Question: Answer question 32A Requirements 1. Prepare corrected income statements for the three years. 2. State whether each year's net income-before your corrections-is understated or overstated,

Answer question 32A

Answer question 32A

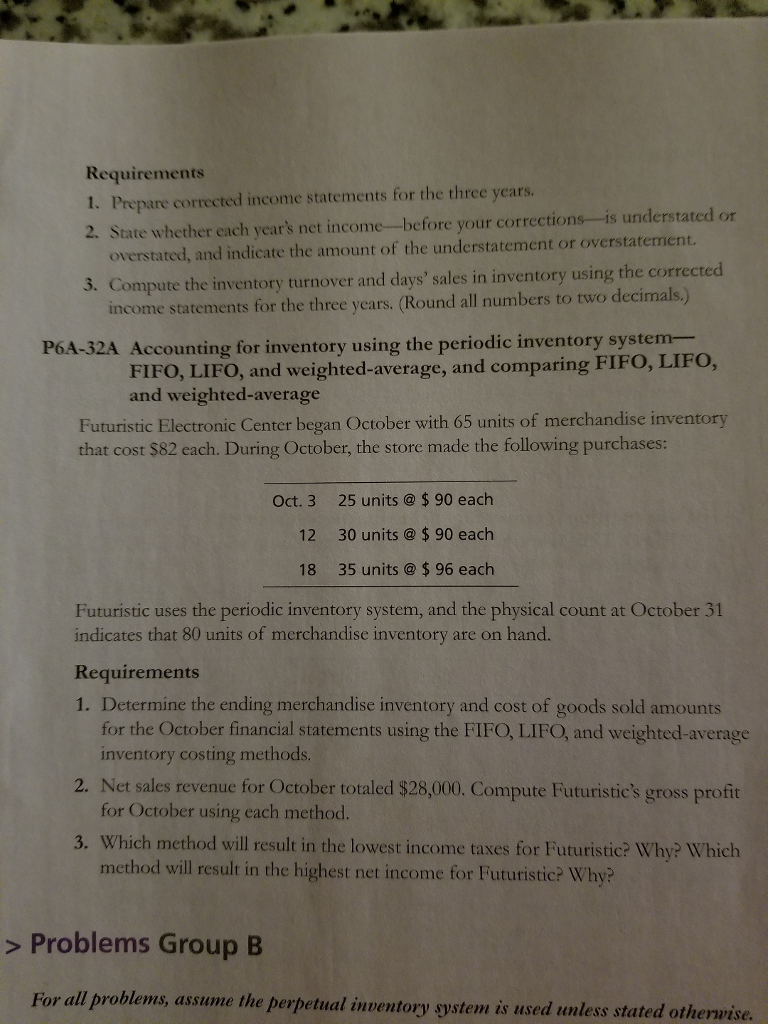

Requirements 1. Prepare corrected income statements for the three years. 2. State whether each year's net income-before your corrections-is understated or overstated, and indicate the amount of the understatement or overstatement 3. Compute the inventory turnover and days' sales in inventory using the corrected income statements for the three years. (Round all numbers to two decimals.) P6A-32A Accounting for inventory using the periodic inventory system FIFO, LIFO, and weighted average, and comparing FIFO, LIFO, and weighted average Futuristic Electronic Center began October with 65 units of merchandise inventory that cost $82 each. During October, the store made the following purchases: Oct. 3 12 18 25 units @ $ 90 each 30 units @ $ 90 each 35 units @ $ 96 each Futuristic uses the periodic inventory system, and the physical count at October 31 indicates that 80 units of merchandise inventory are on hand. Requirements 1. Determine the ending merchandise inventory and cost of goods sold amounts for the October financial statements using the FIFO, LIFO, and weighted average inventory costing methods. 2. Net sales revenue for October totaled $28,000. Compute Futuristic's gross profit for October using each method. 3. Which method will result in the lowest income taxes for Futuristic? Why? Which method will result in the highest net income for Futuristic? Why? > Problems Group B For all problems, assume the perpetual inventory system is used unless stated otherwise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts