Question: answer question 2(A,B,C) 28 Assignment Scenario 2 Whitefield Plc is an organization that manufactures construction machine components. You are appointed as a trainee accountant in

answer question 2(A,B,C)

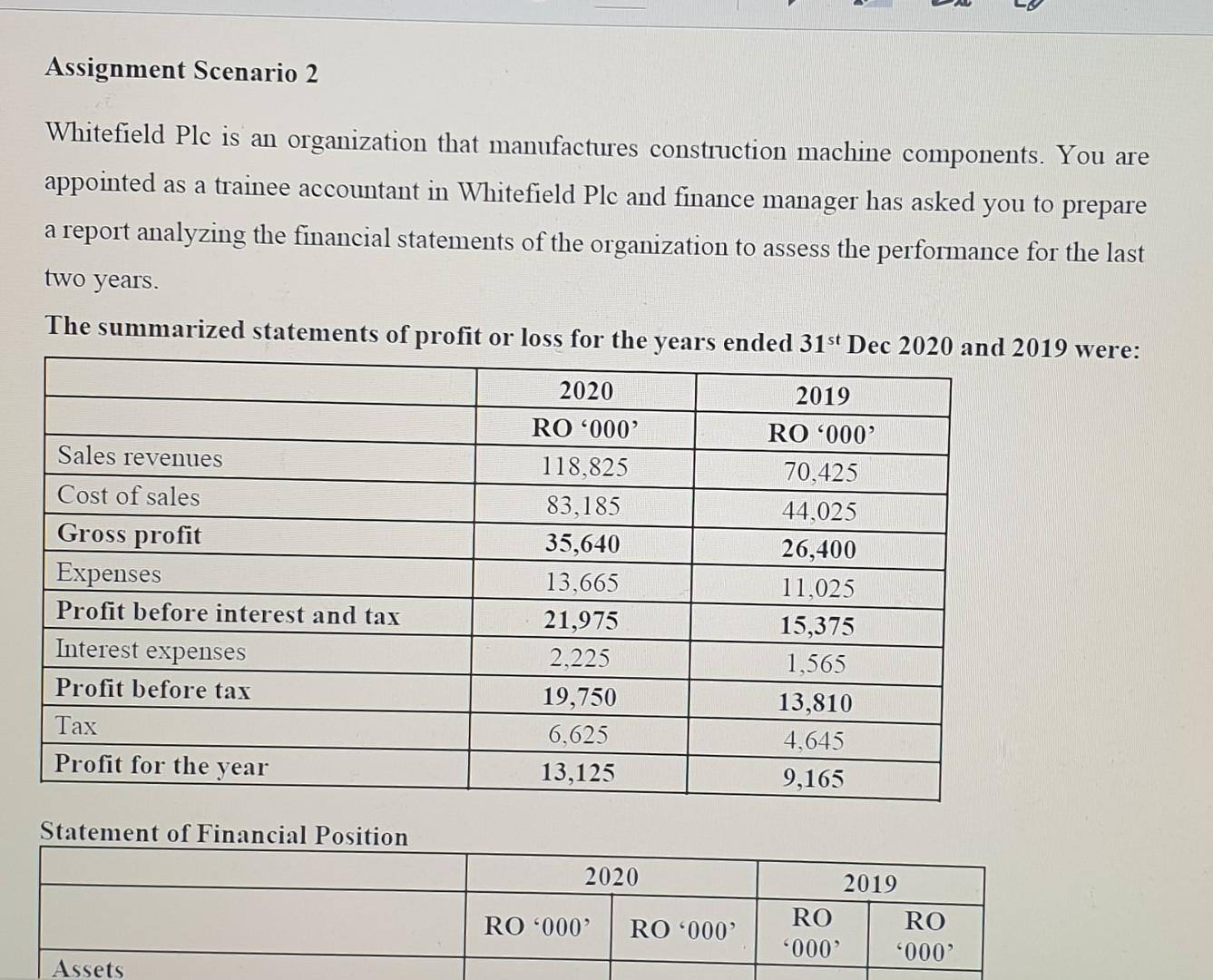

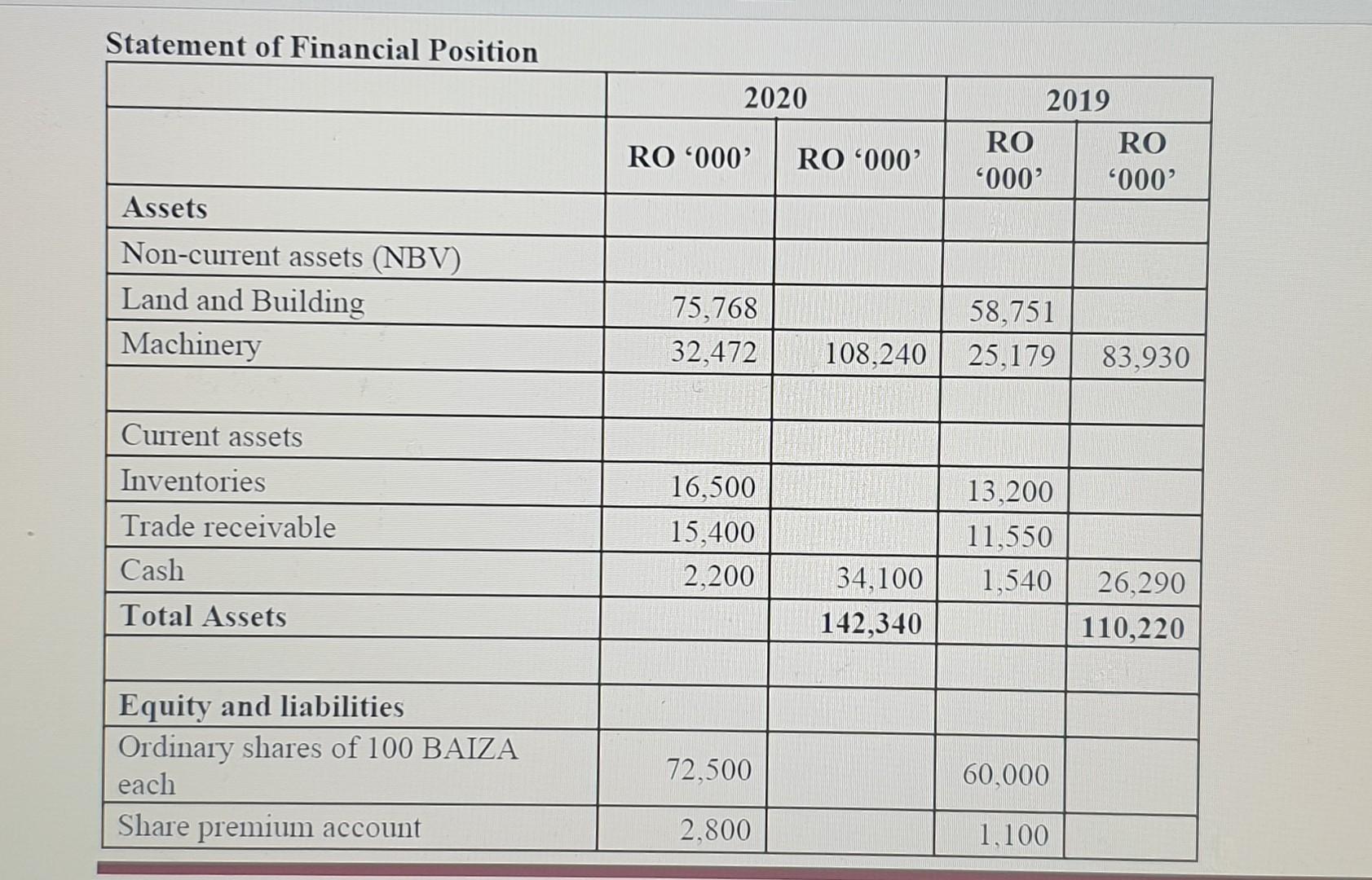

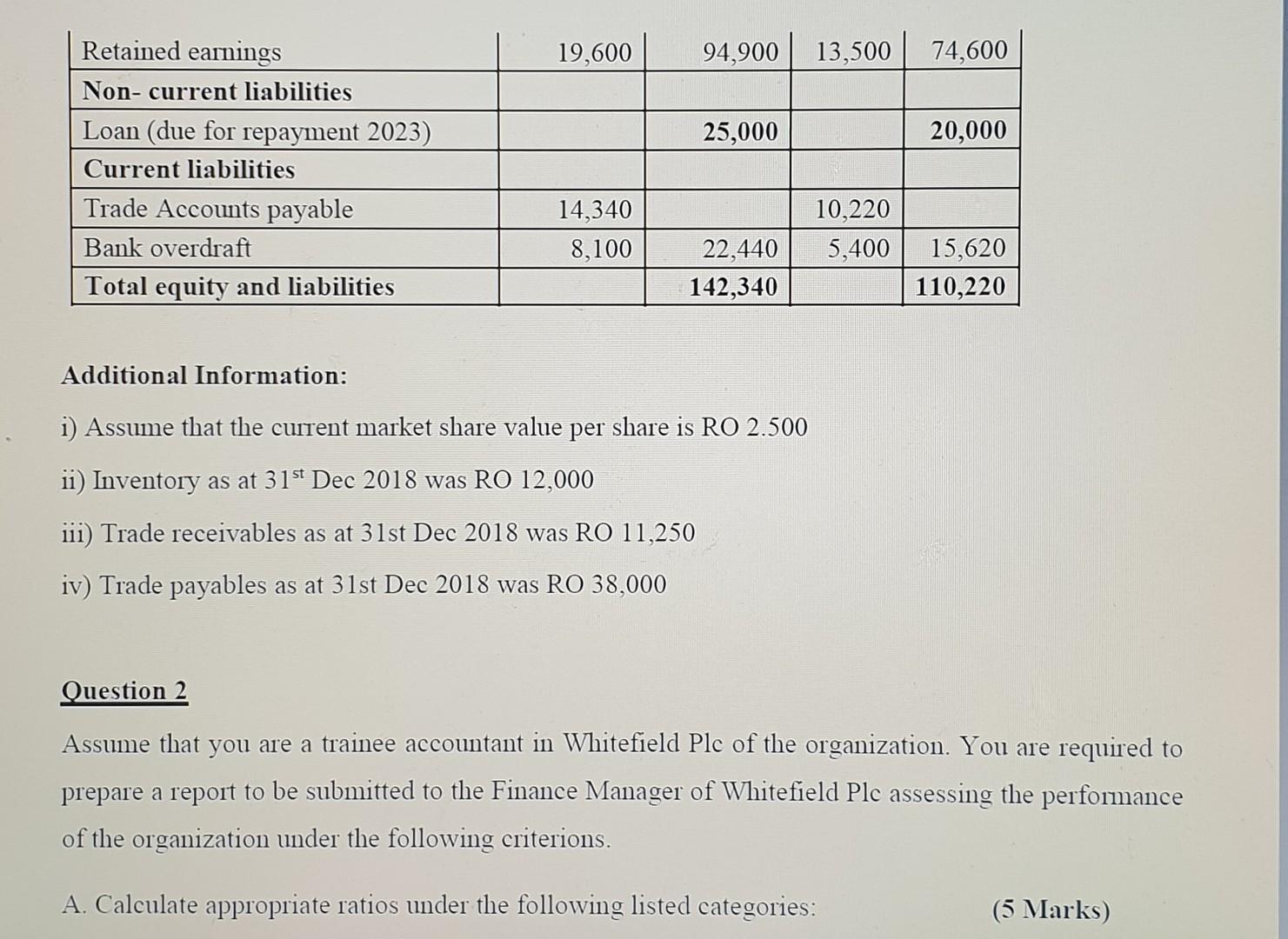

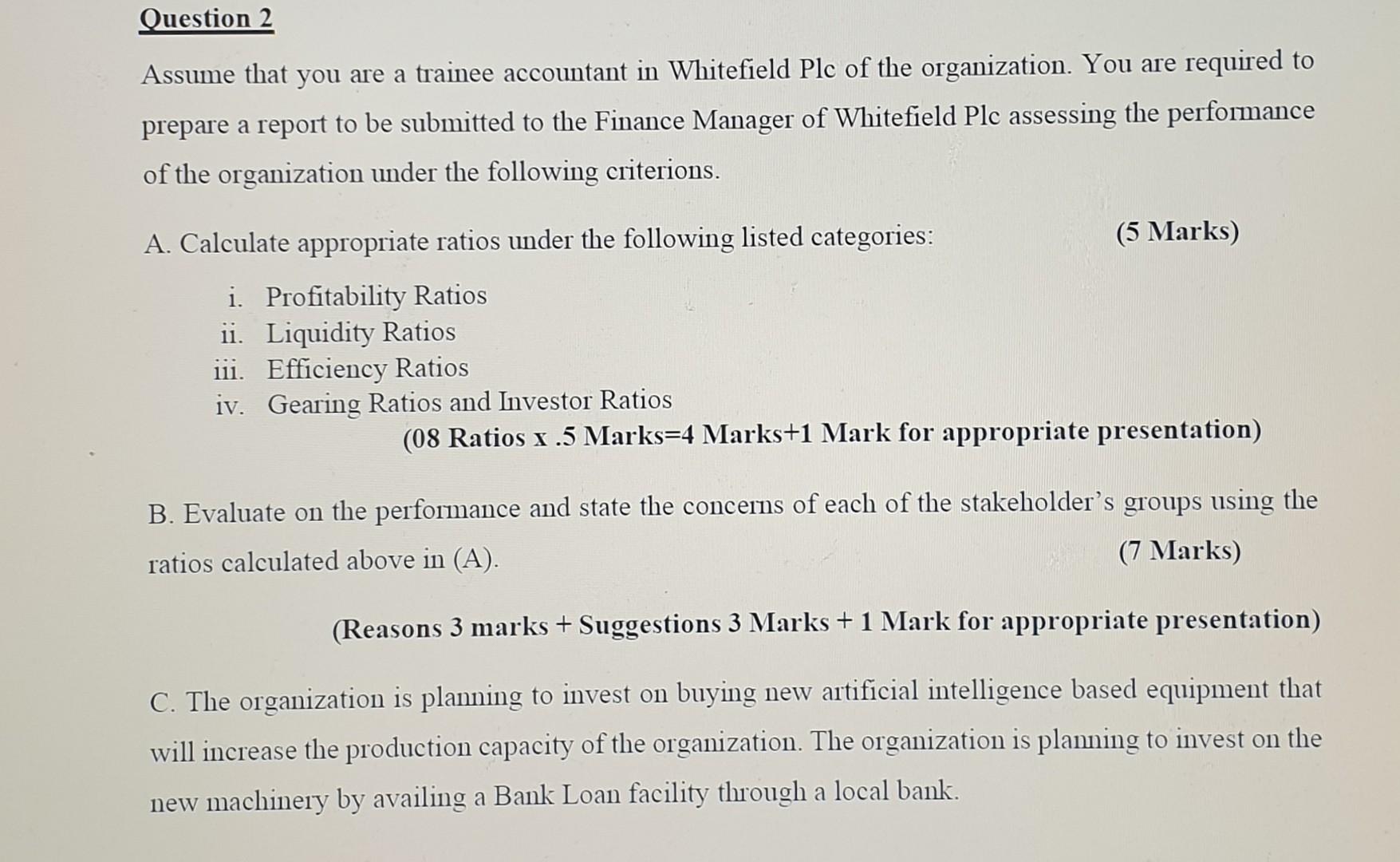

28 Assignment Scenario 2 Whitefield Plc is an organization that manufactures construction machine components. You are appointed as a trainee accountant in Whitefield Plc and finance manager has asked you to prepare a report analyzing the financial statements of the organization to assess the performance for the last two years. The summarized statements of profit or loss for the years ended 31st Dec 2020 and 2019 were: 2019 RO 000 Sales revenues Cost of sales Gross profit Expenses Profit before interest and tax Interest expenses Profit before tax Tax Profit for the year 2020 RO 000 118,825 83,185 35,640 13,665 21,975 2,225 19,750 6,625 13,125 70,425 44,025 26,400 11,025 15,375 1,565 13,810 4,645 9,165 Statement of Financial Position 2020 R0 000 2019 RO RO "000 '000' R0 000 Assets Statement of Financial Position 2020 2019 RO RO 000 '000 RO 000 RO 000 Assets Non-current assets (NBV) Land and Building Machinery 75,768 32,472 58,751 25,179 108.240 83,930 Current assets Inventories Trade receivable Cash Total Assets 16,500 15,400 2,200 13,200 11,550 1,540 34,100 142,340 26,290 110,220 Equity and liabilities Ordinary shares of 100 BAIZA each Share premium account 72,500 60,000 2,800 1,100 19,600 94,900 13,500 74,600 25,000 20,000 Retained earnings Non-current liabilities Loan (due for repayment 2023) Current liabilities Trade Accounts payable Bank overdraft Total equity and liabilities 14,340 8,100 10,220 5,400 22,440 142,340 15,620 110,220 Additional Information: i) Assume that the current market share value per share is RO 2.500 ii) Inventory as at 31st Dec 2018 was RO 12,000 111) Trade receivables as at 31st Dec 2018 was RO 11,250 iv) Trade payables as at 31st Dec 2018 was RO 38,000 Question 2 Assume that you are a trainee accountant in Whitefield Plc of the organization. You are required to prepare a report to be submitted to the Finance Manager of Whitefield Plc assessing the performance of the organization under the following criterions. A. Calculate appropriate ratios under the following listed categories: (5 Marks) Question 2 Assume that you are a trainee accountant in Whitefield Plc of the organization. You are required to prepare a report to be submitted to the Finance Manager of Whitefield Plc assessing the performance of the organization under the following criterions. A. Calculate appropriate ratios under the following listed categories: (5 Marks) i. Profitability Ratios ii. Liquidity Ratios ii. Efficiency Ratios iv. Gearing Ratios and Investor Ratios (08 Ratios x .5 Marks=4 Marks+1 Mark for appropriate presentation) B. Evaluate on the performance and state the concerns of each of the stakeholder's groups using the ratios calculated above in (A). (7 Marks) (Reasons 3 marks + Suggestions 3 Marks + 1 Mark for appropriate presentation) C. The organization is planning to invest on buying new artificial intelligence based equipment that will increase the production capacity of the organization. The organization is planning to invest on the new machinery by availing a Bank Loan facility through a local bank. Advice Finance Manager of Whitefield Plc whether the organization can receive a loan or look for other options (specify clearly the available options, if any). (3 Marks) (Recommendation 2 Marks + 1 Mark for appropriate presentation) Note: For solving question no 2 (A, B & C), Scenario 2, you should use financial information given in statement of profit or loss, statement of Financial position of Whitefield plc for financial year ended 2020 and 2019 and also the additional information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts