Question: *Either handwriting or computerise. *Answer all question. Thank you. Just answer question that you're able to answer. Question 1 (25 Marks) A. The following information

*Either handwriting or computerise. *Answer all question. Thank you.

Just answer question that you're able to answer.

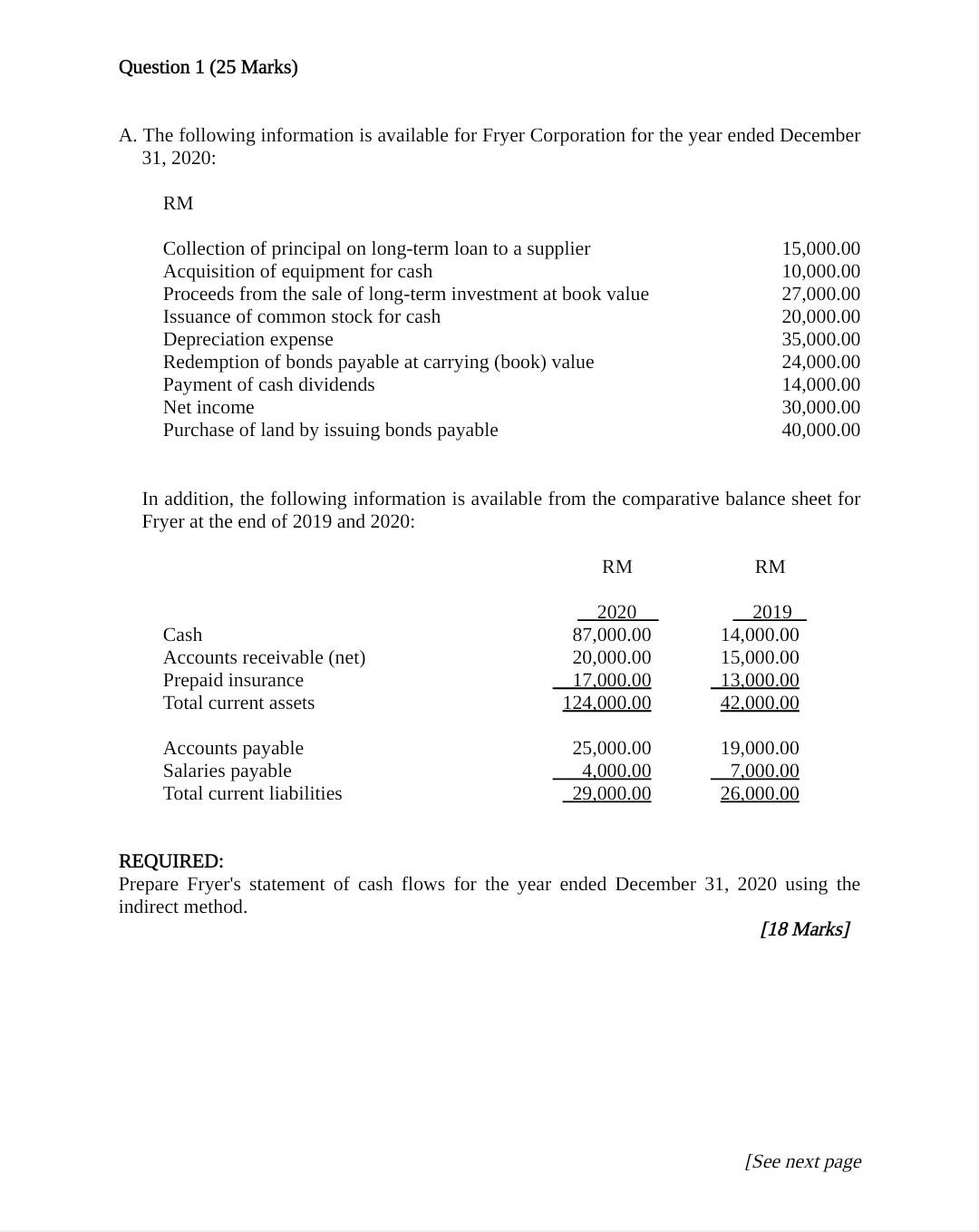

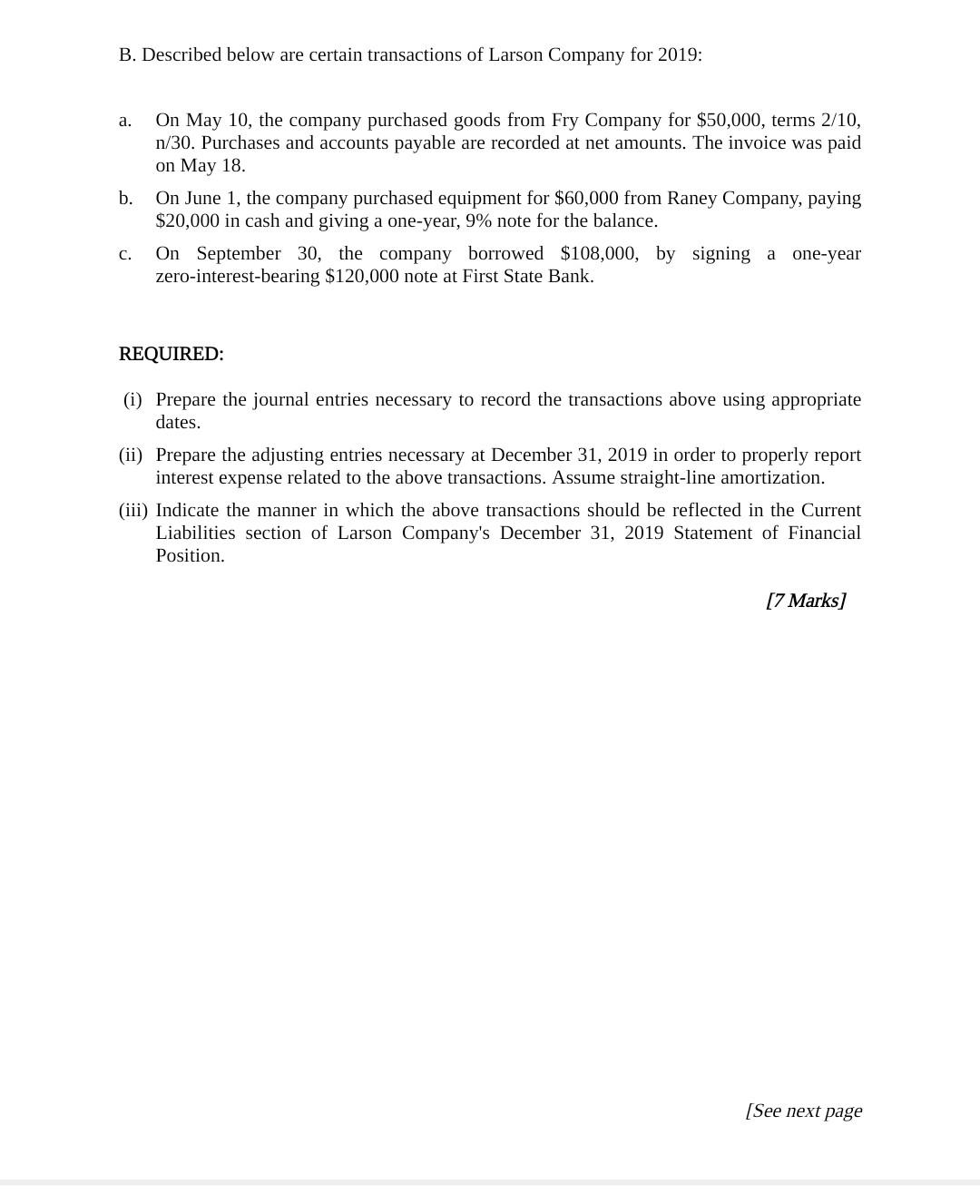

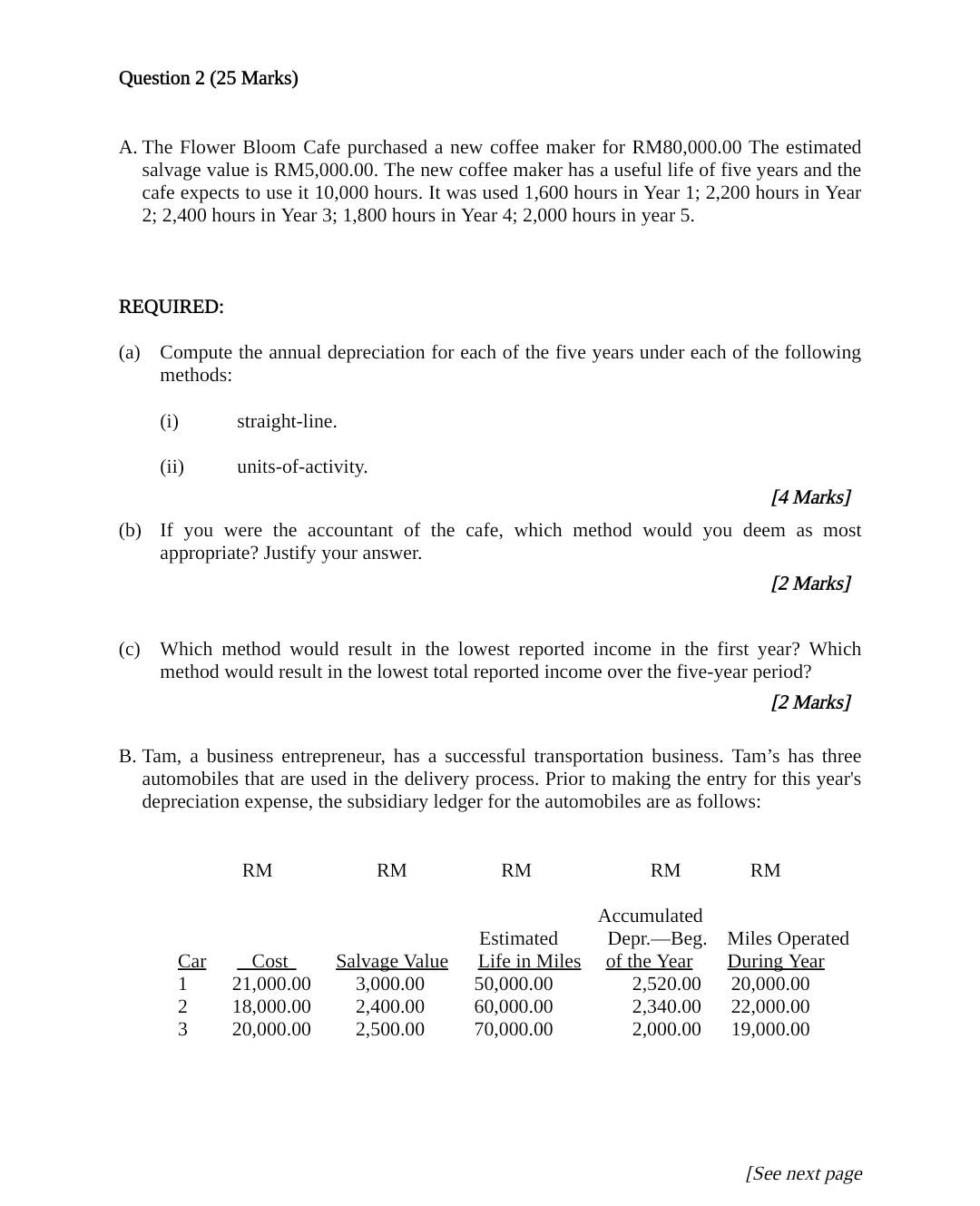

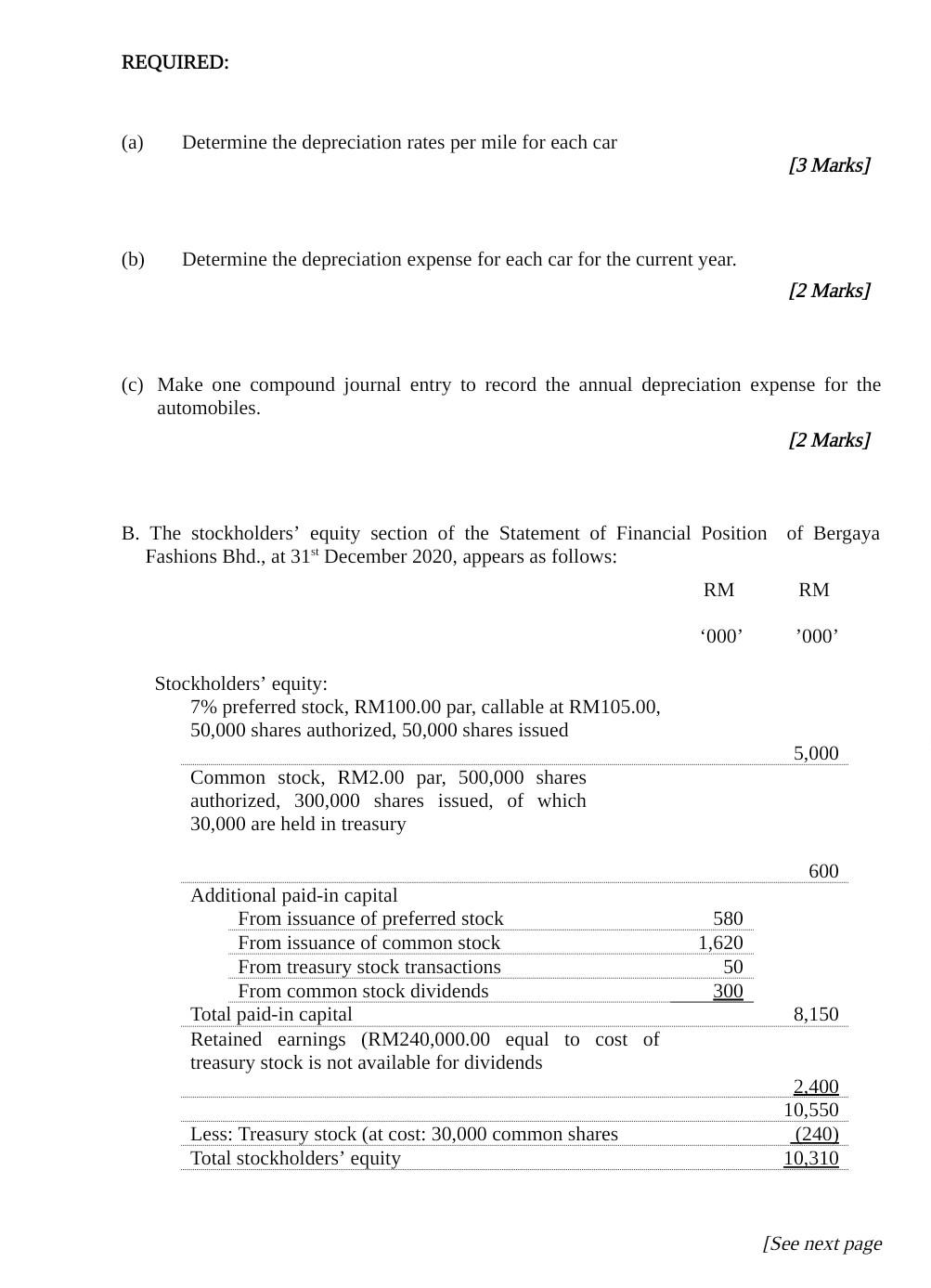

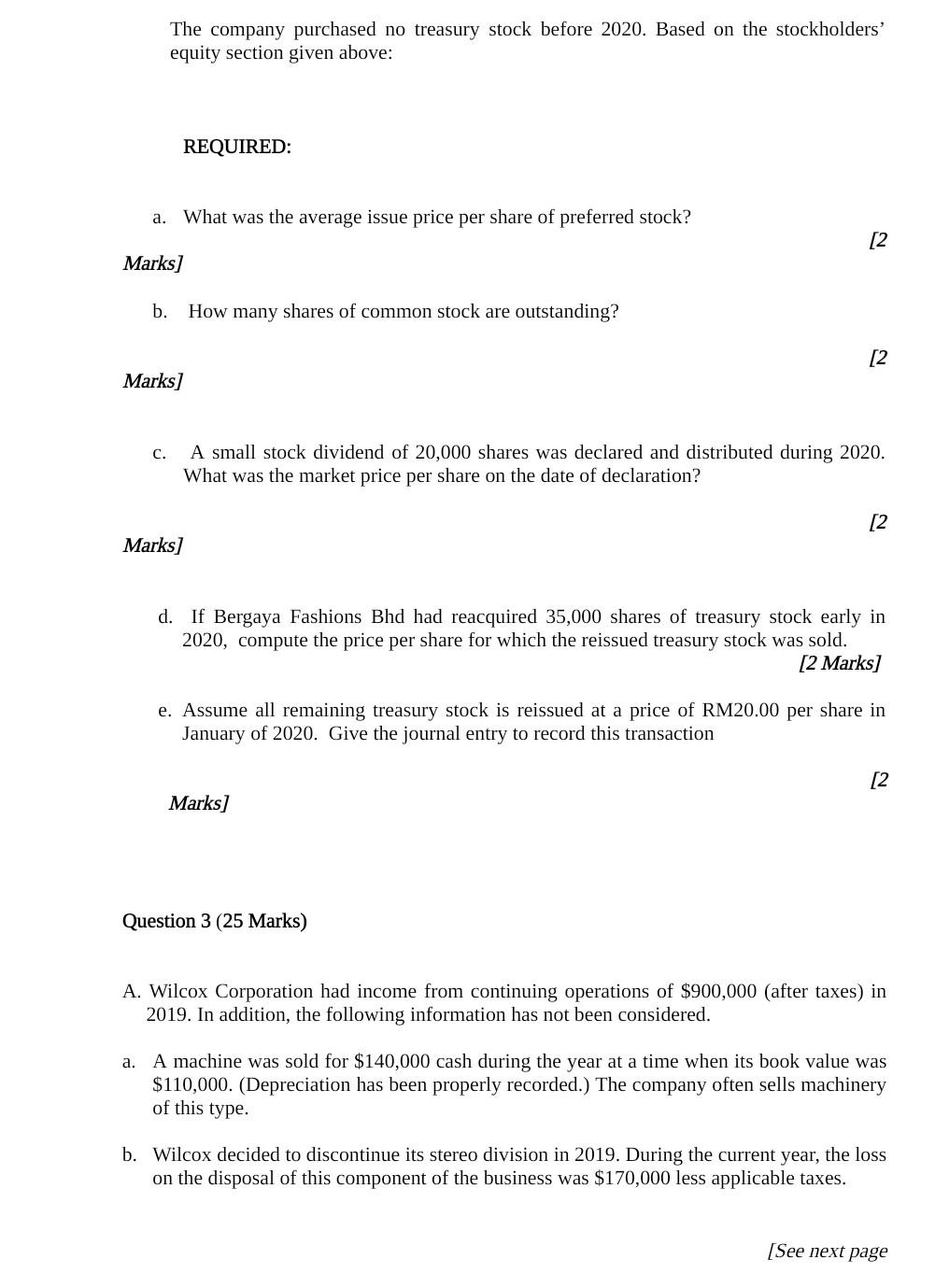

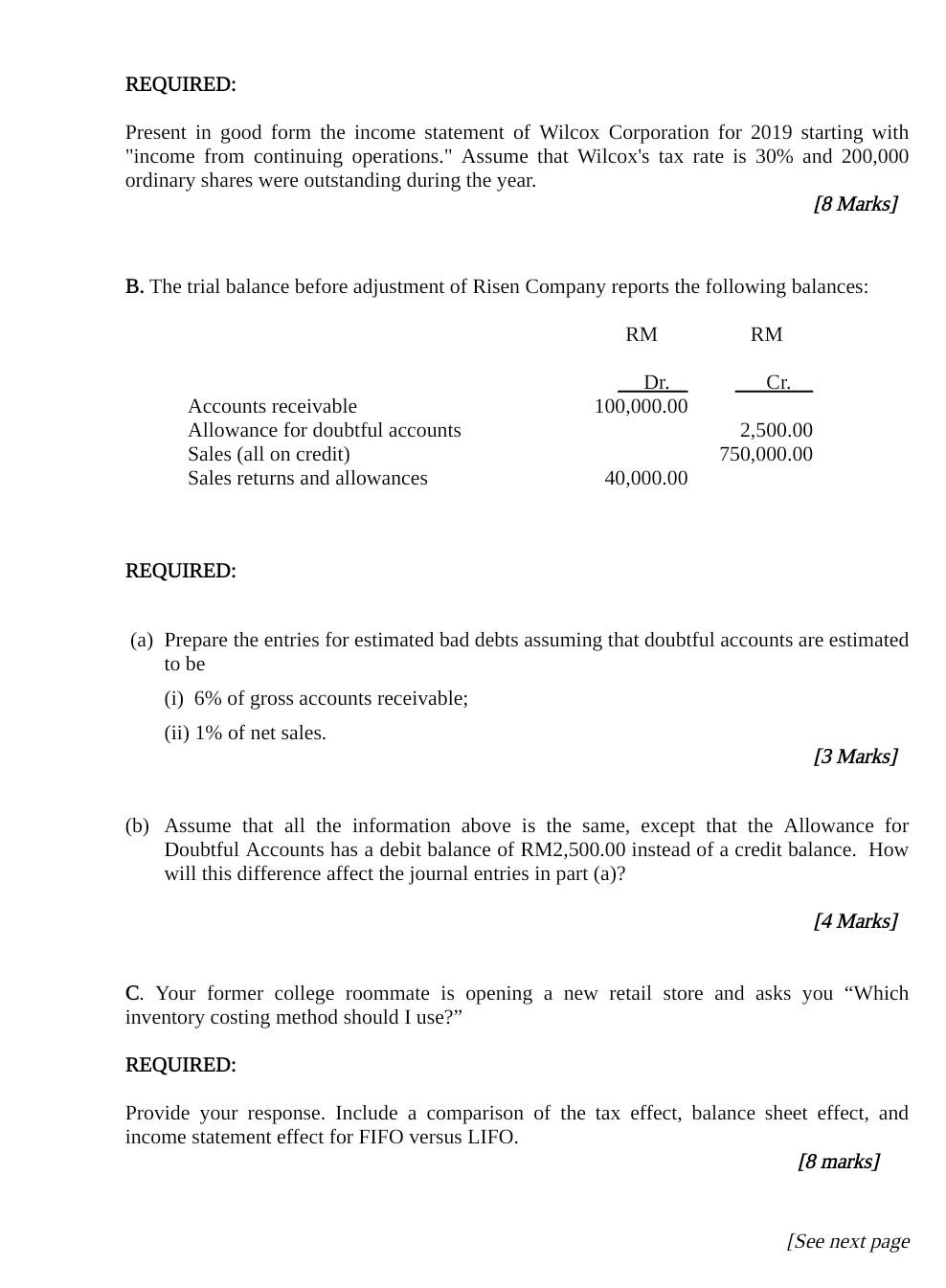

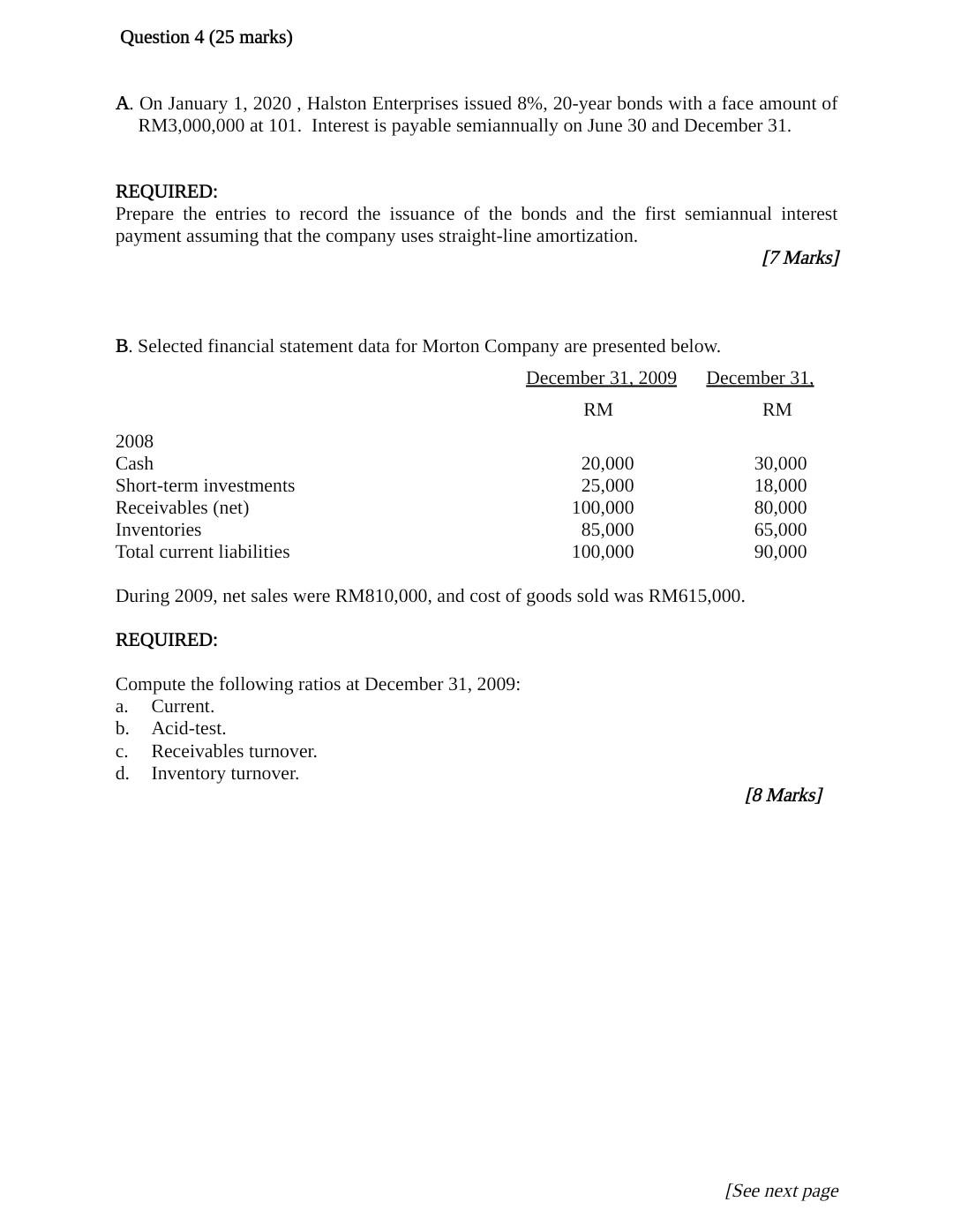

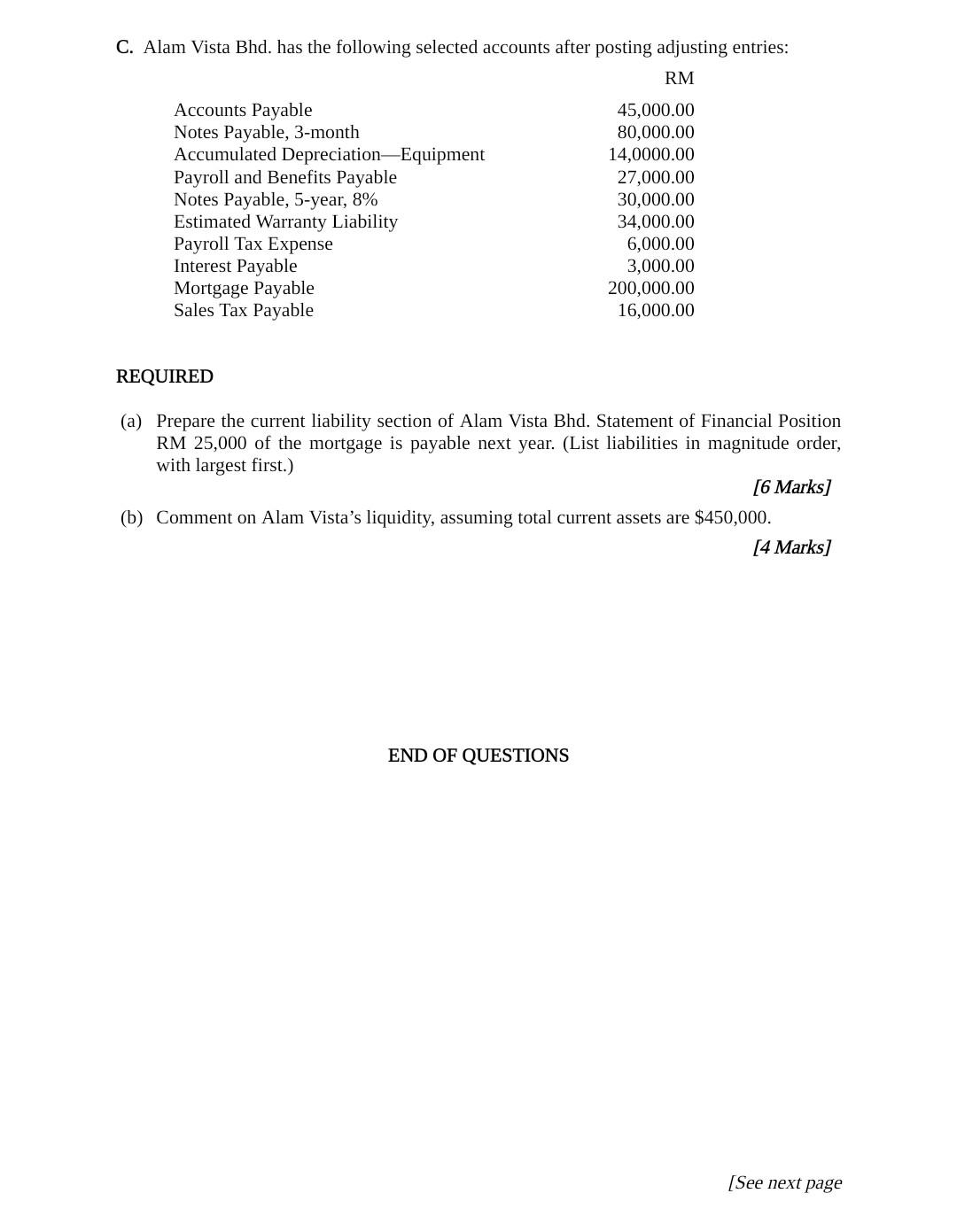

Question 1 (25 Marks) A. The following information is available for Fryer Corporation for the year ended December 31, 2020: RM Collection of principal on long-term loan to a supplier Acquisition of equipment for cash Proceeds from the sale of long-term investment at book value Issuance of common stock for cash Depreciation expense Redemption of bonds payable at carrying (book) value Payment of cash dividends Net income Purchase of land by issuing bonds payable 15,000.00 10,000.00 27,000.00 20,000.00 35,000.00 24,000.00 14,000.00 30,000.00 40,000.00 In addition, the following information is available from the comparative balance sheet for Fryer at the end of 2019 and 2020: RM RM Cash Accounts receivable (net) Prepaid insurance Total current assets 2020 87,000.00 20,000.00 17,000.00 124,000.00 2019 14,000.00 15,000.00 13,000.00 42,000.00 Accounts payable Salaries payable Total current liabilities 25,000.00 4,000.00 9,000.00 19,000.00 7,000.00 26,000.00 REQUIRED: Prepare Fryer's statement of cash flows for the year ended December 31, 2020 using the indirect method. (18 Marks) [See next page B. Described below are certain transactions of Larson Company for 2019: a. b. On May 10, the company purchased goods from Fry Company for $50,000, terms 2/10, n/30. Purchases and accounts payable are recorded at net amounts. The invoice was paid on May 18. On June 1, the company purchased equipment for $60,000 from Raney Company, paying $20,000 in cash and giving a one-year, 9% note for the balance. On September 30, the company borrowed $108,000, by signing a one-year zero-interest-bearing $120,000 note at First State Bank. C. REQUIRED: (i) Prepare the journal entries necessary to record the transactions above using appropriate dates. (ii) Prepare the adjusting entries necessary at December 31, 2019 in order to properly report interest expense related to the above transactions. Assume straight-line amortization. (iii) Indicate the manner in which the above transactions should be reflected in the Current Liabilities section of Larson Company's December 31, 2019 Statement of Financial Position. [7 Marks] [See next page Question 2 (25 Marks) A. The Flower Bloom Cafe purchased a new coffee maker for RM80,000.00 The estimated salvage value is RM5,000.00. The new coffee maker has a useful life of five years and the cafe expects to use it 10,000 hours. It was used 1,600 hours in Year 1; 2,200 hours in Year 2; 2,400 hours in Year 3; 1,800 hours in Year 4; 2,000 hours in year 5. REQUIRED: (a) Compute the annual depreciation for each of the five years under each of the following methods: (i) straight-line. (ii) units-of-activity. [4 Marks] (b) If you were the accountant of the cafe, which method would you deem as most appropriate? Justify your answer. [2 Marks] (C) Which method would result in the lowest reported income in the first year? Which method would result in the lowest total reported income over the five-year period? [2 Marks] B. Tam, a business entrepreneur, has a successful transportation business. Tam's has three automobiles that are used in the delivery process. Prior to making the entry for this year's depreciation expense, the subsidiary ledger for the automobiles are as follows: RM RM RM RM RM Car 1 2 3 Cost 21,000.00 18,000.00 20,000.00 Salvage Value 3,000.00 2,400.00 2,500.00 Estimated Life in Miles 50,000.00 60,000.00 70,000.00 Accumulated Depr.Beg. Miles Operated of the Year During Year 2.520.00 20,000.00 2,340.00 22,000.00 2,000.00 19,000.00 [See next page REQUIRED: (a) Determine the depreciation rates per mile for each car [3 Marks] (b) Determine the depreciation expense for each car for the current year. [2 Marks] (c) Make one compound journal entry to record the annual depreciation expense for the automobiles. [2 Marks] B. The stockholders' equity section of the Statement of Financial Position of Bergaya Fashions Bhd., at 31 December 2020, appears as follows: RM RM "000 '000' Stockholders' equity: 7% preferred stock, RM100.00 par, callable at RM105.00, 50,000 shares authorized, 50,000 shares issued 5,000 Common stock, RM2.00 par, 500,000 shares authorized, 300,000 shares issued, of which 30,000 are held in treasury 600 Additional paid-in capital From issuance of preferred stock From issuance of common stock From treasury stock transactions From common stock dividends Total paid-in capital Retained earnings (RM240,000.00 equal to treasury stock is not available for dividends 580 1,620 50 300 8,150 cost of Less: Treasury stock (at cost: 30,000 common shares Total stockholders' equity 2.400 10,550 (240) 10,310 [See next page The company purchased no treasury stock before 2020. Based on the stockholders' equity section given above: REQUIRED: a. What was the average issue price per share of preferred stock? [2 Marks] b. How many shares of common stock are outstanding? [2 Marks] C. A small stock dividend of 20,000 shares was declared and distributed during 2020. What was the market price per share on the date of declaration? [2 Marks] d. If Bergaya Fashions Bhd had reacquired 35,000 shares of treasury stock early in 2020, compute the price per share for which the reissued treasury stock was sold. [2 Marks) e. Assume all remaining treasury stock is reissued at a price of RM20.00 per share in January of 2020. Give the journal entry to record this transaction [2 Marks] Question 3 (25 Marks) A. Wilcox Corporation had income from continuing operations of $900,000 (after taxes) in 2019. In addition, the following information has not been considered. a. A machine was sold for $140,000 cash during the year at a time when its book value was $110,000. (Depreciation has been properly recorded.) The company often sells machinery of this type. b. Wilcox decided to discontinue its stereo division in 2019. During the current year, the loss on the disposal of this component of the business was $170,000 less applicable taxes. [See next page REQUIRED: Present in good form the income statement of Wilcox Corporation for 2019 starting with "income from continuing operations." Assume that Wilcox's tax rate is 30% and 200,000 ordinary shares were outstanding during the year. [8 Marks] B. The trial balance before adjustment of Risen Company reports the following balances: RM RM Cr. Dr. 100,000.00 Accounts receivable Allowance for doubtful accounts Sales (all on credit) Sales returns and allowances 2,500.00 750,000.00 40,000.00 REQUIRED: (a) Prepare the entries for estimated bad debts assuming that doubtful accounts are estimated to be (i) 6% of gross accounts receivable; (ii) 1% of net sales. [3 Marks] (b) Assume that all the information above is the same, except that the Allowance for Doubtful Accounts has a debit balance of RM2,500.00 instead of a credit balance. How will this difference affect the journal entries in part (a)? [4 Marks] C. Your former college roommate is opening a new retail store and asks you "Which inventory costing method should I use? REQUIRED: Provide your response. Include a comparison of the tax effect, balance sheet effect, and income statement effect for FIFO versus LIFO. [8 marks] [See next page Question 4 (25 marks) A. On January 1, 2020, Halston Enterprises issued 8%, 20-year bonds with a face amount of RM3,000,000 at 101. Interest is payable semiannually on June 30 and December 31. REQUIRED: Prepare the entries to record the issuance of the bonds and the first semiannual interest payment assuming that the company uses straight-line amortization. [7 Marks] B. Selected financial statement data for Morton Company are presented below. December 31, 2009 December 31, RM RM 2008 Cash Short-term investments Receivables (net) Inventories Total current liabilities 20,000 25,000 100,000 85,000 100,000 30,000 18,000 80,000 65,000 90,000 During 2009, net sales were RM810,000, and cost of goods sold was RM615,000. REQUIRED: Compute the following ratios at December 31, 2009: a. Current. b. Acid-test. C. Receivables turnover. Inventory turnover. [8 Marks] [See next page C. Alam Vista Bhd. has the following selected accounts after posting adjusting entries: RM Accounts Payable Notes Payable, 3-month Accumulated Depreciation Equipment Payroll and Benefits Payable Notes Payable, 5-year, 8% Estimated Warranty Liability Payroll Tax Expense Interest Payable Mortgage Payable Sales Tax Payable 45,000.00 80,000.00 14,0000.00 27,000.00 30,000.00 34,000.00 6,000.00 3,000.00 200,000.00 16,000.00 REQUIRED (a) Prepare the current liability section of Alam Vista Bhd. Statement of Financial Position RM 25,000 of the mortgage is payable next year. (List liabilities in magnitude order, with largest first.) [6 Marks] (b) Comment on Alam Vista's liquidity, assuming total current assets are $450,000. [4 Marks] END OF QUESTIONS [See next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts