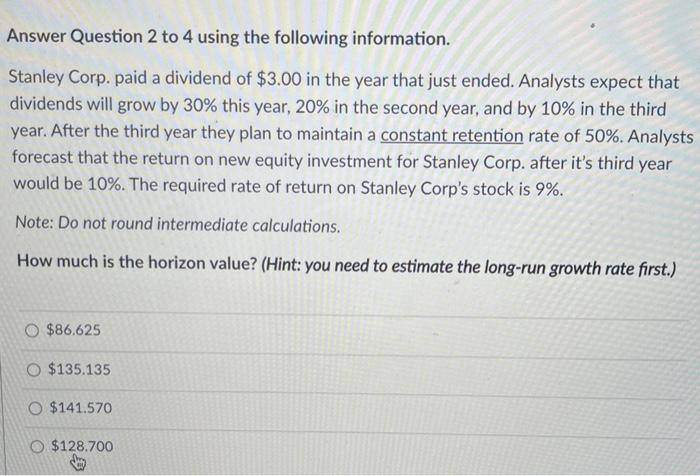

Answer Question 2 to 4 using the following information. Stanley Corp. paid a dividend of $3.00 in the year that just ended. Analysts expect that dividends will grow by 30% this year, 20% in the second year, and by 10% in the third year. After the third year they plan to maintain a constant retention rate of 50%. Analysts forecast that the return on new equity investment for Stanley Corp. after it's third year would be 10%. The required rate of return on Stanley Corp's stock is 9%. Note: Do not round intermediate calculations. How much is the horizon value? (Hint: you need to estimate the long-run growth rate first.) $86,625 O $135.135 O $141.570 O $128.700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts